Good morning…

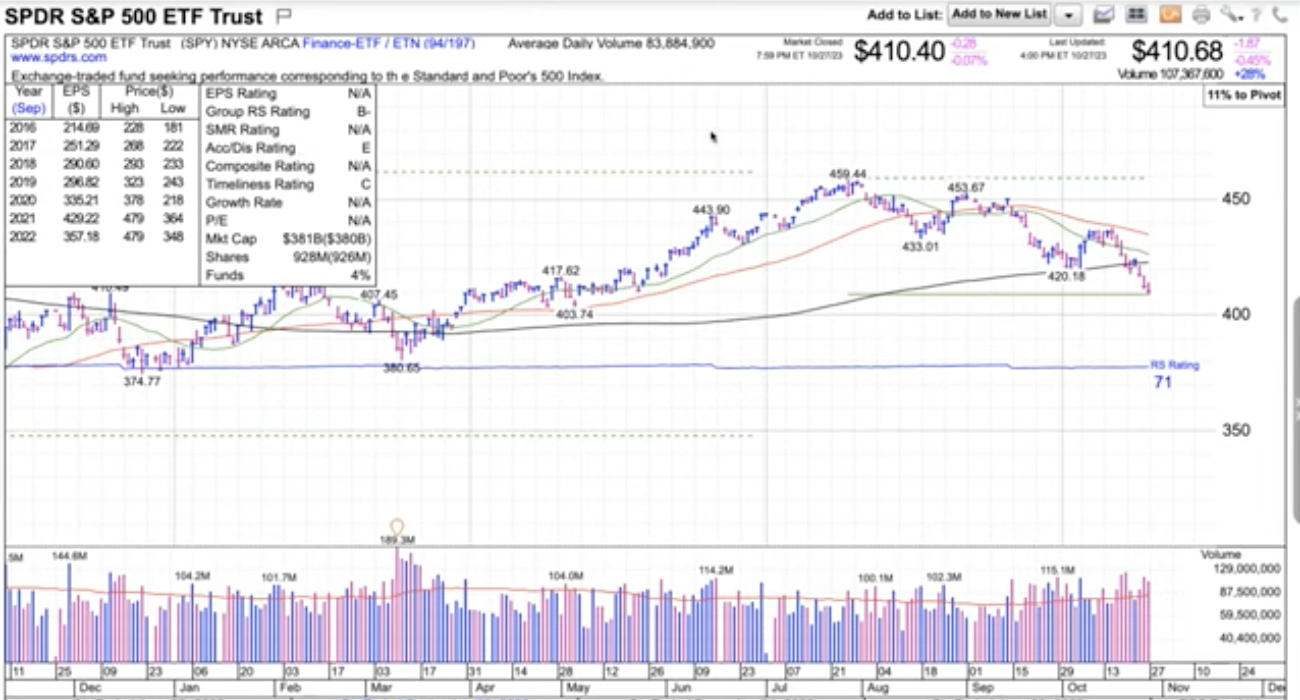

As always, Ivanhoff and I tour the markets looking for momentum. This week I talk about the fact that World War 3 has started to ‘trend’ which is also showing up in a quartet of sectors – Gold, Bitcoin, Oil Tankers and Uranium. The market is a forward looking machine and so these are a group of trends that I hope reverses immediately.

It is another big week of earnings and so far most stocks reporting have been sold off.

You can watch this weeks episode right here on YouTube. It is easy to subscribe so please do and every Sunday you will get an alert when we post the show.

Chapters:

- Intro (0:00)

- Correction mode (0:16)

- Earnings season (1:30)

- WWIII Trade (4:00)

- $DECK (8:50)

- What Howard’s watching (10:13)

- The week ahead (16:40)

- The new environment (20:50)

- False prophets (23:20)

Here are Ivanhoff’s thoughts:

When the market is bullish, it is looking for the slightest reason to go up. We saw that in October of 2022 and January 2023, when earnings reports and growth were lackluster, and yet, many stocks rallied. We are seeing the opposite now. Company after company from various industries reported much better than expected earnings and raised guidance. And yet, they were all sold off for the most part. I pay attention to the earnings reactions because the market is forward-looking and often sees/discounts things that might not be so obvious right now. Google, Meta, and Microsoft crushed estimates and still traded lower. Poor reaction to good news is what causes bear markets.

I know, you keep hearing that positive seasonality is about to kick in and we will have a year-end rally. We’ve been reading the same thing for the past four weeks and most stocks have been making lower highs and lower lows. One of these days, seasonality experts will be right. I am not mocking. I am just saying that relying solely on seasonality is not a practical way to manage risk if you are actually trading or managing money.

Nothing goes straight down. The indexes are not too far from reaching oversold levels that historically led to powerful short-term bounces. Maybe the FOMC meeting next week will trigger one of those rallies? I don’t know, no one does. The sentiment is still a bit complacent considering where interest rates, oil, gold, and volatility are. Traders will be traders and we will look for opportunities regardless of the tape. Those opportunities are not the same every week. This is why we don’t have to be active every single day or use the same position size in every type of market. It’s ok to sit it out and protect capital and confidence if your approach doesn’t work in a corrective tape. It’s ok to be short if this is working for you, It’s ok to learn new tricks if the old ones are not working right now. Whatever you do, make sure that you enter asymmetric trades where your winners are at least 2x your risk. Otherwise, why are you even trading in this tape?

Have a safe week and good thoughts please on bringing the hostages home.

As a reminder, Marketsmith (by Investor’s Business Daily) is now a sponsor of the weekly show. All the charts you have been seeing in the videos and will continue to see are from Marketsmith. They are offering my readers a three week trial for $19.95. Click this link if you would like to try it out.