Successful investing boils down to Patience, Persistence and Perseverance.

You need the patience to wait for the right company to hit the right entry price. You then need the patience to buy it and wait patiently through the ups and downs for the thesis to work out. You then need the patience to ignore the noise, and stay the course through the ups and downs.

You need the persistence to stick to your plan, through thick or thin, month in and month out. You need the persistence to keep going.

You need the perseverance to stick to your investment strategy and your investments, despite the noise. You will see others make more money faster than you. You will experience some disappointments along the way. Yet, you need to persevere through it all, in order to live to see another day and ultimately realize the profit potential of your strategy.

I personally find focusing on dividend growth investing to be my edge. I focus on real companies, with real products or services, which provide value to their customers. I try to acquire those quality companies at a good price, and then wait to let the power of compounding do the heavy lifting for me. I assemble my portfolio patiently, and over time.

But I am not super human at all. I hate to watch the stock market fluctuations. Seeing your portfolio go up or down every day by the amount you made over a certain period in a day job definitely makes it scary to watch those fluctuations. For example, if you made $50,000/year at your day job, you make $1,000/week. If you have a portfolio worth $100,000, a 1% fluctuation is equivalent to the amount you make from your day job after a week of working.

However, I changed my perspective. I typically ignore price fluctuations as noise. Sometimes the market is willing to overpay for a company by offering a massive premium for it. Other times, the market is offering a company at a steep discount. As a long-term business owner, I like to acquire assets at a discount. Hence, while I view fluctuations as noise, I do check to see if good companies are offered at a discount.

I have also changed my perspective in another way. I focus on the dividend income, which is much more stable, dependable and easier to forecast than share prices. That $100,000 portfolio may be worth $50,000 in a bear market or $200,000 in a bull market. But the income it generates won’t be fluctuating so widely (assuming a blue chip portfolio of dividend growth stocks such as the ones found on the dividend aristocrats/dividend champions/dividend achievers list).

That portfolio may be generating $3,000 in annual dividend income. So that portfolio may fluctuate in value all it wants, but that dividend income would likely be at $3,000/year. Even better, that dividend income would likely increase over time as well, fueled by growth in earnings per share in the underlying businesses that the portfolio is assembled from.

So that focus on the dividend is really a super power for me. It’s my edge in the market.

In an environment where everyone is scared of stock prices moving up and down and sideways, dividends provide me with staying power. I am getting paid to hold on to some of the worlds best businesses. And those business pay dividends on a predictable schedule. That’s because their business models are very good, and they have underlying competitive advantages. Those advantages fuel earnings growth, and a predictable stream of cashflows. That’s predictability tends to leave a trail of a long history of annual dividend increases. Those regular dividends make it very easy to hold on to those companies. The increases make it nice to hold too. And those dividends can be then reinvested at a good value in a bear market.

Share prices can go up or down, but my dividends are paid on time, and increased too.

The beautiful thing about dividend growth stocks is that these are stable and mature companies that are leaders in their respective industries. They do not get bid up to the sky in a bull market like unproven risky companies. However, they also do not crash and burn in a bear market like unproven risky companies.

Hence, they are not as volatile as other companies, which make them very easy to hold to through the ups and downs of the market cycle.

The fact that you are also paid to wait a predictable and growing stream of dividends, also make them very easy to hold to through the ups and downs of the market cycle.

I am not speaking just blindly of course.

If you look at the history of popular dividend strateies you can see all of that in action.

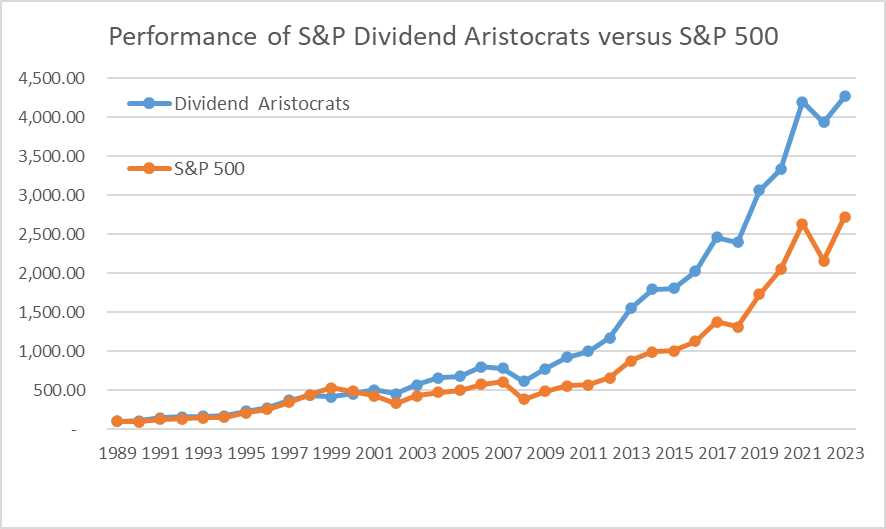

For example, the Dividend Aristocrats list trailed the S&P 500 in the 1990s, during the roaring bull market. This was most pronounced at the end of that massive bull market, right in the 1998 – 2000 euphoria that culminated with the bursting of the dot-com bubble.

However, when the dot-com bubble burst, dividend aristocrats did much better in the 2000 – 2010 period.

In the 2010 – 2019 period, dividend aristocrats did as well as the market. It is only in the past 5 years, during the crazyness of Covid and the tech dominance that the aristocrats have been doing not as good. Howerver, they have still delivered amazing results.

The dividend aristocrat strategy shined in the 2000 – 2003 bear market, the 2007 – 2008 bear market, the 2020 bear market and the 2022 bear market. It went down less than everyone else. It also held its ground during most of the bull markets too.

I expect turbulence in the future. There will be ups and downs. But I find it easier to hold on to dividend growth stocks, where the lows are not so bad, and the highs are just as good. This brings to an overall picture that makes it easier to hold on to through the ups and downs of the cycle.

The best offense is a strong defense.

Most investors time horizons are much longer than they think. They should be investing for success over a lifetime, rather that investing in what has been hot in a given cycle.

Dividend investing wont be hot in a given cycle of a raging bull market. But it holds its ground. It would shine when everyone else experiences a steep drawdown or an excruciatingly testing long period of flat prices. It doesn’t work in every cycle, but it ends up on top over many cycles. This provides staying power, and rewards the investor who has the patience, persistence and perseverance to stick to it over many cycles that comprise their investing journey.

In addition, it’s very reassuring to hold on to my stocks, because I am paid on a predictable schedule. The relative stability, predictability of dividneds makes them an ideal source of income in retirement in my opinion. Add in the fact that qualified dividends are taxed at preferential rates in taxable accounts in the US and the fact that dividends have historucally risen faster than inflation, and you can see the point even better.

But to succeed in any strategy out there, you need to have Patience, Persistence and Perseverance.