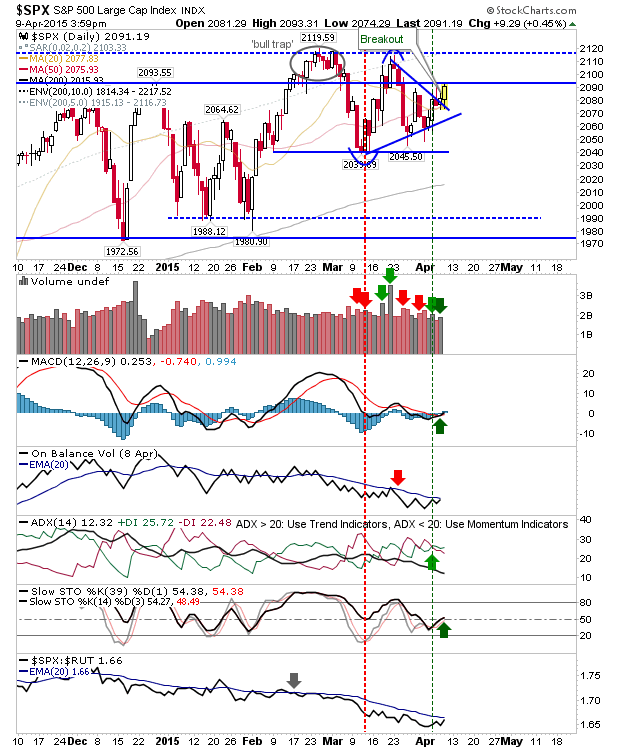

Markets are still bound by the larger range from March, but there was a consolidation breakout on offer from the S&P. It still has overhead supply to work with, but today’s buying registered as accumulation. The S&P enjoyed a MACD and Stochastic ‘buy’ along with today’s action. However, On-Balance-Volume still has to trigger a ‘buy’ signal to turn all technicals net bullish.

The Nasdaq took out the near term high which had looked a good area for shorts to work (but is now history). Next up is to challenge 5000, and then the ‘bull trap’.

The Russell 2000 finished weak on the day, but the ‘bull trap’ in play will likely see a challenge tomorrow. Of all the indices, it’s the one most likely to break to new highs.

While the Nasdaq is playing in favour of bulls, the Nasdaq 100 is potentially offering a shorting opportunity. I don’t think this is the preferred play given strength in other indices, but it’s one to consider.

Today saw some healthy bullish action and tomorrow is nicely set for more. For those who may not know, I do the Friday show on Tradercast from 13:30 GMT. I’ll be covering indices, FX, gold and oil. I’ll be looking for further gains in the indices, and nursing my long in the DAX.

You’ve now read my opinion, next read Douglas’ and Jani’s.

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday’s at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil – all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY – IT’S FREE!

SOURCE: Fallon Financial Commentary – Read entire story here.