I review the list of dividend increases every week, as part of my monitoring process. This exercise helps me to monitor developments in existing holdings. It also helps me to potentially identify companies for further research.

I usually focus on companies with a ten year streak of annual dividend increases, in an effort to weed out cyclical companies. It is not a small feat to raise dividends through a full economic cycle. Meeting this screen increases the chances of identifying quality companies for further research.

Of course, this is just a screen. I look at several data points in order to determine if a company should be put on the list for further research, or discarded.

I look at growth in earnings per share over the past decade, because earnings per share are the fuel behind future dividend increases.

I also look at the most recent dividend increase, and compare it to the 5 and 10 year averages.

Then I also review trends in dividend payout ratios. That’s because I do not want dividend growth that happens solely from expansion in the payout ratio.

If a business is fundamentally sound, I would put it on my list for further research.

Last but not least, I also look at valuation. If a business is overvalued, I would determine a price that I would consider it and wait. If a business is fairly valued, I would research it first (assuming I haven’t done that before”.

Over the past week, there were three companies that raised dividends. These companies have also increased dividends for at least ten years in a row. The companies include:

Philip Morris International Inc. (PM) operates as a tobacco company working to delivers a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector.

The company boosted its quarterly dividend by 2.40% to $1.30/share. This is the 15th consecutive annual dividend increase for this dividend achiever. The company has managed to grow dividends at an annualized rate of 4.70%/year over the past decade.

The company is expected to earn $6.25/share in 2023. Earnings per share went from $5.26 in 2013 to $5.82 in 2022.

The stock sells for 15.34 times forward earnings and yields 5.50%.

You can view PMI’s dividend history since 2008 below:

Realty Income (O) is a real estate investment trust (“REIT”) with over 13,100 real estate properties primarily owned under long-term net lease agreements with commercial clients.

The company increased monthly dividends to $0.256/share. This was a 0.20% increase over the previous quarter and 3.22% increase over the distribution paid during the same time in the previous year. Over the past decade, the company has managed to grow dividends at an annualized rate of 5.30%.

This dividend aristocrat has increased annual dividends since 1994.

Realty Income has managed to grow FFO/share from $2.41 in 2013 to $4.04 in 2022. Realty Income is expected to grow FFO/share to $4.12 in 2023.

The stock sells for 13.12 times forward FFO and yields 5.60%.

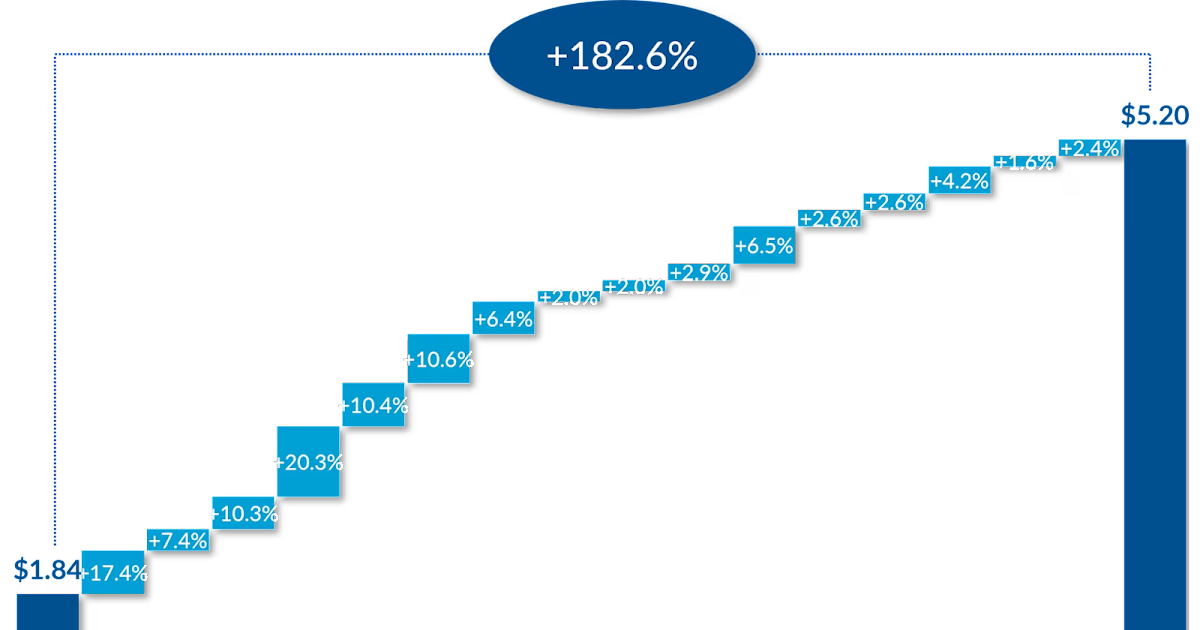

You can view Realty Income’s dividend history from 1994 below:

Fifth Third Bancorp (FITB) operates as a diversified financial services company in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

The company raised its quarterly dividends by 6.10% to $0.35/share. This is the 13th consecutive annual dividend increase for this dividend achiever. The company has managed to grow dividends at an annualized rate of 13.10% over the past decade. Unfortunately, the dividend is still below its peak 2007 levels.

Between 2013 and 2022, the company managed to grow earnings per share from $2.05 to $3.38.

The company is expected to earn $3.30/share in 2023.

The stock sells for 8.30 times forward earnings and yields 5.10%.

Relevant Articles:

– Three Dividend Growth Companies Increasing Dividends Last Week