The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

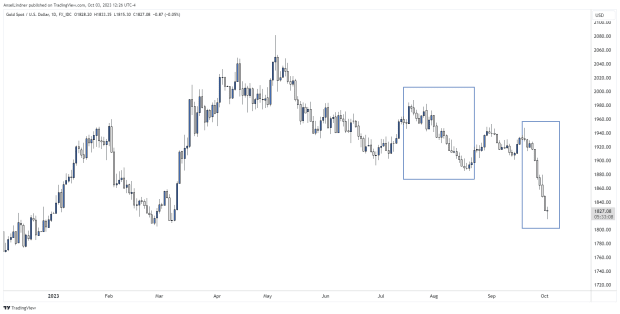

Bitcoin Decouples with Gold

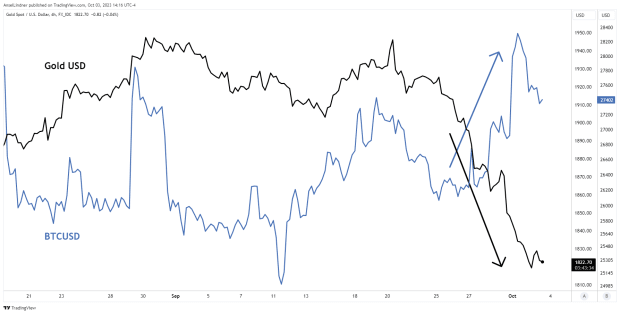

Bitcoin and gold have similar inflation-hedge narratives. Currently, gold has a lower inflation rate (1.7%) than Bitcoin (1.8%), but it will be a monumental flip at the halving. A simplistic inflation story would require gold and bitcoin to rise together. However, gold is getting hammered in the last few days while bitcoin is bouncing.

Very recently, Bitcoin has been trending higher as gold crashes. They are decoupling over the last week in a very obvious way. We might expect gold to lag bitcoin during moves, but this is exactly the opposite direction. Gold is crashing while bitcoin has been bouncing.

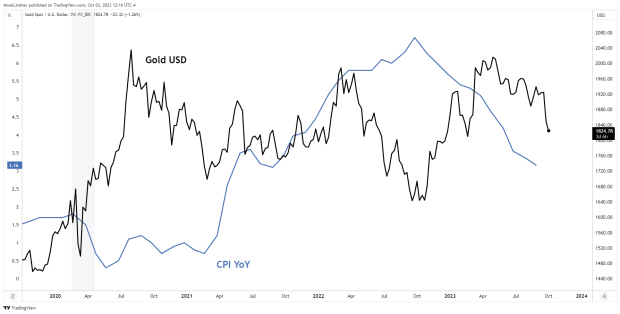

We actually see a slight inverse relationship with CPI for gold and bitcoin. Last year, as CPI was spiking, gold and bitcoin sold off. Some have arbitrarily argued about timing, saying bitcoin pumped before CPI shot up. Or, maybe, inflation is not the primary force in this market.

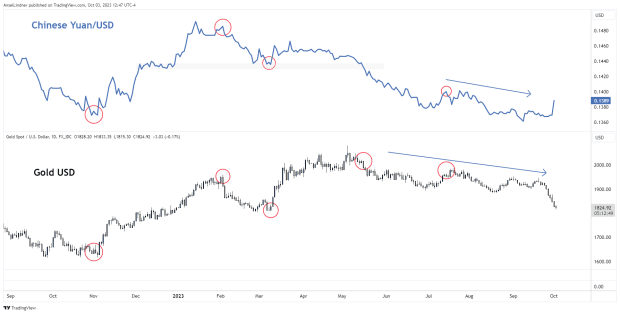

Chinese Selling Gold

We do have something to explain this contradiction of crashing gold and bouncing bitcoin. It is likely the Chinese are selling gold, instead of their dollars, as a way to protect their currency and preserve their precious dollar FX reserves. I ran across this article from Mining.com, China gold prices plunge the most since 2020, curbing record premium, which claimed a Chinese Communist Party quota on gold was just lifted on imports to “reduce the need for local banks to buy dollars.”

That is a staggering development and explains what we are seeing in the gold chart above. The Chinese are in a devastating dollar shortage/credit crunch. I repeat, a dollar shortage, not a flood of liquidity and money printing. It is time to bury the inflation narrative.

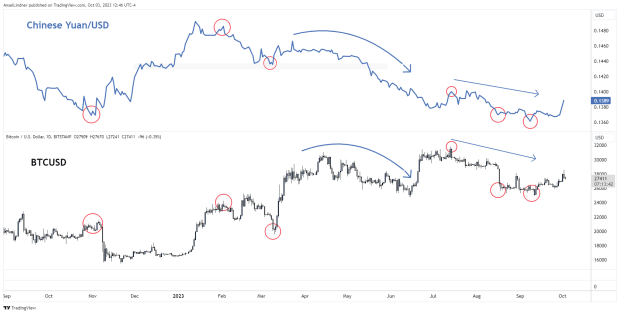

The correlation of both gold and bitcoin to CNY is striking.

