Wall Street took comfort from several downside surprises in US macro data overnight, with the data taming some rate hike bets and saw US Treasury yields decline. The US two-year yields were down 11 basis-point (bp), reversing all of last week’s gains, while the 10-year yields were down 8 bp to deliver a two-week low. The US dollar reverses further (-0.3%), allowing major US indices to secure its third straight day of gains.

Both the US job openings and consumer confidence data overnight were lower than expected, which point towards a weaker consumer spending outlook and some cooling in labour demand. US consumer confidence fell by the most in two years, while job openings touched its lowest level since March 2021. The weaker data may aid to tame the upside in pricing pressures ahead and provided room for the Fed to consider keeping rates on hold, as compared to additional tightening.

The overnight risk rally has allowed the Nasdaq 100 index to overcome its last Thursday’s sell-off, reflecting some control from buyers. This follows after finding support off the 14,630 level, where its 100-day moving average (MA) stands alongside the lower edge of its Ichimoku cloud on the daily chart. A bullish crossover is formed on its moving average convergence/divergence (MACD), with any move above the 15,400 level potentially paving the way to retest its year-to-date high at the 15,900 level next.

Source: IG charts

Asia Open

Asian stocks look set for a positive open, with Nikkei +0.47%, ASX +0.85% and KOSPI +0.66% at the time of writing. The Nasdaq Golden Dragon China Index is up 3.7% overnight, with Chinese equities riding on the improved risk environment for a turnaround from Monday’s whiplash. Earlier stamp duty cuts on stock trades provided some lingering optimism, although its upcoming purchasing managers index (PMI) releases tomorrow will provide another reckoning for its still-weak economic conditions.

This morning saw a significant downside surprise in Australia’s monthly Consumer Price Index (CPI) read, coming in at 4.9% versus the 5.2% expected, which validates current rate expectations for the Reserve Bank of Australia (RBA) to keep rates on hold into next year. This marked the first time since February 2022, where the monthly CPI indicator falls below the 5% level. But given that it is still a distance away from the RBA’s 2-3% target, the central bank may continue to maintain its hawkish-pause stance for some policy flexibility, although we are likely seeing the end of its tightening process.

