I have been

surprised by the extent and persistence of UK inflation over the last

few months, along with many others. So what did I get wrong?

Why is UK

inflation so persistent?

Let’s start by

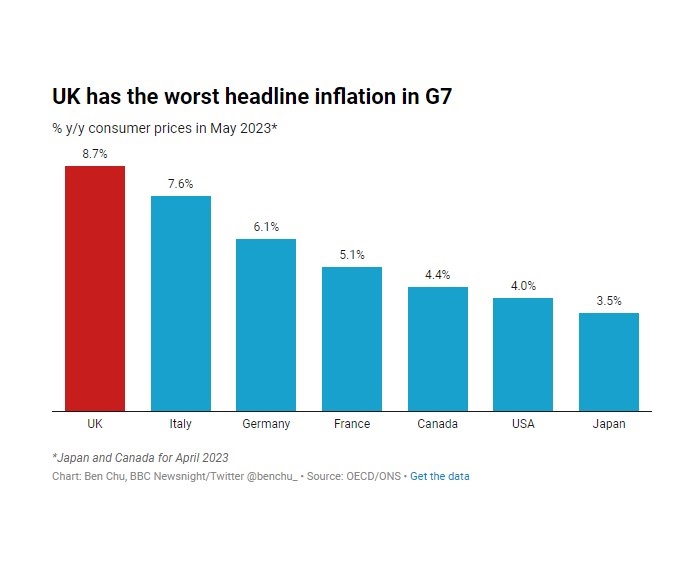

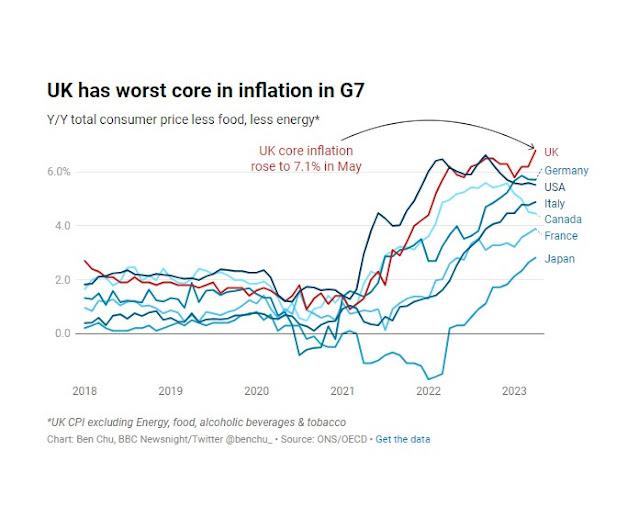

looking for clues. The biggest is that inflation is proving more of a

problem in the UK than elsewhere. Here are a couple of charts from

Newsnight’s Ben Chu. The UK has the worst headline

inflation in the G7

and the worst core

inflation (excluding energy)

That Brexit would

make Inflation worse in the UK than other countries is not a

surprise. I talked

about this over a year ago, although back then US core

inflation was higher than in the UK. In that post I listed various

reasons why Brexit could raise UK inflation (see also here).

Could some of those also account for its persistence?

The one most

commonly cited is labour shortages brought about by ending free

movement. Here is the latest breakdown of earnings

inflation by broad industry category.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Around the middle of

last year the labour scarcity story was clear in the data. One key

area where there was a chronic shortage of labour was in hotels and

restaurants, and wage growth in that sector was leading the way.

However if we look at the most recent data, that is no longer the

case, and it is finance and business services where earnings growth

is strongest. This dovetails with a fall in vacancies in the

wholesale,retail, hotels and restaurant sectors since the summer of

last year (although the level of vacancies remains above end-2019

levels). Has there been a recent increase in vacancies in finance and

business services? No, the explanation for high earnings growth in

that sector lies elsewhere.

Before coming to

that, it is worth noting that any earnings growth numbers above 3-4%

are inconsistent with the Bank’s inflation target, and the labour

market does remain tight, although not as tight as a year ago. One

partial explanation for UK inflation persistence is that it reflects

the consequences of persistently high (in excess of 3-4%) wage

inflation, which in turn reflects a tight labour market.

UK price inflation

is no longer just a consequence of high energy and food prices, as

this breakdown makes clear.

While energy and

food prices are still higher than average inflation, the most

worrying line from the Bank’s point of view is the green one for inflation in all services. It is

this category where inflation is (slowly) increasing, and the latest

rate of 7.4% is the main reason why UK inflation appears to be so

persistent. It is no longer the case that UK inflation is being

generated by external factors that cannot be influenced by the Bank

of England. That is also why it can be a bit misleading to talk about

inflation persistence or sticky inflation, because the prices that

are going up now are not the same as were going up just a year ago.

