The next week in the forex market will feature two of the major central banks rate announcements: the European Central Bank and the Bank of Canada. No changes in rates or stimulus programs are expected. Inflation figures will be published in the United Kingdom which could be influential in the May general elections. The United States economy has posted mixed results that have raised doubts if the recovery is sustainable. Retail sales will be announced in the U.S. which has derailed past USD rallies with disappointing data. This time however there is the expectation that the warmer weather has finally thawed consumers purse strings that have benefited from lower energy prices. Chinese gross domestic product will be released and the forecast is for lower growth as the economy is slowing down. Government officials have been proactive to set the expectations lower. Tuesday and Wednesday are loaded with economic and central bank watch events.

Low UK Inflation Favours Conservative Party

Inflation in the United Kingdom fell to zero for the first time on record on March 24 with the release of the consumer price index (CPI) figures. Food and energy prices have fallen potentially given British consumers a higher disposable income. Given the general elections environment the inflation data is a positive for David Cameron’s government as it gives it an edge versus the attacks from Labour on higher costs of living.

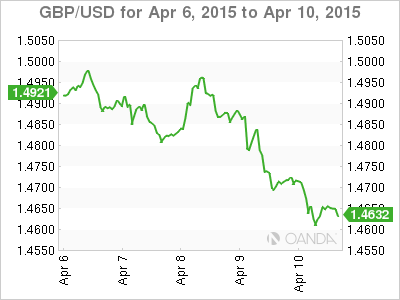

The UK CPI will be released on Tuesday, April 14 at 4:30 am EDT. The GBP/USD finished the week lower after the fallout from the disappointing U.S. job report was finally digested as more markets came back from the Easter holiday. The pair started the week close to 1.50 after the rapid depreciation of the USD versus all major pairs. As the week progressed the USD found its legs and gained traction to finish the week versus the GBP at 1.4623.

With the U.K. election campaigns underway the CPI release takes political connotations as it could strengthen the case for Conservatives. The Bank of England did not change rates or the size of its stimulus program and will not do so until after the elections when the political picture is fully formed. The outcome of the U.K. elections has plenty of economic implications which is why it is one of the biggest risks to global growth. A conservative victory might mean the end of the British Isles membership in the European Union as Cameron will push a referendum if he wins. A Labour victory on the other hand could bring higher taxes to foreign investors making the GBP less attractive.

US Retail Sales Expected to Thaw After Warmer Weather

The U.S. Retail Sales remains one of the thorns in the side of full economic growth. With an impressive job recovery and the lower price of oil putting more income into consumer’s pocket it has been an unexpected surprise that they are not spending. Last month the -0.1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} figure of the Core retail sales and the -0.6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} have raised questions about how even the recovery has been. The lower purchases in March marked the third consecutive decline. Consumer confidence remains high, but the fact of the matter is that consumers are not spending. Cold weather is partly to blame but that should start being much of a factor as spring sets in the U.S. The warmer weather is expected to influence the data released on Tuesday, April 14 at 8:30 am EDT with a forecasted improvement of 0.7{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} on the core reading (excluding auto) and 1.1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} for the headline retail sales figure.

The EUR/USD has depreciated as rate divergence drives the EUR lower versus the USD. The effects of the disappointing NFP released on Good Friday started being discounted as the USD was boosted by Fed member comments about the possibility of a benchmark interest rate June hike still being on the table. Elections in the United Kingdom and the Greece debt repayment will continue to affect prices as they are ongoing events to consider.

China GDP To Show Slowdown Heading to New Normal

The Chinese economy is slowing down. The lower than expected growth quarter over quarter is no surprise after China fell behind government forecasts. The change of tone from politicians has helped the market not to overreact to lower than 7{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} growth. A “new normal” is to be expected from an economy than enjoyed such a sustained period of double digit growth. The forecast for the first quarter growth of China’s economy is 7.0{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. The sometimes pessimistic tone of Chinese politicians have made forecasters underestimate growth consistently. Case in point last month’s forecast of 7.2{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} was narrowly beat by a 7.3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} figure. The market rewarded the better than expected growth figure with stock market gains.

Commodity currencies will be closely following this release as they could get a boost from a higher than forecasted GDP that in turn could hint at a higher demand from the Asian economy.

ECB to Hold and Remain Optimistic About QE Positive Effects

The European Central Bank launched an unprecedented quantitative easing program in March that has started to pay dividends. The ECB is not expected to announce any changes to the benchmark interest rate or the QE program, but the words from ECB President Mario Draghi could further boost the USD versus the EUR as interest rate divergence continues to drive the forex market. A Reuters poll of economics showed that the consensus was for a positive impact from ECB QE measures. The announcement and launch of the trillion euro program has depreciated the currency and lowered bond yields in the European Union. The challenge remains in how to turn that liquidity into a productive force for growth.

ECB President Draghi will continue to be optimistic about European growth, and this time the data backs him up. Inflation has improved as per the latest CPI flash estimate (-0.1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} versus -0.3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}). European manufacturing continues to expand as per the PMI readings released on March 24. Next week the advanced estimates for manufacturing in Europe will be released and should give further insight into the state of European factories.

The EUR/USD has depreciated as rate divergence drives the EUR lower versus the USD. The effects of the disappointing NFP released on Good Friday started being discounted as the USD was boosted by Fed member comments about the possibility of a benchmark interest rate June hike still being on the table. Elections in the United Kingdom and the Greece debt repayment will continue to affect prices as they are ongoing events to consider.

Bank of Canada Expected to Hold as Employment and Oil Improves

The Bank of Canada Governor Stephen Poloz has called the effect of lower oil prices “atrocious” to the Canadian economy. On Friday the employment figures were positive with a 28,700 jobs added to the economy and the unemployment rate avoided inching upwards and held at 6.8{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. The USD/CAD depreciated after the employment figures were released and the pair is trading at the 1.26 price level. Next week Governor Poloz will make a decision on benchmark interest rates that could further depreciated the loonie if he decides to cut rates like he did in January.

Even if the BOC does not cut in April the market is expected rates to be lower by the end of 2015. The good news is that the price of oil has stabilized, but this might be the calm before the storm if Iran finally reaches a deal that see its oil exports sanctions reduced flooding the market and driving the price even lower. The Bank of Canada can afford to wait as there is major uncertainty on where energy prices will be in a month’s time. Central bank action will be needed, but Poloz is more concerned with the timing and after surprising the market with anticipated action, might wait until the data makes it unavoidable. This is the reason some economist see no change for the rest of the year, and the first rate move could be a hike in 2016.

Energy exports will continue to decrease as the price of crude is still under pressure from a supply glut. There are reasons for optimism as non-energy exports have increased, and should be further supported by a lower loonie.

The Bank of Canada Governor Stephen Poloz has mentioned that the surprise rate cut in January was a pre-emptive move to avoid a further slowdown. If the trade balance continues to show the Canadian economy is losing traction it could put pressure on the central bank to cut rates again. The interest rate differential favours the USD as the expectation is for the Federal Reserve to hike the benchmark interest rate as early as June, but more likely in its September meeting.

SOURCE: MarketPulse – Read entire story here.