Davidson” submits:

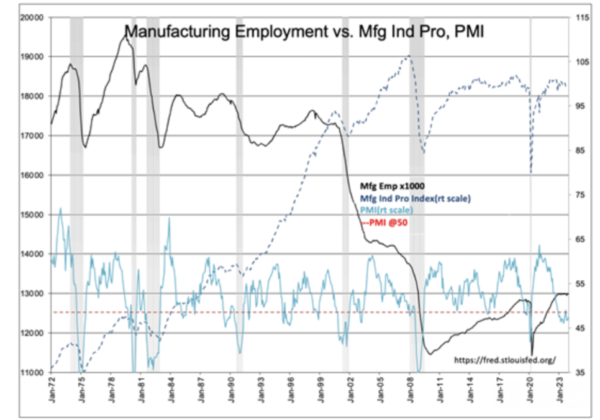

The headlines persist in declaring a current manufacturing recession. The referenced indicator is PMI shown in Manufacturing Employment vs. Mfg Ind… from Jan 1972. The recessions are indicated by the gray columns and the benchmark of —PMI @50 is the level below which many forecast recession and above which they believe indicates economic expansion. Lost in translation is the fact that forecasters have called for recession using the PMI many more times than they have occurred. The call today is we are in a manufacturing recession since Nov 2022 when the PMI last fell below 50. The problem with this perception is the combination of Manufacturing Employment (___ Black Line) and the Mfg Ind Production Index (—– Dark Blue Line) that do not support the PMI as an indication of anything other than investor sentiment, having zero use as an economic indicator.

Both Manufacturing Employment and Mfg Ind Production Index are respectively best estimates of the number of employees involved in manufacturing and the value of their output . One can see as time progressed from Jan 1972 the US lost manufacturing employment as competition lowered prices and forced reconsiderations of cost/benefit outcomes. It became cheaper to manufacture overseas. The US retained the higher valued manufacturing products which saw Mfg Ind Pro rise as employment fell. As economic indicators each generally dips prior to the onset of recession by as many as 24mos prior. If one counts carefully one can see 17 instances of the PMI forecasting recession to only 7 actual recessions. The facts ofPMI is that this is not an economic benckmark but an opinion survey of purchasing managers. It is the market psychology of a group of individuals reflecting the current mood of the moment. The PMI rises and falls with shifts in the SP500 vs. PMI. The SP500, experience indicates, is a highly media-sensitive market psychology indicator with a smattering of tracking financial indicators that vary in importance depending on the season.

That a manufacturing recession continues as a headline is due to the PMI being below 50. The economic data do not support recessionary thinking. With the SP500 continuing to defy investor pessimism, at some point, the PMI’ers will change their view. When they do I expect to see a surge of buying in economically sensitive issues that have been reporting decent recovery post COVID-lockdowns.