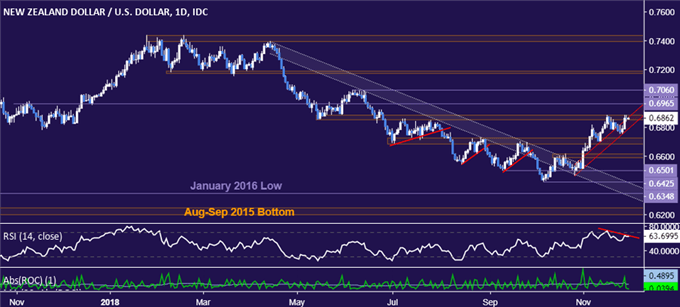

NZD/USD Technical Strategy: 0.6785

- New Zealand Dollar bounce cut short at familiar resistance level

- RSI divergence suggests that a double top may be in in the works

- Short position remains in play absent clear bullish invalidation

See our free trading guide to help build confidence in your NZD/USD trading strategy!

The New Zealand Dollar has returned to challenge resistance in the 0.6851-84 area after a foray to the downside was cut short below the 0.68 figure. A nominally higher high has been set but confirmation of a break on a daily closing basis is conspicuously absent (at least for now) and negative RSI divergence warns of ebbing upside momentum.

A reversal downward from here sees initial trend line support at 0.6795, with a break below making a compelling argument for downtrend resumption and opening the door for a test of the 0.6688-0.6726 zone. Alternatively, a daily close above 0.6884 eyes a minor chart inflection point barrier at 0.6965, followed by a more substantive threshold at 0.7060 (June 6 high).

The short NZD/USD trade

Article source: https://www.dailyfx.com/forex/technical/home/analysis/nzd-usd/2018/11/30/NZDUSD-Technical-Analysis-Double-Top-Forming-Below-0.69.html

The post NZD/USD Technical Analysis: Double Top Forming Below 0.69? appeared first on Daily Forex Signals.

SOURCE: Daily Forex Signals – Read entire story here.