This high level of

services inflation could be a response to high nominal earnings

growth, with perhaps still some lagged effect from higher energy

costs [1], but recent data for profits suggests a third factor

involved. Here is the share of the operating surplus for corporations

(i.e. corporate profits) to GDP since 1997.

UK

Profit Share

Apart from a spike

in the first quarter of the pandemic, this measure of the profit

share has stayed below 24% since 2000, averaging about 22% between

2000 and 2022. However the end of 2022 saw this share rise to 22.5%,

and the first quarter of this year saw a massive increase to 24.7%.

We have to be careful here, as this sudden increase in the profit

share could be revised away as better data becomes available. But if

it is not, then it looks as if some of the recent persistence is

coming from firms increasing their profit margins.

Why might firms be

increasing their profit margins? This might not be unexpected during

a period where consumer demand was very buoyant, but with the cost of

living crisis that isn’t happening. It may be that firms have

decided that an inflationary environment gives them cover to raise

profit margins, something that seems to have happened in the US and EU. However another factor is Brexit once again. EU

firms now face higher costs in exporting to the UK, and this may

either lead them to withdraw from the UK market altogether, or to try

and recover these costs through higher prices. Either way that allows

UK firms competing with EU firms in the UK market to raise their

prices. If you look at what I wrote

a year ago, that effect is there too, but it was

impossible to know how large it would be.

What is to be

done?

The mainstream

consensus answer is to use interest rates to keep demand subdued to

ensure wage and domestically generated price inflation start coming

down. It doesn’t matter if the inflation is coming from earnings or

profits, because the cure is the same. Reducing the demand for labour

should discourage high nominal wage increases, and reducing the

demand for goods should discourage firms from raising profit margins.

In this context, the debate about whether workers or firms are

responsible for current inflation is beside the point.

That does not

necessarily imply the Monetary Policy Committee of the Bank was right

to raise interest rates to 5% last week. Indeed two academic

economists on the MPC (Swati Dhingra and Silvana Tenreyro) took a

minority view that rates should stay at 4.5%. I probably would have

taken that minority view myself if I had been on the committee. The

key issue is how much of the impact of previous increases has yet to

come through. As I note below, the current structure of mortgages is

one reason why that impact may take some time to completely emerge.

That demand has to

be reduced to bring inflation down is the consensus view, and it is

also in my opinion the correct view. There is always a question of

whether fiscal policy should be doing some of that work alongside

higher interest rates, but it already is, with taxes rising and

spending cuts planned for the future. Increasing taxes further on the

wealthy is a good idea, but it doesn’t help much with inflation,

because a large proportion of high incomes are saved. An argument I

don’t buy is that higher interest rates are ineffective at reducing

demand and therefore inflation. The evidence from the past clearly

shows it is effective.

For anyone who says

we should discount the evidence from the past on how higher interest

rates reduce demand because the world is different today, just think

about mortgages. Because of higher house prices, the income loss of a

1% rise in interest rates is greater now than it was in the 70s or

80s. Yet because many more people are on temporarily fixed rate

mortgages, the lag before that income effect is felt is much greater,

which is an important argument for waiting to see what the impact of

higher rates will be before raising them further (see above). There

is however one area where the government can intervene to improve the

speed at which higher interest rates reduce inflation, which I will

talk about below.

With the economy

still struggling to regain levels of GDP per capita seen before the

pandemic [2], it is quite natural to dislike the idea that policy

should be helping to reduce it further. This unfortunately leads to a

lot of wishful thinking, on both the left and the right. For some on

the left the answer is price controls. The major problem with price

controls is that they tackle the symptom rather than the cause, so as

soon as controls end you get the inflation that was being repressed.

In addition they interfere with relative price movements. They are

not a long term solution to inflation.

Sunak at the

beginning of the year made a deceitful and now foolish pledge to half

inflation. It was deceitful because it is the Bank’s job to control

inflation, not his, so he was trying to take the credit for someone

else’s actions. It has become foolish because there is a good

chance his pledge will not be met, and there is little he can do

about it. When challenged about making pledges about things that have

little to do with him he talks about public sector pay, but this has

nothing to do with current inflation (see postscript

to this)! As I noted

last week, the Johnsonian habit of lying or talking

nonsense in public lives on under Sunak.

