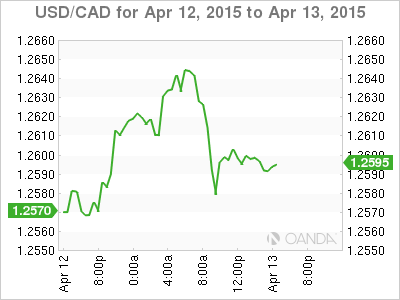

The USD/CAD continued to appreciate in the Asian and European sessions at it hit highs of 1.2650. The American session open saw a retracement as the USD was sold off and the loonie was able to recover some ground to trade at 1.2565. At the time of writing the CAD has not been able to remain at those levels and heads towards 1.26.

Chinese exports shrank 15 percent overall from last year. Exports to Europe and Japan have dropped 19.1 percent and 24.8 percent respectively. Commodity markets were hit by the news with Australia being the one punished the most considering the flow of trade with China. The AUS/USD started the session trading at 0.7680 and is now trading a cent lower at 0.7580. The decision to hold rates from the Reserve Bank of Australia now looks to have been the correct one. Now with outside data pressuring the Australian economy the RBA will announce a cut in the next meeting to help Australian goods remain competitive and boost exports.

The Bank of Canada Governor Stephen Poloz has called the effect of lower oil prices ‘atrocious’ to the Canadian economy. On Friday the employment figures were positive with a 28,700 jobs added to the economy and the unemployment rate avoided inching upwards and held at 6.8{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. The USD/CAD depreciated after the employment figures were released and the pair is trading at the 1.26 price level. Next week Governor Poloz will make a decision on benchmark interest rates that could further depreciated the loonie if he decides to cut rates like he did in January.

The majority of economists and analysts are not expecting a rate cut but their focus will be on the quarterly Monetary Policy Report from the BOC. Depending on the optimism of that report the sooner we can see a rate cut if the Canadian economy starts to underperform. On the other hand a pessimistic report could give the Bank of Canada flexibility on when to cut, or even if the economy does grow the central bank can even decide not to do it at all. The loonie will be affected by the eventual optimistic versus pessimistic forecasts of the central bank.

The USD strength will face a challenge from the release of the U.S. retail sales figures. The sales data remains one of the thorns in the side of full economic growth. With an impressive U.S. job recovery and the lower price of oil putting more income into consumer’s pocket it has been an unexpected surprise that they are not spending. Last month the -0.1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} figure of the Core retail sales and the -0.6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} have raised questions about how even the recovery has been. The lower purchases in March marked the third consecutive decline. Consumer confidence remains high, but the fact of the matter is that consumers are not spending. Cold weather is partly to blame but that should start being much of a factor as spring sets in the U.S. The warmer weather is expected to influence the data released on Tuesday, April 14 at 8:30 am EDT with a forecasted improvement of 0.7{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} on the core reading (excluding auto) and 1.1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} for the headline retail sales figure.

The big driver of USD/CAD will be the outcome of the Bank of Canada rate announcement, the quarterly monetary policy report and Governor Stephen Poloz’s press conference on Wednesday starting at 10:00 am EDT when the reports are released the the conference will start at 11:15 am EDT.

SOURCE: MarketPulse – Read entire story here.