– by New Deal democrat

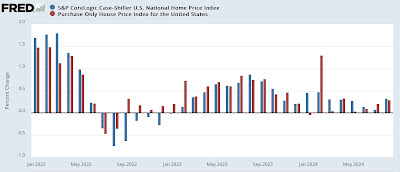

This morning’s repeat house price indexes from the FHFA and Case Shiller continued to show deceleration in this metric which is very important to home buyers. Specifically, on a seasonally adjusted basis, in the three month average through August, U.S. house prices according to both indexes rose 0.3%. This is a slight acceleration from the 0.1% increases for June and July in the Case Shiller Index, and from the 0.1% and 0.2% increases, respectively, for the FHFA Index:

On a YoY basis, both indexes rose 4.2%. This was the lowest YoY increase in the Case Shiller index since the period of January through July last year, and before that January 2020. For the FHFA Index, it was the lowest since the onset of the pandemic except for March through June of last year – and before that October 2014!:

In the last six months, the Case Shiller Index has only risen 1.5%, and the FHFA index 1.0%, which translate into annual increases of 3.1% and 2.0% respectively, which as shown above, would be absolutely typical for an annual increase before the pandemic.

Further, because the house price indexes lead the shelter component of the CPI (Owners Equivalent Rent, black in the graph below) by 12-18 months, this also means we can continue to expect deceleration in that very important component of consumer prices as well, if somewhat slowly:

Specifically Owners Equivalent Rent, which is 25% of the entire CPI, should continue to trend towards 3%-3.5% YoY increases in the months ahead, continuing to bode well for both the headline and core measures of that index.

Rebalancing of the housing market, new home sales edition: sales increase, prices firm, Angry Bear by New Deal democrat