Many investors discuss Buffett on diversification, and conclude that he ran a “concentrated portfolio”

This is missing the nuance that he was diversified in terms of strategies he followed, especially in his early years. The best investors in the world tend to build their investment records by following a multi-strategy approach. Buffett is no exception, as this post will demonstrate.

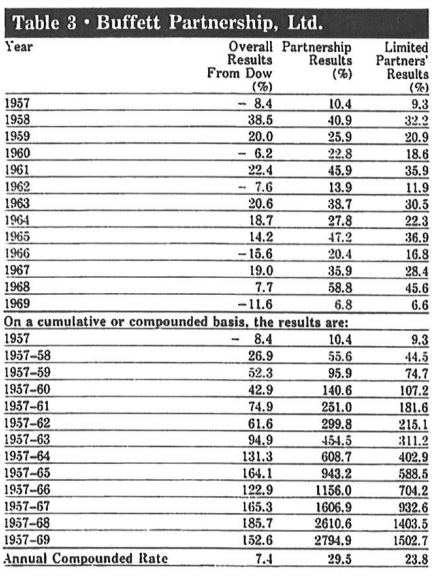

Buffett was a very successful fund manager. He was able to compound money at close to 30%/year before fees for 14 years in his partnership.

What built his wealth was the fact that Buffett obtained 25% of any profits over 6% that the partnership generated.

Many investors are not fully aware that when he ran the Buffett Partnership, Warren Buffett essentially followed three different strategies

He focused on:

1. Generally undervalued securities (“Generals”) – These were generally undervalued securities, where Buffett waited for valuation to correct upwards.

2. Work-Outs – stock affected by corporate events like mergers & acquisitions, spin-offs, reorganizations &liquidations. Buffett did mention that this strategy would produce relatively stable earnings from year to year, .

3. Control Situations These were events where the partnership would initiate a large enough position in a company and try to influence corporate policy.

A famous control situation is Berkshire Hathaway (BRK.A), which started out as an undervalued position.

Enjoy a more detailed overview from the 1957 Buffett Partnership Letters below:

The best investors in the world tend to build their investment records by following a multi-strategy approach. That provides diversification in returns. We saw how this has been the case with Warren Buffett in his early years. He has also followed a similar strategy in his later years with Berkshire Hathaway as well.

The same has been the case with other great investors such as Peter Lynch and Ben Graham for example. We will be discussing those investors (and more) in future posts. Please stay tuned!