My investment strategy is Dividend Growth Investing. I invest in companies that have a long track record of annual dividend increases. These are well-known companies that can be found on several well-known dividend lists:

– Dividend Achievers – Companies that have increased dividends annually for at least 10 years in a row

– Dividend Aristocrats – S&P 500 Companies that have increased dividends annually for at least 25 years in a row

– Dividend Champions – Companies that have increased dividends annually for at least 25 years in a row

– Dividend Kings – Companies that have increased dividends annually for at least 50 years in a row

Dividends from diversified portfolios tend to grow at or above the rate of inflation over time. This is because companies manage to grow earnings over time. Companies also manage to grow the amount of excess cashflows they generate as well. That’s what drives growth in dividends over time – growth in earnings per share. Ultimately, those businesses also grow intrinsic values. While share prices will fluctuate in the short run, in the long-run those share prices would likely grow at the rate of increase in the underlying fundamentals.

Dividends are a great source of income in retirement, because they are more stable, and easier to predict than share prices. That makes them a very good source of income in retirement.

For example, I could reasonably expect that a REIT like Realty Income (O) would distribute at least $3.16/share in dividends over the next 12 months. If history is any guide, this company would also raise those dividends as well.

However, I have no idea whether the stock price would be above $80/share or below $40/share.

Investing to me means buying future retirement income.

For each $1000 I invest today, I expect to generate about $30 in annual dividend income that grows above the rate of inflation. Reinvesting dividends further grows total annual dividend income.

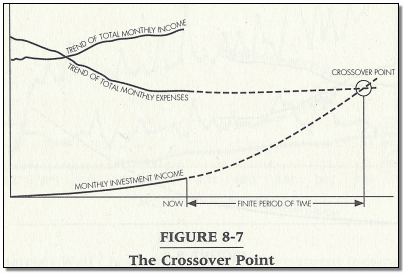

I keep stacking assets and reinvesting dividends until dividend income exceeds annual expenses. That’s the dividend crossover point, which is synonumous with financial independence for dividend growth investors.

The concept of covering expenses with dividends is very powerful.

If I spend $50/month on internet, that’s $600/year.

To generate $600/year in dividends, I need to invest $20,000 in a portfolio at a 3% average dividend yield.

Once I invest $20,000 my internet is essentially paid for.

Also those dividends increase over time, at or above the level of inflation.

The concept of a dividend crossover point is a very neat way to illustrate your path on the way to financial independence. It works for covering overall expenses, and also for working on your way to covering expenses, one at a time.

If your overall expenses are say $3,000/month, it may seem impossible to reach there. Or you may get discouraged about the time it could take to get there. This is where defining smaller dividend crossover points first may make it seem not so impossible.

You can get motivated by smaller dividend crossover points such as:

$50/month – I can cover my internet with dividends

$100/month – Dividends pay my cell phone

$150/month – I can buy a Starbucks latte every day w/dividends

$500/month – Dividends can cover car payment

$1,000/month – Dividends pay my rent

Learn more about the Dividend Crossover Point here:

This exercise also shows the “cost” of a typical recurring expense as well (e.g. that daily Staburcks Latte). It also shows the amount of capital it would take in retirement to pay for such expense. It’s also a good way to look at the natural progression of dividends too..

Of course, nobody just hands you out $20,000. Getting to a certain income target is a function of:

1. How much you can invest every month

2. Rate of return (Dividend Yield + Dividend Growth)

3. How long you invest for

As I stated above, for each $1000 I invest today, I expect to generate about $30 in annual dividend income that grows above the rate of inflation. Reinvesting dividends further grows total annual dividend income.

I keep stacking assets and reinvesting dividends until dividend income exceeds the target expense I am needing to be covered.

For example, if you can invest $1,000/month, and find companies that yield 3% and grow dividends at a rate of 6%/year, it would take 19 months to get to the point of generating $50 in dividends per month.

If you can only invest $500/month, using the returns criteria listed above, it would take 36 months to get to the point of generating $50 in dividends per month.

You may like the spreadsheet listed in this post, which helps me play around with various scenarios.

All of those scenarios assume dividend reinvestment into more shares. But frankly, instead of thinking of “how much capital I need to retire”, I like to think in terms of “how much income I can generate to retire”. I use the terms “retire” and “achieve financial independence” interchangeably.

Growing that dividend income is extremely motivating. You know exactly where you are on your journey at any moment.

You grow that dividend income stream through several inputs.

1. Capital you invest

2. Reinvesting Dividends

3. Dividends that grow

All of those factors work together, in synchrony, to help you build that income machine.

Brick by Brick

That’s you financial future in question. So make sure you have a strong foundation for your financial house to be in order.

To me this means focusing on sound businesses, with competitive advantages, long histories of annual dividend increases, sound business models, and making sure those businesses are making and growing that net income over time. It also means diversifying into as many quality businesses as I can find, making sure I do not overpay, and making sure I am not concentrated in only a few companies and in a few sectors. It also means not chasing yield, but focusing on dividend stability, sustainability and evaluating that the payout ratio is not too high or growing too much.