“Davidson” submits:

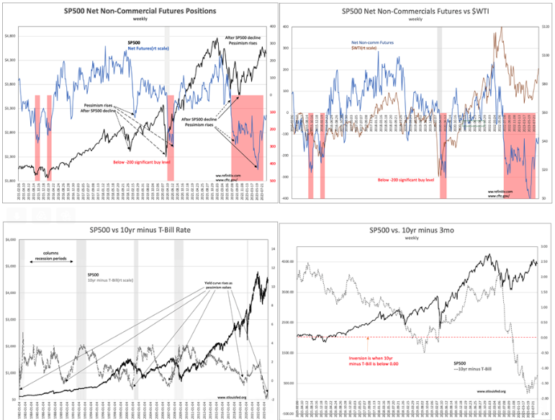

Sentiment continues to improve as does the yield curve. It is proving to be a slow process in this turn of a pessimistic market towards something more optimistic. The first chart, SP500 Net Non-Commercial Futures Positions, as has been the historical pattern, shows the highly negative futures position improving after the rise in the SP500. Last week’s futures close was -116.3, well off the historic low of -434.2 the 1st week of June. $WTI in the second chart, SP500 Net Non-Commercial Futures vs. $WTI, shows a correlating rise in crude oil prices as market hedges are removed. The next two charts show the history of the 10yr Treasury rate minus the T-Bill rate(3mo) from 1982 vs. the SSP500 and the more detailed view on the same time scale as the futures charts. The yield curve saw its low early May. The positive-turning in the yield curve always proceeds higher equity prices by several months. Every market cycle has nuances not present in past cycles and this cycle has had an unusual spike in T-Bill rates during a period of extreme pessimism. This is diametrically opposite to the historical norm as investors have in the past driven T-Bill rates lower as they sought the safety of falling equity markets. The only conclusion one can come to in my experience after reading reports of various hedging techniques this cycle is that enough institutional managers have shorted T-Bills to buy 5yr-10yr maturities to protect themselves from a market collapse which has yet to occur. As can be seen in the net futures and $WTI pricing, fear of a collapse has been easing and some of the particular hedge is reversing resulting in the less-negative yield inversion. While the rise in equity prices from the low, Oct 22 of $3,491, may seem significant, the history of a rising yield curve suggest much higher equity prices lay ahead.

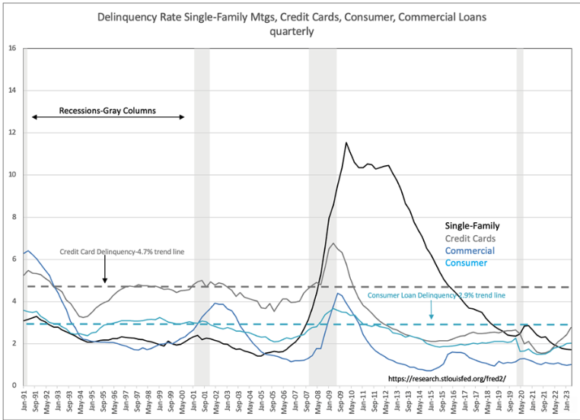

The last chart is a reminder of the quarterly August release of debt delinquency rates. Consumers and businesses currently have little of the financial stress that precedes every market and economic correction. It is worth taking note of 2 benchmark levels, credit card delinquencies at 4.7% and Consumer Loan delinquencies at 2.9%. Even though both have risen a little, they remain below prior cycle-low levels. The media discussion by some does not state these facts. Delinquencies need to rise substantially before there is enough financial stress to threaten a market and economic correction of any consequence.

Current market psychology remains decently pessimistic and investors have not committed capital to equity markets to the degree they are likely to when more optimistic. My experience suggests an optimistic turn is likely to produce a dramatic desire to own equities as the better return alternative.