- EUR/USD briefly weakened below the 1.0500 support to hit new YTD lows.

- Further gains lifted the US Dollar to fresh 2024 peaks despite lower yields.

- US Producer Prices ticked higher in October, while weekly Claims were firm.

EUR/USD stayed under pressure on Thursday, marking its fifth consecutive decline and dipping to new 2024 lows in the sub-1.0500 region.

The ongoing strength of the US Dollar, driven by a surge in investor optimism over potential economic policies under the incoming Trump administration, sent the US Dollar Index (DXY) beyond the 107.00 barrier to clinch fresh yearly highs.

The Greenback’s gains were bolstered by the so-called “Trump trade,” reflecting market confidence in potential pro-growth policies. Contrasting with the above, US bond yields moved lower across the board, while German 10-year bund yields dropped to two-day lows, breaking below 2.35%.

On the policy front, the Federal Reserve (Fed) cut its target interest rate by 25 basis points last week, lowering it to the 4.75%-5.00% range as expected. The Fed acknowledged that inflation is inching closer to its 2% goal, though the labor market is showing early signs of cooling despite persistently low unemployment figures. Notably, the Fed’s statement included a subtle shift in language, suggesting inflation has “made progress.”

Fed Chair Jerome Powell refrained from signalling any specific policy direction for December, highlighting continued economic uncertainties. He noted that while recent data was encouraging, there’s no intent to resign if pressured by President-elect Trump.

Meanwhile, Fed officials has maintained a cautious approach when it came to gauge the potential continuation of the bank’s easing cycle. On this, Richmond Federal Reserve President Tom Barkin argued that uncertainties, such as high union wage settlements and the potential for upcoming tariff increases, could lead Fed policymakers to be more cautious in concluding that they have successfully curbed inflation. Barkin did not specify whether he supports another rate cut at the Fed’s upcoming December meeting.

Across the Atlantic, the European Central Bank (ECB) lowered its deposit rate to 3.25% on October 17 but decided to pause any further actions, waiting for more economic data before making additional moves.

Looking forward, potential trade policies from the Trump administration, including tariffs on European and Chinese goods, could push US inflation higher. If the Fed adopts a cautious or hawkish stance, it may continue to lend support to the US Dollar.

Back in the US, inflation remained in centre stage, showing Producer Prices rising more than expected by 2.4% YoY in October, and 3.1% from a year earlier when it came to prices excluding food and energy costs.

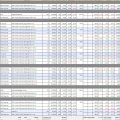

EUR/USD daily chart

Technical Outlook for EUR/USD

Further losses could see EUR/USD testing its 2024 low at 1.0495 (November 14), before the 2023 bottom at 1.0448 (October 3).

On the upside, immediate resistance lies at the 200-day SMA of 1.0865, seconded by the November high at 1.0936 (November 6) and the provisional 55-day SMA at 1.0947.

In addition, the short-term technical outlook remains bearish as long as EUR/USD stays below the 200-day SMA.

The four-hour chart highlights accelerating downward momentum, with key support levels at 1.0495 and 1.0448. On the upside, initial resistance appears at 1.0653, followed by 1.0726. The RSI rebounded above 32.