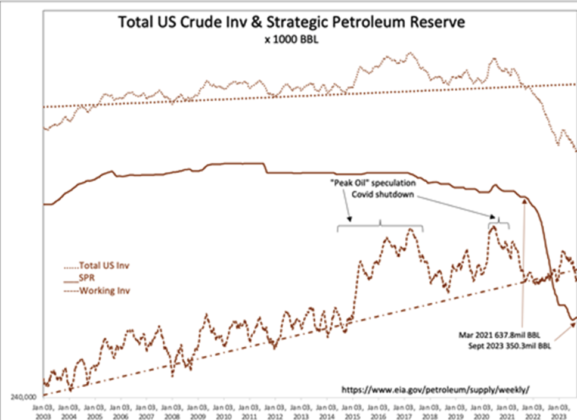

Inflation watch: Further drawdowns at Cushing would spell more trouble for an already tight oil market due to the deepening supply cuts from Saudi Arabia and Russia. Inventory levels in Cushing have been cut in half since June, and now stand at just below 23M barrels, or a level that’s close to the operational minimum. If tank storage falls below 20M barrels, the oil can become sludgy and difficult to remove, potentially adding to upward pressure on prices and renewing fears of inflation.

“The U.S. has, in essence, bailed out the rest of the world from an oil supply shortage, but that is about to come to an end,” writes Investing Group HFI Research. “U.S. crude storage will not build during refinery maintenance season [in October]… and one of the bear factors was demand, but demand is holding up well.” Oil stocks have also reflected similar sentiment since the summer, with big gains seen for companies like Chevron (NYSE:CVX), Conoco (NYSE:COP), EOG Resources (NYSE:EOG), Exxon Mobil (NYSE:XOM), Hess Corporation (NYSE:HES), Occidental Petroleum (NYSE:OXY), Pioneer Natural Resources (NYSE:PXD), Schlumberger (NYSE:SLB) and Valero (NYSE:VLO).