US Dollar (DXY), Treasuries News and Analysis

- US CPI data in focus as a potential re-acceleration in prices gains traction

- USD eases ahead of CPI – bullish outlook still constructive

- Treasury yields trend higher suggesting USD may have to play catch up if we see hotter data

- Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. dollar Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free USD Forecast

US CPI Data in Focus as a Potential Re-acceleration in Prices Gains Traction

Tomorrow, US CPI data is likely to garner much attention, especially after recent, key shorter-term measures of inflation suggest price pressures may be re-accelerating. Shorter-term measures of inflation, such as the month-on-month comparisons, have revealed a stubbornness in getting inflation down to 2%.

Impressive US data has also helped contribute to the lack of progress on the inflation front, with US GDP expected to be 2.5% according to the Atlanta Fed’s GDPNow forecast and last week’s jobs report revealed a massive surprise of an additional 300k jobs added in March.

Customize and filter live economic data via our DailyFX economic calendar

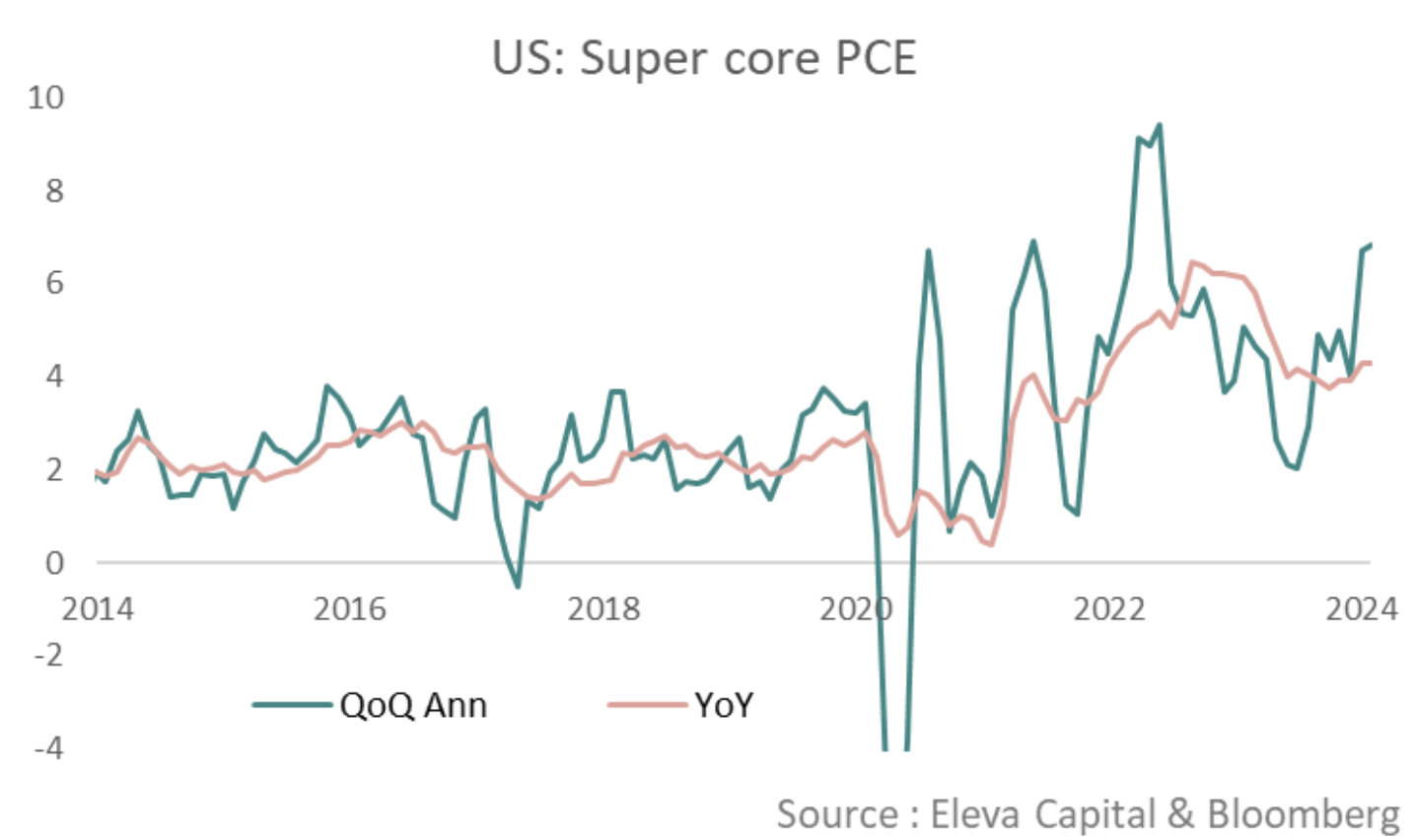

However, the overall disinflationary narrative is becoming harder to motivate, given the rise in current, shorter-term price data. The Fed has often cited a measure of inflation referred to as ‘super core’, which comprises of services inflation less energy and housing. This measure strips out volatile items like fuel and removes the effect of housing data which tends to have a massive lag.

