Shell is delivering on its promise of “consistent” returns, chief executive Wael Sawan said, as the company committed to another $3.5bn of share buybacks after its quarterly profits beat market expectations.

Europe’s largest oil and gas company reported adjusted earnings of $6bn for the third quarter, far exceeding average analyst estimates of $5.4bn, as increased gas production offset lower oil prices and weaker refining margins.

“We’ve said that we wanted to become consistent both in delivery and in distributions; I think this quarter shows that,” Sawan told the Financial Times, adding that this was the 12th consecutive quarter that the company had announced $3bn or more of share buybacks.

Since taking over in January 2023, Sawan has sought to improve financial performance by cutting costs and simplifying Shell’s approach to the energy transition.

That process has involved streamlining the senior management team, re-emphasising the oil and gas business, and trimming less profitable parts of the company’s low-carbon portfolio.

“It’s a transformation of a culture and we’re embracing it and continuing to move forward on it,” Sawan said.

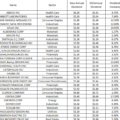

In line with those plans, Shell said capital expenditure for 2024 would be at “the lower end” of the previously outlined range of $22bn to $25bn. Net debt fell by $3.1bn from the previous quarter to $35.2bn, the lowest since 2015.

The company maintained its dividend at $0.34 a share and its shares were up almost 2 per cent by Thursday lunchtime in London.

“We see this is a strong set of numbers once again,” said Biraj Borkhataria at RBC Capital Markets, adding that Shell’s falling net debt should leave the company well positioned to maintain current levels of shareholder returns even if oil and gas prices are lower into next year. “We continue to see Shell’s distribution programme as being more resilient than peers given its fortress balance sheet.”

BP on Tuesday signalled it would “review” its expectations for 2025 share buybacks in February, after lower commodity prices pushed quarterly profits to the lowest in almost four years. Its shares closed down 5 per cent on the day.

French rival TotalEnergies on Thursday reported third-quarter profits at a three-year low of $4.1bn. Adjusted net income fell in all its major business divisions but the decline was steepest in refining and chemicals, which saw a 62 per cent drop, owing to European refining margins falling by two-thirds, quarter on quarter.

Shell suffered similar declines in its chemicals and products division, which includes refining, where adjusted earnings slumped to $463mn, from $1.1bn in the previous quarter.

The biggest contributor to group profits was once again Shell’s integrated gas division, which reported quarterly earnings of $2.9bn thanks to increased liquefied natural gas production.

Sawan said Shell’s LNG trading business, which is the biggest in the world, will continue to drive profits for the group even if LNG prices fall in the second half of the decade amid an expected increase in global supply, mainly from Qatar and the US.

Shell has built “a very diverse portfolio with multiple different supply points, multiple different demand points”, Sawan said. “We are building a business that’s resilient to the future.”

Separately, investments in its renewables and energy solutions division fell to 8 per cent of group-wide capital expenditure in the third quarter, down from 10 per cent across 2023 and 15 per cent across 2022.

Sawan said this did not include Shell’s investments in areas such as biofuels and electric vehicle charging, which sit in other business divisions. He stressed that the company remained committed to spending $10bn to $15bn on low carbon solutions between 2023 and 2025.

“This is not going to be linear, it’s going to be lumpy and at the end of the day, it’s very much aligned with the strategy that we have laid out,” he said.