I have wasted far too much of my time killing zombies. This is what Paul Krugman calls ideas or alleged facts that, despite being shown to be wrong countless times, keep coming back to life. In terms of anti-Keynesian mythology, the zombie I have spent too much time on is that 2013 UK growth showed austerity works, but I’ve also done a bit on the mistaken idea that US growth in 2013 shows that Keynesian multipliers are zero. (I’ve been told that what I have done in the US case is deficient for a couple of reasons – neither of which I accept – but those saying this have never shown that doing it their way makes any difference. Instead they prefer to stick to gotcha economics. You can draw your own conclusions from that.) But these are particular episodes for particular countries – what about the big picture?

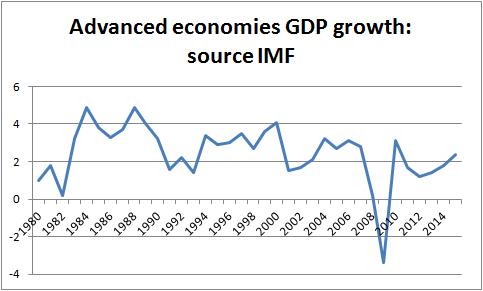

I happened to be using the IMF’s datamapperrecently, and it contains the following for GDP growth in the advanced economies.

There was slow growth in the early 80s, but that was followed by years of around 4{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} growth. Another slow growth period in the early 90s, followed by years of around 3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} growth. The same again for the 2000s. We then had the massive recession of 2009, followed by 3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} growth in 2010. Then four years of growth below 2{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}, which would have been classed as a downturn based on previous experience.

Why has there been such a pathetic recovery? There is a simple, entirely conventional answer, which perfectly fits the timing: fiscal austerity. As I set out here, growth from 2010 in the US, UK and Eurozone would have been closer to previous recoveries without cuts in government consumption and investment.

Now of course there are other explanations. The most obvious is that recoveries from financial crises have been weaker and more prolonged in the past. However a point that is not made often enough is that the austerity explanation and the weak finance explanation are quite compatible with each other. In a recession private spending and public spending on goods and services do not compete, so even if private spending has been weak because of difficulties in obtaining finance, austerity in the form of public spending cuts will still reduce GDP. Furthermore, an inability by consumers to borrow can magnify the impact of cuts in transfers or increases in taxes on consumption.

The only theoretically plausible explanation for why austerity in the form of cuts to government consumption and investment will not reduce output in a demand deficient recession is if monetary policy eases to offset the cuts. That explanation suggests weak growth since the recession is a deliberate choice by monetary policy makers, and it gets more implausible as each day passes. Here is consumer price inflation from the same source. Whereas inflation wobbled around 2{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} during the Great Moderation, in 2013 and 2014 it was below 1.5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}, and this year is heading towards zero.

SOURCE: mainly macro – Read entire story here.