Super core has been rising faster (MoM) than the year-on-year data for six months now and is starting to resemble what we saw back in 2022 when prices were on the rise.

US Super Core Accelerating in the Shorter-Term

Source: Stephane Deo via X, Eleva Capital & Bloomberg

USD Eases Ahead of US Inflation Data – Bullish Outlook Still Constructive

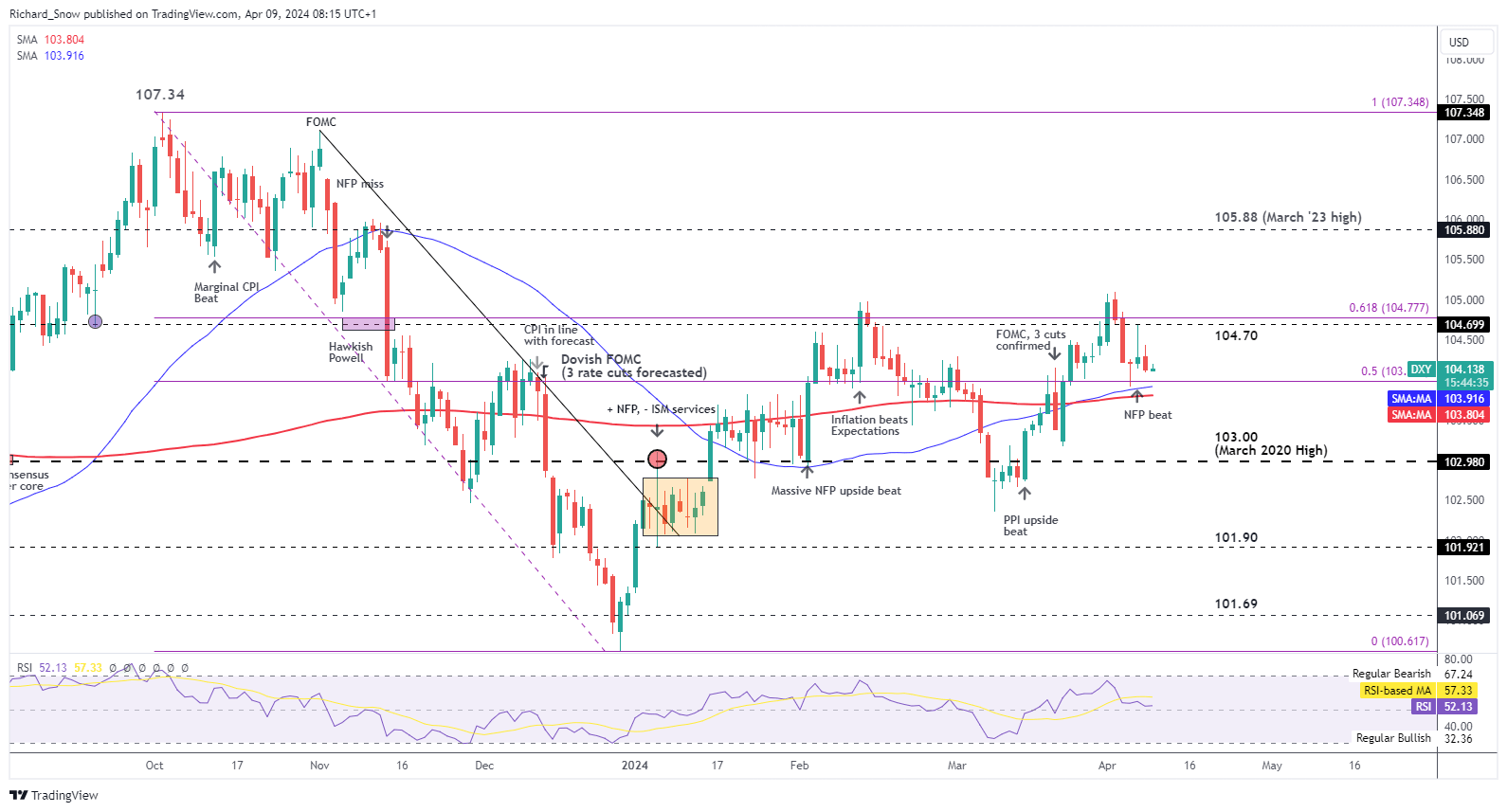

The US dollar (via proxy DXY) has been on the decline in April, apart from April Fool’s Day. It must be noted that the majority of the US dollar basket is comprised of the EUR/USD pair and the recent lift in confidence/sentiment surveys in the EU has added to the view that things are looking up in the EU.