The idea among

Conservative MPs that mortgage holders should somehow be compensated

by the government for the impact of higher interest rates is also

wishful thinking on their part, reflecting the prospect of these MPs

losing their seats. While there is every reason to ensure lenders do

everything they can for borrowers who get into serious difficulties,

to nullify the income effect of higher mortgage rates would be to

invite the Bank to raise rates still further. [3] Sunak cannot both

support the Bank in getting inflation down and at the same time try

and undo their means of doing so. In addition there are other groups

who are in more need of protection from the impact of inflation than

mortgage holders.

Another argument

against high interest rates is that inflation today reflects weak

supply rather than buoyant demand, so we

should try to strengthen supply rather than reduce

demand. Again this looks like wishful thinking. First, demand in the

labour market is quite strong, and there are no clear signs of above

normal excess capacity in the goods market. Second, the problems we

have with supply – principally Brexit – are not going to be fixed

quickly. To repeat, it is the domestically generated inflation rather

than the external price pressures on energy and food that represent the

current problem for inflation.

A similar argument

relates to real wages. People ask how can nominal wage increases be a

problem, when real wages are falling and are around

the same level as they were in 2008? Part of the

answer is that, as long as the prices of energy and food remain high,

real wages need to be lower. (The idea that profits alone should take

the hit from higher energy and food prices is ideological rather than

sound economics.) Because higher energy and food prices reduce rather

than increase the profits of most firms, they are bound to pass on

higher nominal wages as higher prices.

Yet there is one new policy measure that would help just a little with the fight against

inflation, and so help moderate how high interest rates need to go.

As I noted earlier, the sector leading wage increases at the moment

is finance and business services. In finance at least, some of this

will be profits led because of bonuses or implicit profit sharing.

Bank profits are rising for various reasons, one of which is that the

Bank of England is paying them more for the Bank Reserves they hold.

There is a sound

economic case for taxing these profits whatever is

happening to inflation, and the fact that higher taxes on banks could

help reduce inflationary pressure is a bonus right now.

What did I get

wrong? Just how bad the state of the UK economy has become.

While the Monetary

Policy Committee (MPC) of the Bank of England may have underestimated

the persistence of UK inflation, I have for some time been arguing

that the Bank has been too hawkish. On that, MPC members have been

proved right and I have been wrong, so it is important for me to work

out why.

A good part of that

has been to underestimate how resilient the UK economy has so far

been to the combination of higher interest rates and the cost of

living crisis. I thought there was a good chance the UK would be in

recession right now, and that as a result inflation would be falling

much more rapidly than it is. It seems that many of those who built

up savings during the pandemic have chosen (and been able) to cushion

the impact of lower incomes on their spending.

But flat lining GDP,

while better than a recession, is hardly anything to write home

about. As I noted above, UK GDP per capita has yet to regain levels

reached in 2018, let alone before the pandemic. If the UK economy

really is ‘running too hot’ despite this relatively weak recovery

from the pandemic, it would imply the relative performance of the UK

economy since Brexit in particular (but starting from the Global

Financial Crisis) was even worse than it appeared

just over a year ago. If I am being really honest, I

didn’t want to believe things had become that bad.

This links in with

analysis by John Springford that suggests the cost of Brexit so far

in terms of lost GDP may be a massive 5%, which is at

the higher end (if not above) what economists were

expecting at this stage. If in addition the UK economy is overheating

more than other countries (which is a reasonable interpretation of

the inflation numbers), this number is an underestimate! (UK GDP is

flattered because it is unsustainable given persistent inflation.)

Of course this 5% or

more number is really just our relative performance against selected

other countries since 2016, and so it may capture other factors

beside Brexit, such as bad policy during the pandemic, chronic

underfunding of health services and heightened

uncertainty due to political upheaval detering investment.

In thinking about

the relative positions of aggregate demand and supply, I did not want

to believe that UK supply had been hit so much and so quickly since

2016. [4] The evidence of persistent inflation suggests that belief

was wishful thinking. It seems the economic consequences of this period of

Conservative government for average living standards in the UK has

been extraordinarily bad.

[1] The UK was also

particularly badly

hit by high energy prices.

[2] In the first

quarter of this year GDP

per capita is not only below 2019 levels, it is also

below levels at the end of 2017!

[3] Higher interest

rates do not reduce demand solely by reducing some people’s

incomes. They also encourage firms and consumers to substitute future

consumption for current consumption by saving more and spending less.

However with nominal interest rates below inflation, real interest

rates so far have been encouraging the opposite.

[4] I probably

should have known better given what happened following 2010

austerity. While it is hard for politicians to significantly raise

the rate of growth of aggregate supply, some seem to find it much

easier to reduce it substantially.