Please note, Chinese markets are closed this week for Mid-Autumn Festival and China’s National Day (29 Sept – 8 Oct). The CNY data above is from the Intercontinental Exchange (ICE) but other sources are not showing the recent spike. There was a higher low on the CNY prior to market closing for the holiday, and I have been expecting an imminent broad market pivot/consolidation. This would fit both bills.

Another piece of evidence that supports this bounce in CNY is seen in bitcoin. It too has been highly correlated to CNY, and this week’s bounce probably corresponds to a CNY bounce in shadow markets.

Using gold instead of Treasuries and FX reserves to support the crashing Yuan is a smart move and would remove sell pressure from US Treasuries. This could turn the tide on the runaway US 10Y yield, which hit 4.82% on Tuesday. The same thing happened last September into October, with the 10Y spiking from roughly 100 basis points (bps), from 3% to 4%.

The overriding pressure in this market is a dollar shortage, not inflation. A dollar shortage, higher rates, and higher oil prices we’ve discussed previously, will squeeze the market into recession. Even a brief relaxation of pressure on the yuan by selling gold could create a disproportionate move in bitcoin. Bitcoin rallied 40% in January and March, and 26% in June on similar or weaker yuan moves. Bitcoin only has to rally 17% currently to break the long term resistance at $31,000.

Market-based Inflation Expectations

Shifting gears back to the US markets, regarding inflation vs recession odds. Last week, I wrote extensively on this relationship. If a recession is around the corner, which markets are pricing into Fed Funds futures and many experts agree, that scenario precludes even mild inflation. It’s either/or. Either inflation, or recession.

Using that heuristic, we can examine inflation expectations and apply them to recession odds.

The most respected market-based indicators for general inflation expectations are the 5y-5y Forward Contract (expected inflation for the 5 year period starting in 5 years) and the 5 and 10-year Breakevens (the difference between inflation protected securities (TIPS) and unprotected securities at those maturities).

All three measures are showing the market expecting inflation of less than 2.5%. Red arrows denote times of inversion, that is times when the 5-year breakeven was above the 10-year breakeven. This is another inversion similar to the yield curve, that signals recession.

There is also a pattern to the compression in spreads. Prior to the Great Financial Crisis and prior to COVID, as recession became more likely, spreads compressed. Today, we again see compression with only 24 bps separating all three.

Inflation expectations of 2.5% are neither high nor low, so it is hard to draw a direct conclusion from the level itself. However, the tightness indicates the market is becoming increasingly worried, like in 2007 and 2019. The next thing we should expect is inflation expectations to start moving down as we approach recession.

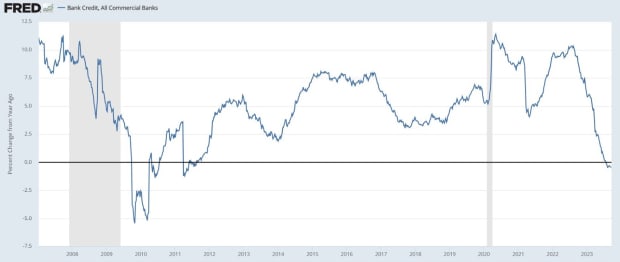

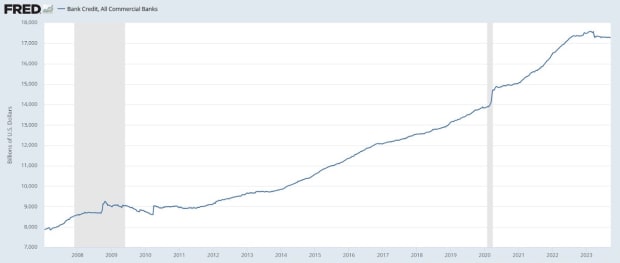

We can cross check a forecast for falling inflation expectations with the level of bank credit. That is base money after all in a credit-based system. If inflation was a threat, bank credit would have to be rising, making recession impossible. However, we see just the opposite. YOY change in bank credit has hit zero.

Bank credit is stagnant, meaning a deflationary outcome is very likely. That’s great for bitcoin, because it is also a hedge against systemic credit risk. There is no counterparty risk to your bitcoin, unlike all manner of credit-based financial assets.

We have, therefore, added two more metrics to our ‘recession-not inflation’ thesis we’ve been building. Stagnant bank credit will pull down inflation expectations and the resulting slow decline in breakevens outline a general timeline. Once inflation expectations begin to fall, which bank credit says it will, historically a recession follows in roughly 15 months.

Stocks and risk assets, including bitcoin, tend to rise and yields fall in the year leading up to recession (as outlined last week). So, we have yet another confirmation that bitcoin should have plenty of runway through the halving and into next year.