It is increasingly looking like we will not see the severe recession many were predicting. Now, the question is “Do we start seeing real growth” or are we going to “drag along for a few years”.

My guess is the latter. Inflation is still running at 4%-5% and until it gets to 2% or lower, rates are going to stay elevated compared to the last three decades. While, this may not cause a recession, it will have an effect on growth.

“Davidson” submits:

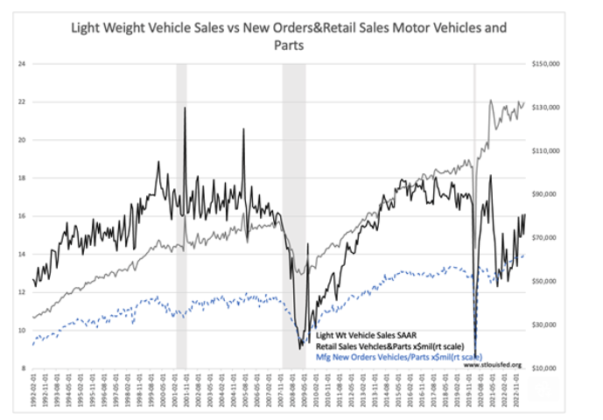

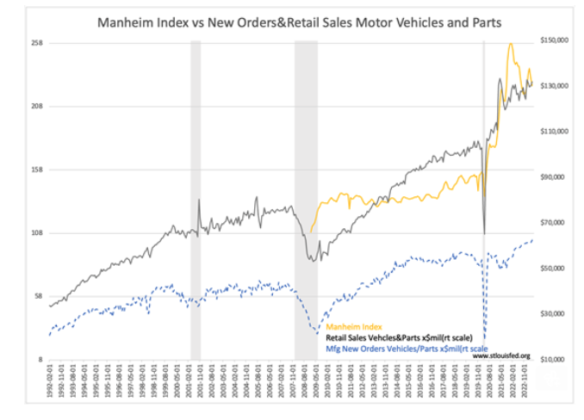

The est. June 2023 SAAR(Seasonally Adjusted Annual Rate) for Lt Weight Vehicle sales is in the low-16mil range. This number is climbing slowly held in check by continued supply chain issues. That demand for vehicles remains strong is reflected in the Manheim used-vehicle price index which remains ~70% pre-COVID levels i.e., demand strong vs weak supply = high prices for existing supply of vehicles. The pre-COVID Manheim Index had risen from 2019 level of ~135 to ~152 with the policies of government deregulation spurring demand for personal transport. Post-COVID supply chain issues have seen new vehicle supply shrink drastically, still 60% below prior inventory levels, leaving used vehicle pricing near the 230 index pricing level. This is 70% higher than pre-COVID pricing.

Vehicle demand is reflected in a stubbornly high Manheim Index and rising trends in New Orders and Retail Sales. Estimates remain, the US has a 5mil vehicle deficit yet to fill. Rising employment indicates vehicle demand should remain strong till manufacturing and deliveries have spent several years in the 17-18mil SAAR range. A good signal that sufficient supply has been achieved will be a significant reduction in the Manheim Index. Inflation is an issue in judging what level is likely to reflect rebalancing supply/demand but the pre-COVID trend suggests a level closer to 160-170 or 60%+ lower than current levels.

Demand for personal transportation remains strong. On-shoring to offset prior supply chain disruptions is adding to manufacturing employment which makes estimates for how long this condition is likely to continue difficult. Nonetheless, this demand continues to be one of the drivers of general economic demand that supports higher industrial and energy related equity prices.