- Ripple whales holding 100 million XRP and higher shed 140 million tokens in seven days.

- XRP retail investors accumulated the coin in the same time frame.

- XRP slips under support at $0.60, trades at $0.5950 at the time of writing.

Ripple (XRP) posts a second consecutive session of losses on Monday, dipping under the key psychological support of $0.60, as large-wallet investors seem to have engaged in a selling spree, ushering a correction in the price of XRP Ledger’s native token.

Daily digest market movers: Ripple on-chain metric shows sell-off by whales

- Santiment data shows XRP investors holding 100 million or more tokens reduced their portfolio by 140 million coins in a seven-day time frame between August 19 and 26. When large-wallet investors drop their holdings, a correction is more likely as their bigger capacity to influence prices increases the selling pressure.

- However, as whales shed their XRP token holdings, retail investors accumulated the altcoins. This is likely one of the factors that help ease the selling pressure on the XRP. The supply distribution chart below shows the change in XRP holdings of investors in different categories.

XRP supply distribution

- Generally, a decline in whale holdings is followed by a correction in the asset’s price, as seen in previous instances in the last six months. It remains to be seen whether the recent decline will lead to a steeper correction for XRP.

- The Network Realized Profit/Loss metric (NPL), which represents the net profit/loss of all assets sold on a given day, also suggests that investors are opting to sell XRP to realize gains. Positive spikes in the NPL suggest that investors on average sold on profits, while negative values represent that traders realized losses.

- Between August 19 and 26, XRP traders consistently took profits, approximately $35.5 million, per Santiment data. Typically, consistent profit-taking increases the selling pressure on the altcoin, thus negatively influencing its price.

Network realized profit/loss

- Ripple CEO Brad Garlinghouse recently shared the speaker lineup for the annual flagship event Ripple Swell 2024. The upcoming event is another key market mover for the altcoin since historically XRP prices have noted heightened volatility before and during the event.

Technical analysis: XRP loses key support

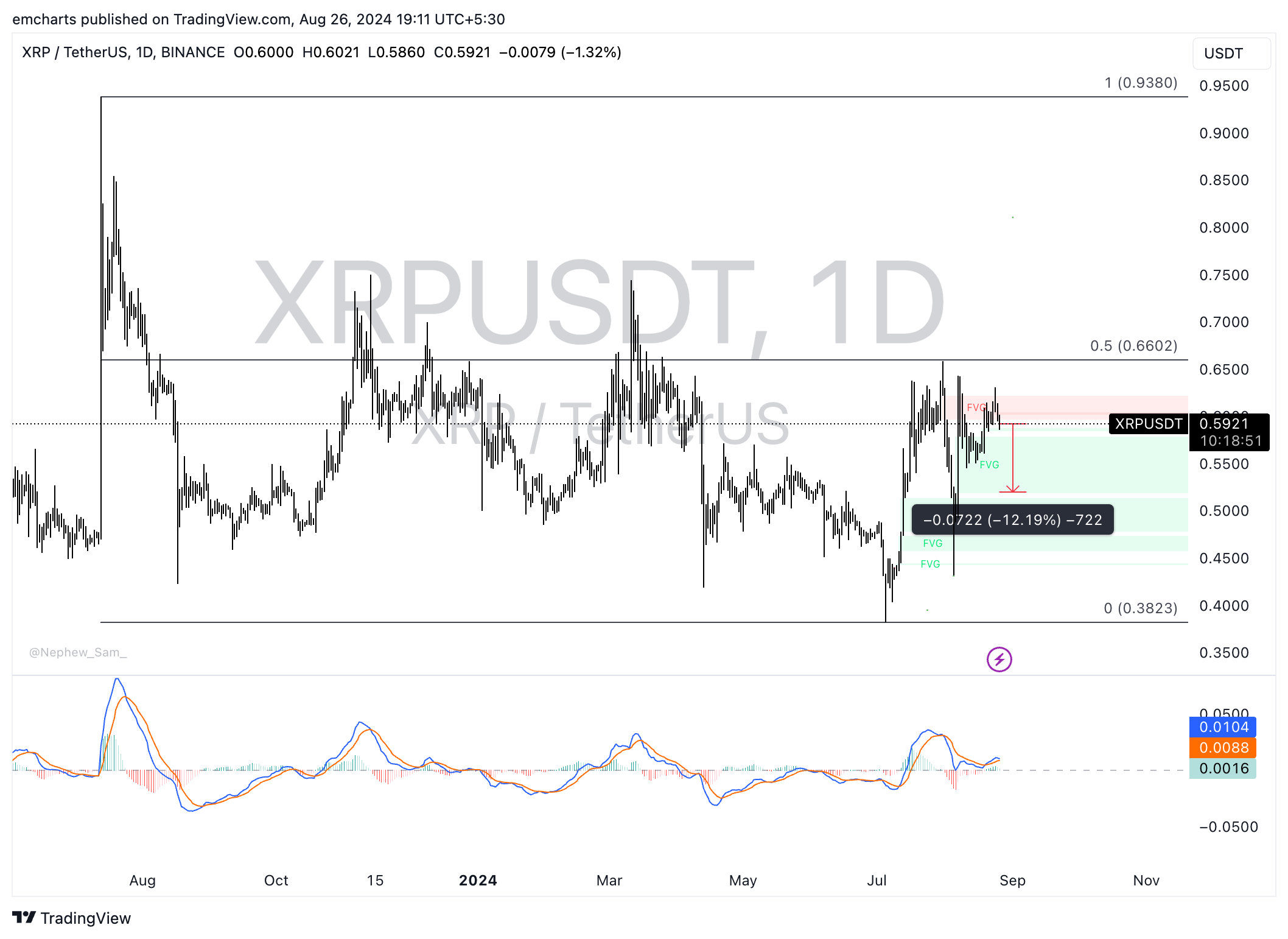

Ripple is currently in a multi-month downward trend. The altcoin fell significantly from its peak of $0.9380 on July 13, 2023, to the July 5, 2024, low of $0.3823. Since then it has recovered somewhat, trading in a sideways trend for the last month. In case of a correction, XRP could erase another 12% of its value and sweep liquidity at $0.5188, the lower boundary of the Fair Value Gap (FVG) seen in the XRP/USDT daily chart.

The Moving Average Convergence Divergence (MACD) momentum indicator flashes green histogram bars above the neutral line, suggesting that XRP has an underlying positive momentum. However the Relative Strength Index (RSI) reads 52.80 on the daily time frame, close to neutral levels.

Traders need to watch the signal line and MACD line for a crossover. If the MACD line crosses under the signal line, it could give a sell signal.

XRP/USDT daily chart

Looking up, XRP could extend gains to the Fair Value Gap extending between $0.5970 and $0.6217.

%20[19.03.54,%2026%20Aug,%202024]-638602795935316258.png)