DXY finds support currently at the 50% Fibonacci retracement of the 2023 decline, with the 50 and 200-day simple moving averages (SMAs) reinforcing that general area. Therefore, should inflation data surprise, or simply remain robust, there is potential for the dollar to rise in the aftermath of the report. This is backed up further by rising US treasury yields (2- year and 10-year). The bullish posture holds as prices trade above the 50 SMA, and the 50 SMA is above the 200 SMA – which suggests a bullish setup.

Resistance appears at 104.70 followed by the swing high of 105.

US Dollar (DXY) Daily Chart – 9 April 2024

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

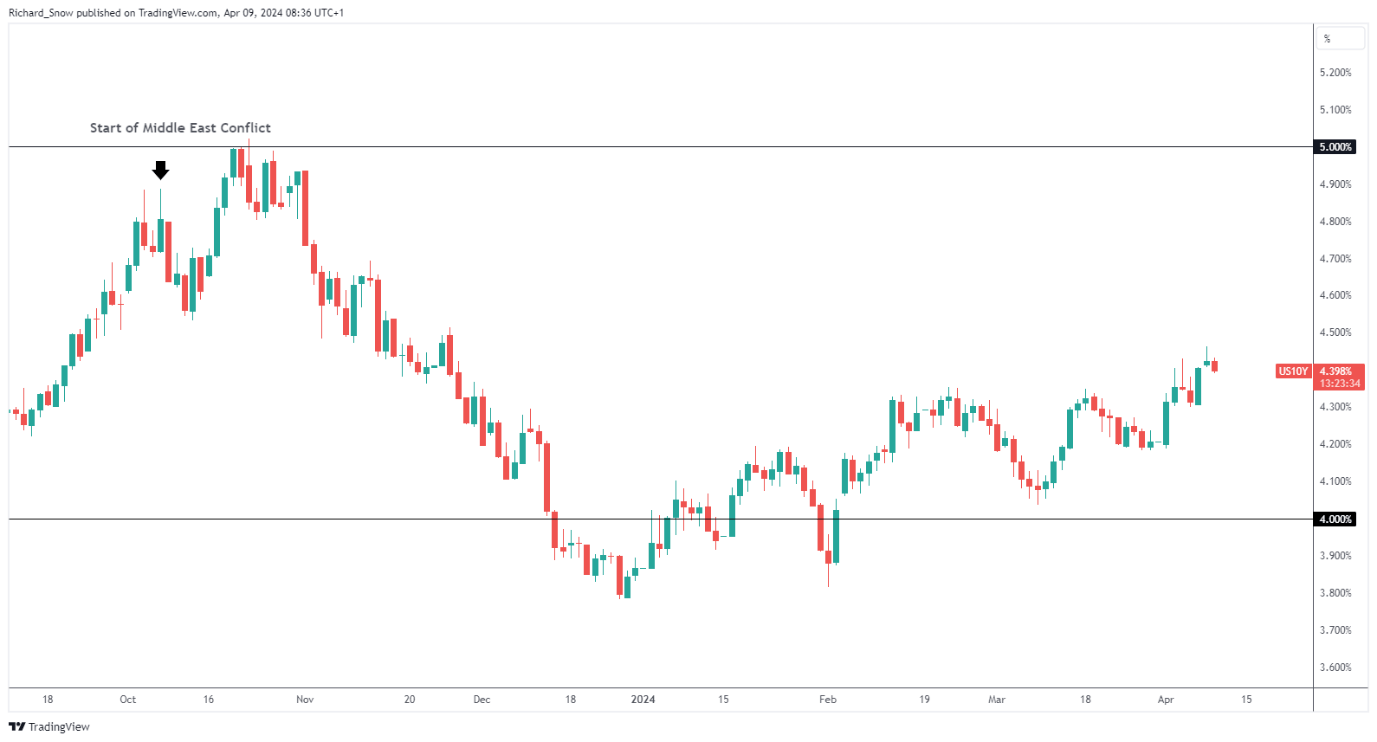

Treasury Yields Trend Higher

US Treasury yields have maintained the longer-term uptrend as robust US data continues to lower expectations of aggressive rate cuts materialising in 2024. Markets have even started to entertain a greater likelihood of that first rate cut only coming through in July, instead of June. In addition, the market is pricing in the possibility of only two cuts this year as opposed to the Fed’s three, something that ought to keep the dollar supported.

US Treasury Yields (10-Year) – 9 April 2024

Source: TradingView, prepared by Richard Snow

Stay up to date with the latest breaking news and themes by signing up to the DailyFX weekly newsletter:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX