‘Davidson” submits:

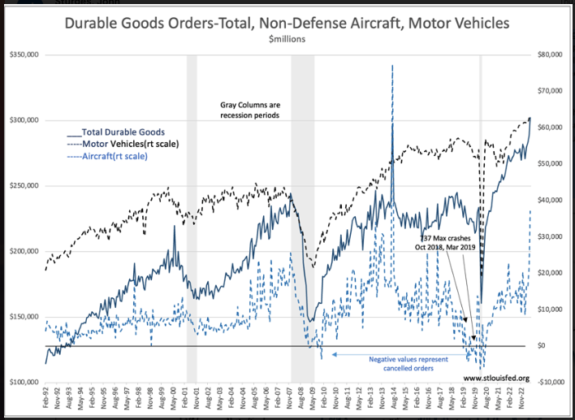

The Manufacturers’ New Orders for Durable Goods reported this morning adds to the series of positive economic surprises including recent months’ reports revise higher. 2wks ago an updated and revised higher report was issued but this report again revised higher the earlier revised report. Enough market participants continue to worry about being caught up in a market decline various indicators of pessimism have not shifted as fundamentals continue to improve. The ADP employment report this week was well above expectations and mostly treated as confusing. It does feel like many investors are tiptoeing past a dark closet expecting to be sucked in by something they missed being unable to protect themselves. Today’s New Orders report does not support such fear.

Employment is key to the economic trend. Thus far, employment has been rising and demand for employment from manufacturing, healthcare and the leisure industry has been reflected and continue to be reflected in quarterly corporate commentaries. The vehicle and aircraft manufacturing industries have supply chains that span a wide swath of technologies and independent vendors. The demand they see represents sources of employment growth . On-shoring to improve supply-chains provides employment beyond what is normal for recovery from an economic correction. Clearly, the demand shown in vehicle and aircraft manufacturing is not slowing. In my experience, this demand is likely to continue for several years and in turn US economic activity.

Economic trends continue to positively surprise while investors continue to fret. Equity prices should continue to rise.