On September 27, 2023,

TOWERVIEW LLC (Trades, Portfolio), a New York-based investment firm, added to its holdings in Tejon Ranch Co (TRC, Financial), a diversified real estate development and agribusiness company. This article provides an in-depth analysis of the transaction, the profiles of

TOWERVIEW LLC (Trades, Portfolio) and Tejon Ranch Co, and the potential impact of the transaction on both entities.

Details of the Transaction

TOWERVIEW LLC (Trades, Portfolio) acquired an additional 12,673 shares of Tejon Ranch Co on September 27, 2023, at a trade price of $15.85 per share. This transaction increased

TOWERVIEW LLC (Trades, Portfolio)’s holdings in Tejon Ranch Co to a total of 3,845,500 shares, representing 14.39% of the company’s total shares. The transaction had a 0.13% impact on

TOWERVIEW LLC (Trades, Portfolio)’s portfolio, which now has a 39.73% position in Tejon Ranch Co.

Profile of

TOWERVIEW LLC (Trades, Portfolio)

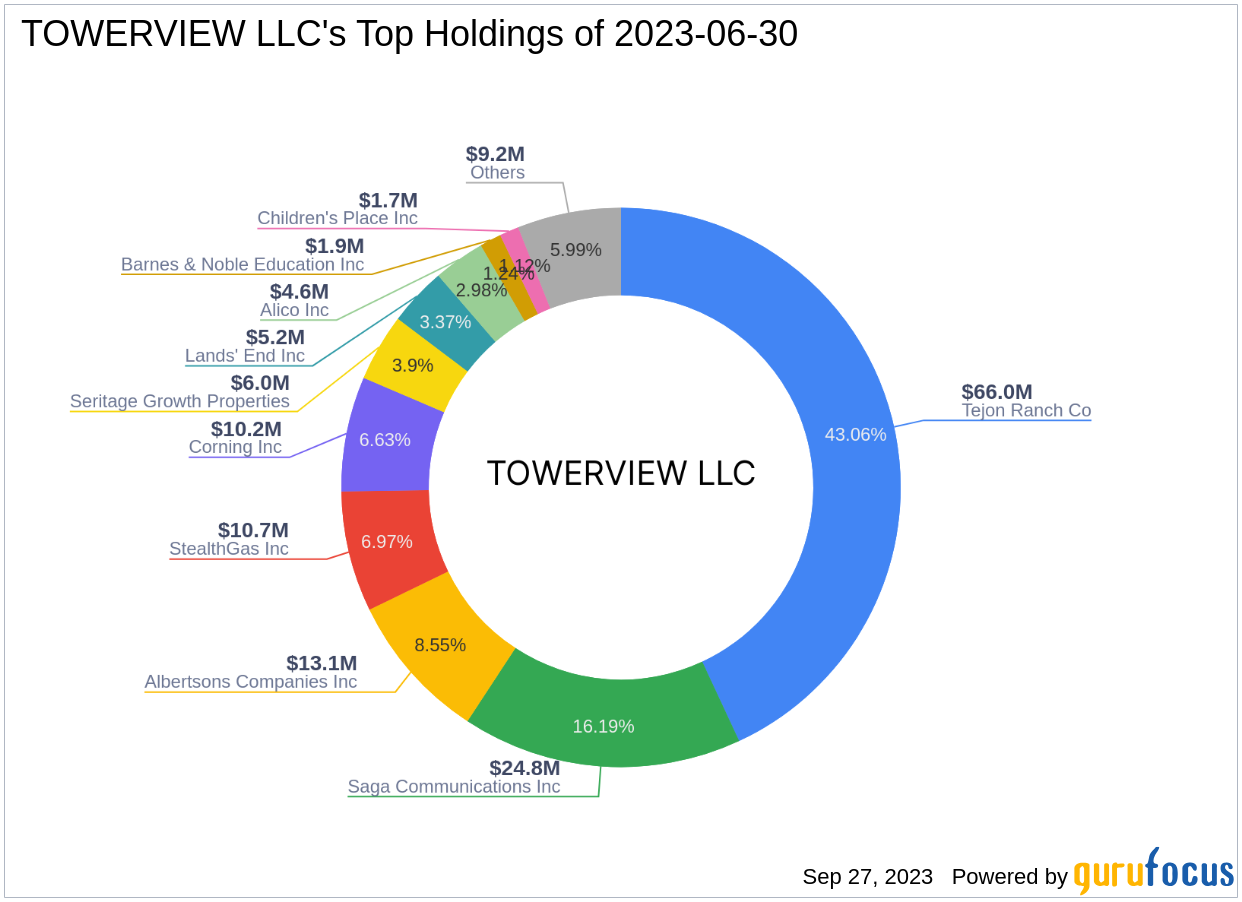

TOWERVIEW LLC (Trades, Portfolio) is an investment firm located at 500 Park Avenue, New York. The firm manages a portfolio of 24 stocks, with a total equity of $153 million.

TOWERVIEW LLC (Trades, Portfolio)’s top holdings include Saga Communications Inc (SGA, Financial), StealthGas Inc (GASS, Financial), Corning Inc (GLW, Financial), Tejon Ranch Co (TRC, Financial), and Albertsons Companies Inc (ACI, Financial). The firm’s investments are primarily concentrated in the Industrials and Communication Services sectors.

Overview of Tejon Ranch Co

Tejon Ranch Co, based in the USA, is a diversified real estate development and agribusiness company. The company, which went public on March 17, 1992, is committed to responsibly using its land and resources to meet the housing, employment, and lifestyle needs of Californians and create value for its shareholders. Tejon Ranch Co operates in five segments: commercial/industrial real estate development, resort/residential real estate development, mineral resources, farming, and ranch operations. As of September 28, 2023, the company has a market capitalization of $423.08 million and its stock is trading at $15.83 per share.

Analysis of Tejon Ranch Co’s Financials

Tejon Ranch Co has a PE Percentage of 29.87. According to GuruFocus’s valuation, the company’s stock is modestly undervalued, with a GF Value of $21.44 and a Price to GF Value ratio of 0.74. The company has a GF Score of 79/100, indicating a likely average performance. Tejon Ranch Co’s Balance Sheet Rank is 6/10, its Profitability Rank is 6/10, and its Growth Rank is 5/10. The company’s GF Value Rank is 9/10 and its Momentum Rank is 7/10.

Momentum and Predictability of Tejon Ranch Co’s Stock

Tejon Ranch Co’s RSI 5 Day is 21.55, its RSI 9 Day is 31.45, and its RSI 14 Day is 35.86. The company’s Momentum Index 6 – 1 Month is -9.53 and its Momentum Index 12 – 1 Month is 10.50. However, the company’s Predictability Rank is not available due to insufficient data.

Comparison with the Largest Guru Holder of Tejon Ranch Co’s Stock

The largest guru holder of Tejon Ranch Co’s stock is GAMCO Investors. A comparison of

TOWERVIEW LLC (Trades, Portfolio)’s and GAMCO Investors’ holdings in Tejon Ranch Co will be provided in a future update.

In conclusion,

TOWERVIEW LLC (Trades, Portfolio)’s recent acquisition of additional shares in Tejon Ranch Co is a significant development that could potentially influence the stock’s performance and the firm’s portfolio. As always, investors are advised to conduct their own comprehensive research before making investment decisions.