“Davidson” submits:

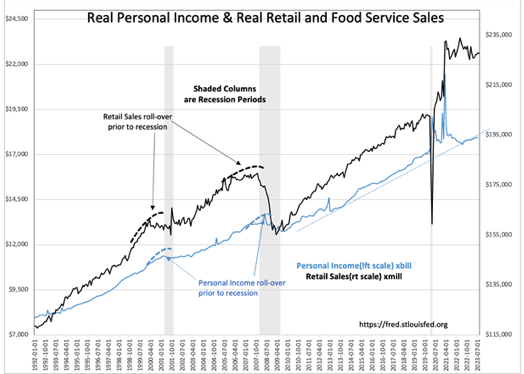

Real Retail Sales and Trucking Tonnage reports continue to hold for the former and remain on trend for the latter. One would expect Retail Sales to reverse to the pre-COVID trend. It has not as employment continues to rise. That economic activity continues to trend higher is supported by these reports.

Every week it seems that there is a call for some form of correction with economic consequences. The ongoing data supports a steady economic uptrend at a traditional pace. Coupled with low delinquency rates for consumer borrowing and rising personal income, the financial system is not signaling the stress that normally accompanies corrections. My observation is that many have lost touch with economic fundamentals and are swayed by rapid price movements believing these to be visible challenges to economic stability. This makes markets prone to emotional swings ignoring economic factors altogether.

Long-term investors require patience and attention to basics. The fundamentals always have won. Higher employment, higher personal income have always translated to higher equity prices.