So the total buyback available now is $31.7B ($6.7B remains on previous buyback that expires 8/1). In theory they could be buying the dip now with what remains (as of 6/30) on the initial buyback.

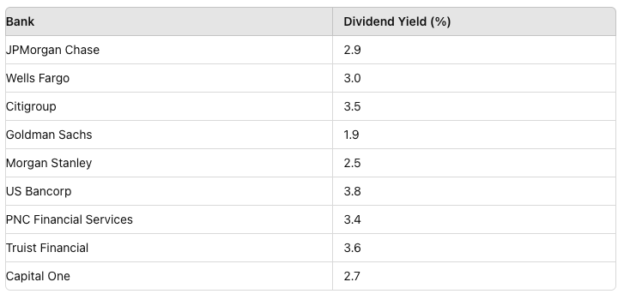

The dividend should end the year with about a ~$1.02 annual dividend which comes to ~2.4% yield at current prices which is below most peers

Now, the stock has run 24% YTD and started the year with a 2.8% dividend which is better, but still below peers. 3%+ is really where they should be. They are returning ~$7.9B in dividends and ~$30B in buybacks.

When the stock hits $52 we will have our 3rd 10-bagger (excluding options trades) following GGP and AAPL.

The News:

Bank of America Increases Common Stock Dividend 8% to $0.26 Per Share, Authorizes $25 Billion Stock Repurchase ProgramCHARLOTTE, NC – Bank of America Corporation today announced the Board of Directors declared a regular quarterly cash dividend on Bank of America common stock of $0.26 per share, up $0.02 from the prior quarter. The dividend is payable on September 27, 2024 to shareholders of record as of September 6, 2024.The Board also authorized a new $25 billion common stock repurchase program, effective August 1, 2024, to replace the company’s current program, which will expire on that date. As of June 30, 2024, the current program had approximately $6.7 billion in common stock repurchases remaining. Today’s authorization will continue to provide additional capital return flexibility going forward, in line with the company’s commitment to return to shareholders excess capital that is not needed to support economic growth, deliver for customers and communities, invest in the future and sustain strength and stability through the economic cycle.Bank of America’s ability to make capital distributions depends, in part, on its ability to maintain regulatory capital levels above minimum capital requirements.The timing and amount of common stock repurchases made pursuant to the Bank of America common stock repurchase program are subject to various factors, including the company’s capital position, liquidity, financial performance and alternative uses of capital, stock trading price, regulatory requirements and general market conditions and may be suspended at any time. Such repurchases may be effected through open market purchases or privately negotiated transactions, including repurchase plans that satisfy the conditions of Rule 10b5-1 of the Securities Exchange Act of 1934, as amended.The Board also declared a regular quarterly cash dividend of $1.75 per share on the 7% Cumulative Redeemable Preferred Stock, Series B. The dividend is payable on October 25, 2024 to shareholders of record as of October 11, 2024.