An important choice in retirement planning is when to start claiming your Social Security benefits. If you claim earlier, your monthly benefits will be reduced for the rest of your life. If you claim later, your monthly benefits will be increased for the rest of your life. Here is how much of the benefit taken at “full retirement age” will change based on your birth year. Taken from Fool.com using data from SSA.gov. Found via Early Retirement Forums.

This can be a complicated question, but if you were to force a rule of thumb*, it would probably be to wait to claim as late as you can in order to maximize your total lifetime benefits. (* Don’t just follow this blindly. There are many online calculators to help you with the details, especially for couples, like the free Open Social Security.)

Social Security is the only place you can “buy” a lifetime of guaranteed inflation-adjusted income. The difficulty is that you have to “buy” it by living off your other investments until your claim age.

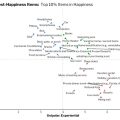

Here are some interesting charts from the article The Retirement Solution Hiding in Plain Sight: How Much Retirees Would Gain by Improving Social Security Decisions, which analyzed the “actual Social Security decision and wealth accumulation of 2,024 households in a Social Security Administration sponsored panel survey.”

As you can see, the optimal claim age to maximize total lifetime benefits is mostly tilted towards the maximum age of 70. However, the actual claim age is heavily clustered towards the earliest possible age of 62.

How much difference are we talking about? Here is a chart showing of the average lifetime increase in income if you went for the optimal instead of the actual (in percentages).