“Davidson” submits:

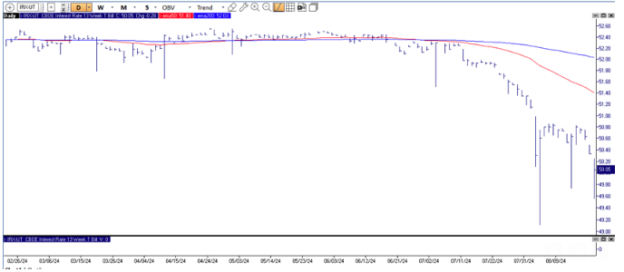

The 3mo Treasury rate is declining in recent days. Today’s low below 5%. There are two possible reasons for this IMO:

1) Individuals are getting more bearish and selling equities for money market

2) Institutions are lessening the Short-month/Long-5yr-10yr Treasury hedge that seemed in place the last 2yrs.

A continuation of this pattern is how the Fed comes to cut Fed Funds once the 3mos moves to 4.75%. The commentary I am hearing is that “no-landing” or “soft-landing” has replaced “hard landing”. The hedge will not work without a hard landing.