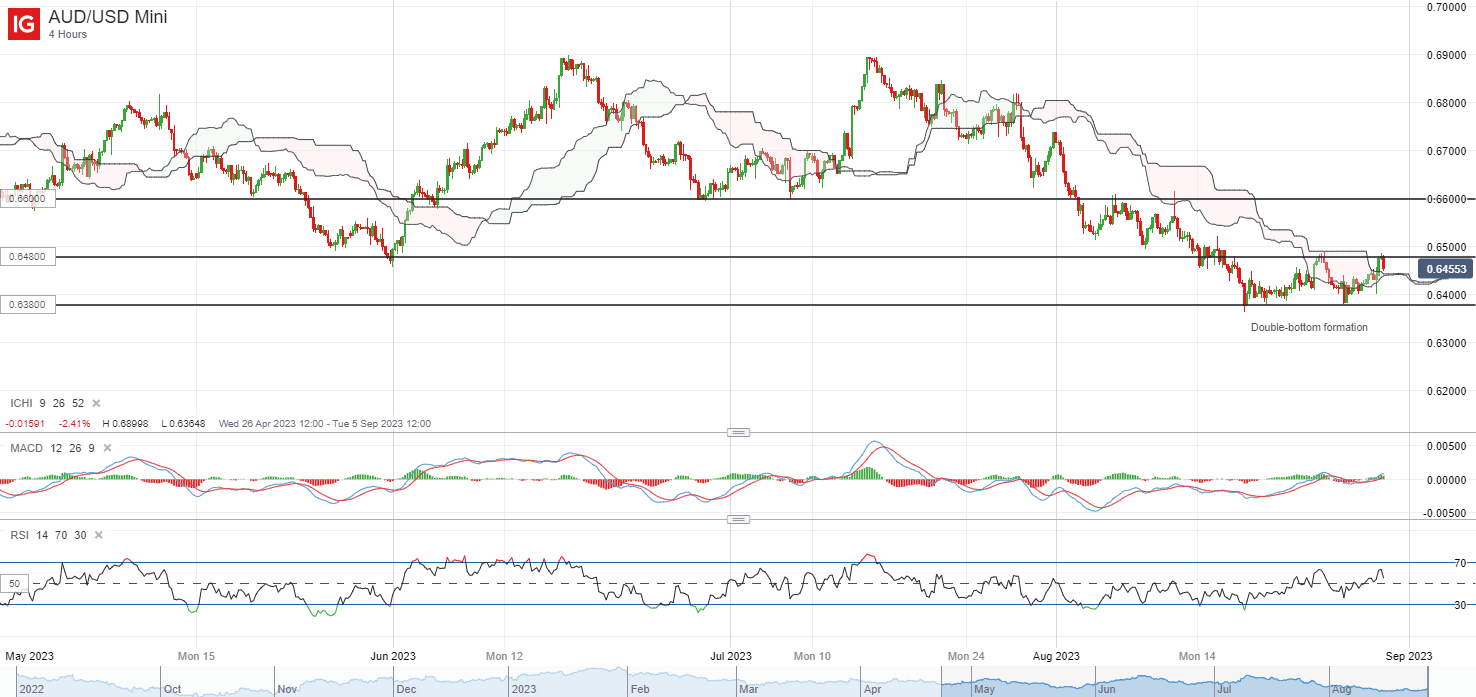

Improved risk sentiments and some near-term relief on the China’s front have allowed room for some recovery in the AUD/USD this week, but upside has been challenged into today’s session with the lower-than-expected Australia’s inflation number. The pair has been displaying a near-term double-bottom pattern on its four-hour chart, but resistance are currently found at its neckline at the 0.648 level, which also marked the peak of last Thursday’s sell-off. A move above this level will be much needed to support further recovery to retest the 0.660 level next, while on the other hand, further downside may leave its 0.638 level on watch.

Source: IG charts

On the watchlist: Paring rate hike bets brought some cooling in US dollar rally

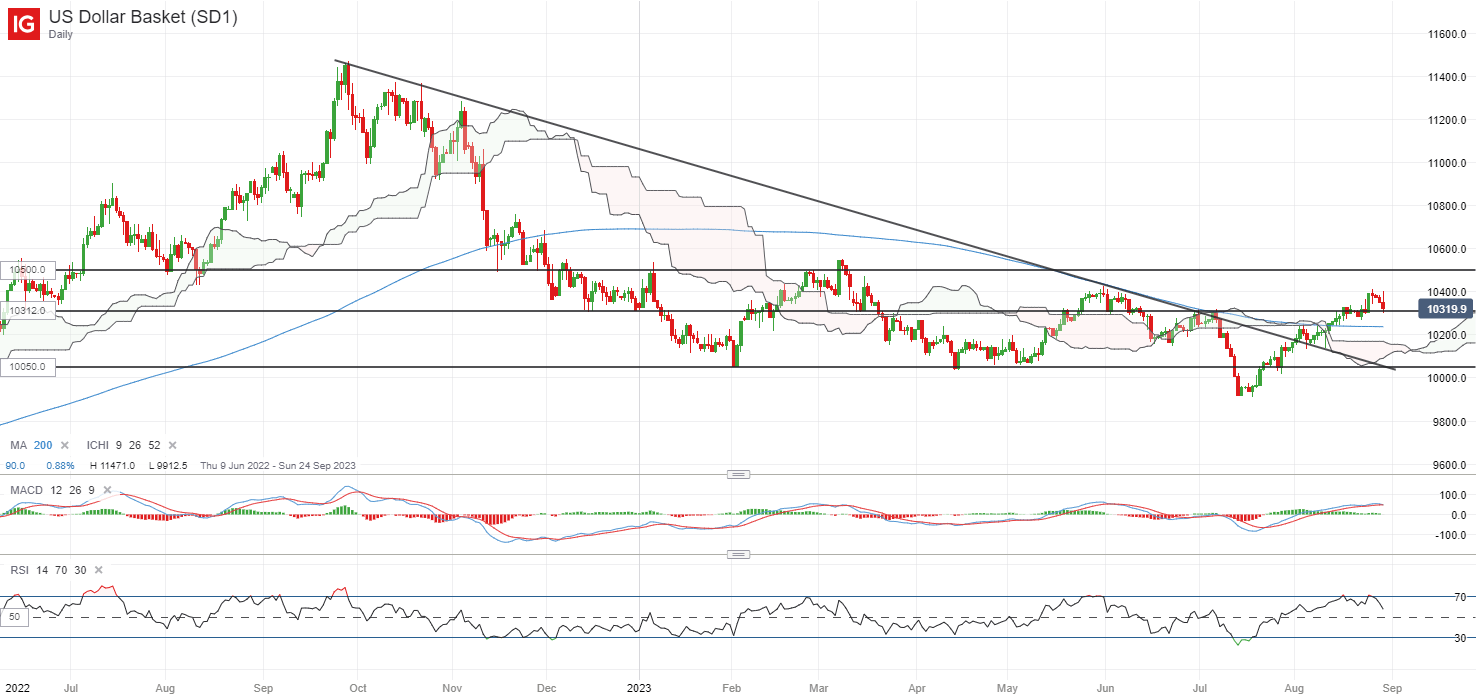

Rate expectations for the November Fed meeting have leaned back towards a rate-pause scenario, following yesterday’s weaker-than-expected US macro data. The odds for rates to be kept on hold in November currently stands at 51%, versus the 38% probability priced at the start of the week. With paring rate hike bets, the US dollar rally cooled for the third straight day, finding its way back to the 103.12 level.

Its 200-day MA will be one to watch next, with the US dollar having reclaimed the MA line previously for the first time since November 2022. Any failure for the 200-day MA to hold may validate sellers in greater control and potentially pave the way back towards the 100.50 level next.

Source: IG charts

Tuesday: DJIA +0.85%; S&P 500 +1.45%; Nasdaq +1.74%, DAX +0.88%, FTSE +1.72%