Allan Roth takes a closer look at the role of fixed index annuities as part of an “efficient” portfolio, and as usual finds all of the holes in the argument using precision and knowledge. The first thing about fixed index annuities is that no two are the same – the insurance companies don’t want to create a standardized product where they have to compete with each other on price. There are surrender charges, surrender periods, caps, spreads, market value adjustments, participation rates, just to name a few. (That’s why MYGAs and SPIAs are one of the few annuity types I might consider.)

The second thing about fixed index annuities is that within nearly every contract, the insurance company can significantly change the crediting rules after purchase.

From Annuity.org:

The growth of indexed annuities aligns with the performance of a particular stock index, such as the S&P 500. Interest rate caps denote the maximum amount of interest an annuity can earn — regardless of the change in the index. Insurance companies have the right to adjust these caps every year.

From Roth’s article:

Every FIA contract I’ve reviewed has the unilateral right of the insurance company to change the terms of the contract, such as lowering that 12% cap. Pfau agreed that insurance companies have that right. I asked Pfau how low those caps could go, and he responded, “As low as 1-2%.” I’ve seen 0.25%, meaning the contract owner would get between 0% and 0.25% annually. This right of the insurance company to slash returns was not mentioned in Pfau’s paper.

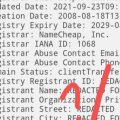

Here’s some fine print I just pulled off the internet for an FIA product:

The rates are guaranteed for the length of the crediting period. They are declared at issue and at the end of the crediting period. The minimum monthly cap for the monthly sum with cap crediting method is 0.50%. The minimum annual cap for the annual point-to-point with cap crediting method is 0.25%. The maximum annual spread for the annual point-to-point with spread crediting method is 12%. The minimum participation rate for the annual point-to-point with a participation rate and the 2-year MY point-to-point with a participation rate crediting methods is 5.0%. The minimum interest rate is 0.10%.

Note that the rates are only guaranteed for “the length of the crediting period” (one year is common, but can be up to 5-7 years). As of this writing, the current “annual point-to-point with cap” is 6.5% for the S&P 500 index. But in the next crediting period, they could lower it down to 0.25%. The current “annual point-to-point w/ participation rate” for the PIMCO Tactical Balanced ER Index+ is 120%. But in the next crediting period, they could lower it all the way down to 5%.

FIAs don’t offer easy comparison shopping that encourage consumer-friendly pricing, the index it tracks never includes dividends (that I’ve ever seen), and the insurance company keeps the power to change the return parameters after purchase. Hard pass.