====================

In my view, these were my best posts written between August 2016 and October 2016:

What to do when Ethics are Discouraged

Eight ways to promote ethics where it is not popular.

On how to price illiquid bonds, and why GAAP accounting does not matter for financial stock prices.

On Donald Trump, during a time in 1990, when he said in the midst of a personal business financial crisis said:

“What I want to do is go and bargain hunt,” he said. “I want to be king of cash.”

I even get to draw analogies to Warren Buffett, Elon Musk, and nifty finance poem that is less known today.

Dead as a Severed Horse’s Head

A lot of people got skinned by the bankruptcy of Horsehead Holdings, which was unfair to stockholders, but sadly, legal. That said, those that owned the company missed several significant points regarding risk control, and that is why they lost.

Thinking About Monetary Policy: A Counterfactual

On a rare time that I agree with Paul McCulley — we both think the Fed in general should not invert the yield curve. Also, how the Fed could be genuinely independent, unlike their “independence” that they talk of presently.

Practically Understanding Non-GAAP Earnings Adjustments

It ain’t all dirty, and it ain’t all clean. Sometimes non-GAAP is a correction, and sometimes it is abusive of economic reality. You have to analyze it carefully.

On the Decline of Lifestyle Employment

On the political fetishes that exist with protecting certain types of employment, when economies constantly change.

Watch Net Income Double in Two Years, Not

Remember, earnings estimates are off of non-GAAP earnings. Do not confuse them with prior GAAP earnings for making an estimate of the growth in the value of corporations.

“What municipalities lose businesses and people? Those that treat them like milk cows. Take a look at the states, counties and cities that have lost vitality, and will find that is one of the two factors in play, the other being a concentrated industry mix in where the dominant industry is in decline.

The more a municipality tries to milk its businesses and people, the more the businesses begin to hit their flinch point, and look for greener pastures. With the loss of businesses and people, they may try to raise taxes to compensate, leading to a self-reinforcing cycle that eventually leads to insolvency.”

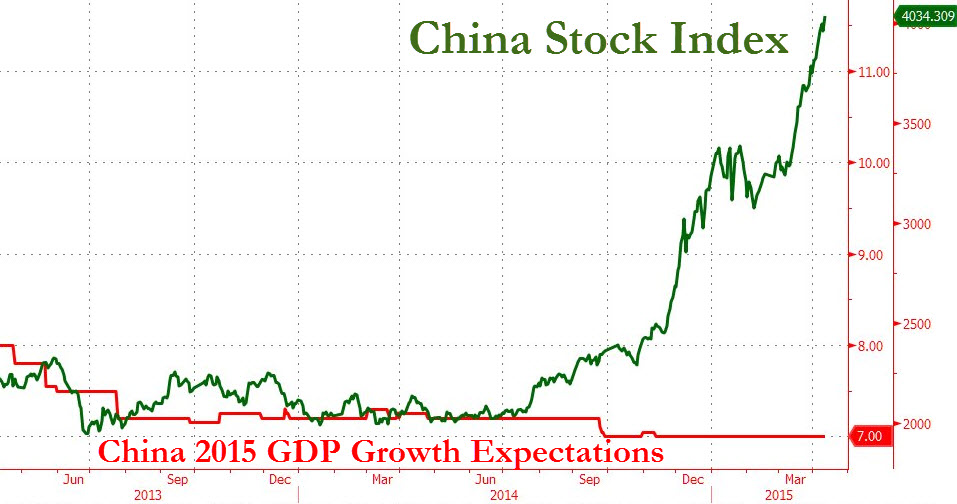

How financial imitation helps create bubbles, if imitators don’t understand the risks they are taking.

“Money does not flow into or out of assets. When a stock trade happens, shares flow from one account to another, and money flows the opposite direction, with the brokers raking off a tiny amount of cash in the process. Prices of assets change based on the relative desire of buyers and sellers to buy or sell shares near the existing prior price level. In a nutshell, that is how secondary markets work.”

SOURCE: The Aleph Blog – Read entire story here.