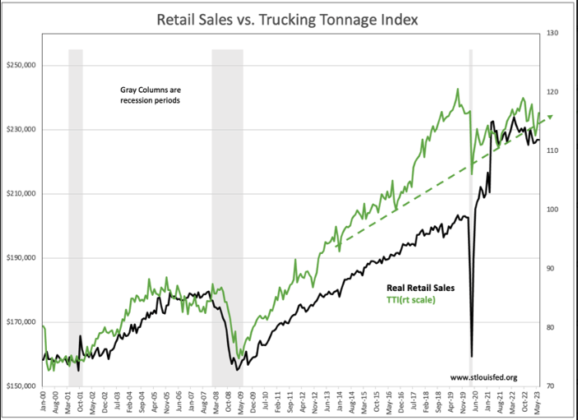

Adding another positive data point to others indicating economic expansion is the Trucking Tonnage Index. This is a volatile series that should only be monitored as a multi-month trend and in conjunction with other related economic series. The June report rose 2.1% vs May with a downward revision with the net effect being a rise above the trend line.

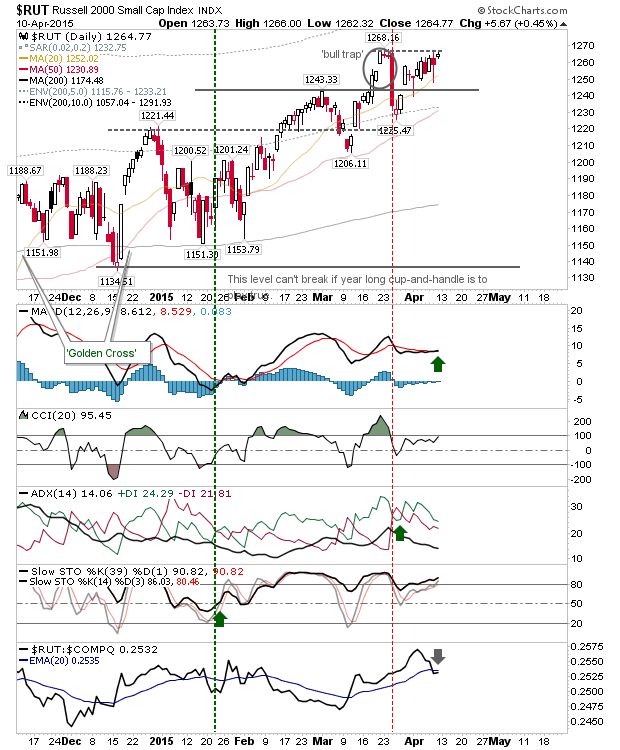

Within the last 10 days, Tom Lee and Ed Yardeni have both forecasted SP500 higher than $5,000 by year-end. Just 1mo ago, the SP500 having pierced the artificial “up-20% from Oct lows”, was declared a “Bull Market”. For those tracking fundamentals, we have been in an expanding economy since April 2020 with many recession forecasts unsupported. Equity prices swooned with market psychology but now appear to be turning positive.

Just as we witnessed individual securities priced at ridiculously low levels the past few years, in my opinion, we are likely to see the reverse to ‘ridiculously high pricing” for those issues once psychology swings fully optimistic. It is the nature of human psychology to act this way and it will prove our patience to hold through the mania to benefit fully.

Coming out of a dark period is where the market views itself currently. Higher equity prices are ahead for now.