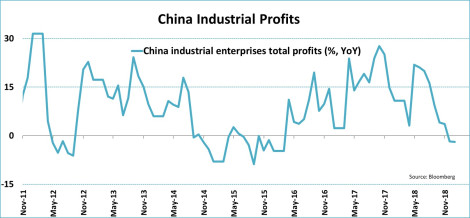

Profits of Chinese industrial companies fell 1.9{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} year on year in December, marking the second consecutive month of earnings decline. For 2018 as a whole, profits rose 10.3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}, half the pace of the previous year. Slower GDP growth, pressure on export volumes and lower producer prices are negatively impacting company earnings. Comparable to other Chinese macro data, the effects of government stimulus have yet to become noticeable. Given the weaker economic momentum, it could take another couple of months for that to happen. Therefore, the January PMI data, which will be published later this week, are unlikely to show much improvement, if any. More patience ? and stimulus ? are required.

Obviously, falling earnings are never a good thing. But investors in Chinese equities have already priced in a very subdued outlook for Chinese company earnings, as is shown by the graph below. EBITDA for all of China’s stock market has increased significantly in recent years while stock prices have plummeted. It would take a drop in earnings of more than 25{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} to push that blue line (earnings) towards the black line (stock prices). Hence, it’s not unlikely that the massive turn in sentiment in the last months of 2018 have left investors too negative on future earnings.

SOURCE: Jeroen Blokland Financial Markets Blog – Read entire story here.