Uh-oh! ;

Uh-oh! ;

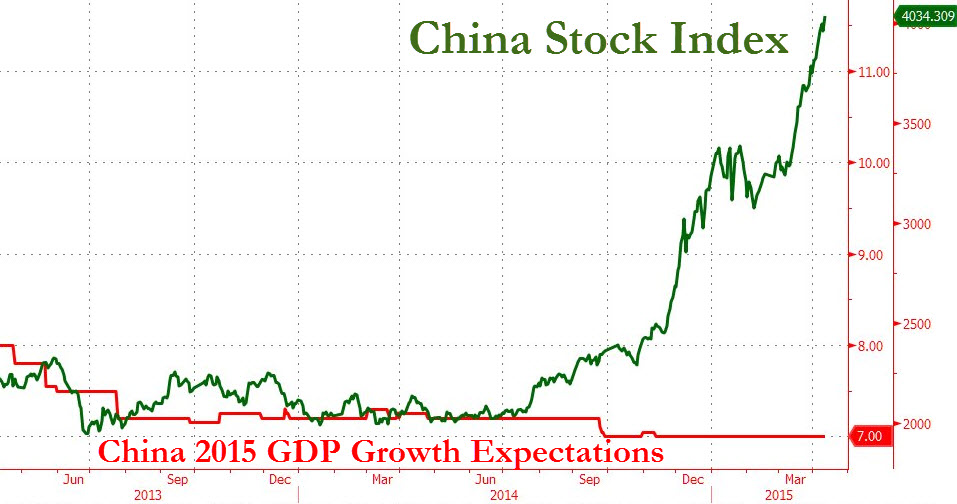

It's Monday and there are no major M&A deals and no QE announcements to goose the markets. ;China is still going like gangbusters as lots of bad economic data over ;there is getting traders expecting more stimulus announcements by the PBOC, so 100{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} is no longer a reason to pause after 6 months of gains, is it? ;

We picked up 40 of the FXI May $48 puts on Thursday and those should be down around 0.70 this morning. ;So far, so wrong on our entry though as FXI is up 5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} since we went short just 2 sessions ago. ;At this rate, Chineese markets will be double again by the end of the month – no wonder traders are rushing to get in desptie the World Bank downgrading their growth projections this morning. ;After all, who needs economic growth when you have market growth, right? ;

China's March Exports were down 15{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} y/y but don't worry, Imports were down 12.7{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} to match, so even must be a good thing and that explains the rally. ;

China's March Exports were down 15{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} y/y but don't worry, Imports were down 12.7{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} to match, so even must be a good thing and that explains the rally. ;

Imports have now been in freefall for 5 consecutive months and that's a drag on the whole Asian economy and Exports were sucking too except for the Feb shipment of IPhones and IWatches to the US that bumped the numbers 50{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} from last year but back to our usual crap numbers already in March. ;

Isn't this the kind of data that makes you want to pay an average of 100{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} more for the companies that are participating in this economy? ;If you are a Chinese trader, the answer is – OF COURSE! ; Things are slowing down so fast in China that Feb Power Consumption was off 6.3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} from last year, due exclusively to a 2.5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} drop in consumption by Primary Industries, who are the primary users of power in China (remember when we used to manufacture stuff?). ;

BNPs Chief Economist, Richard Iley calls China a "self feeding frenzy of speculation" that is ;using margin debt to finance "speculative gains built on unsustainable increases in leverage." ;There's no hidden meaning here, folks – the man is telling you to GET THE F OUT of the Chinese market! ;Q1…

SOURCE: Phil’s Stock World – Read entire story here.