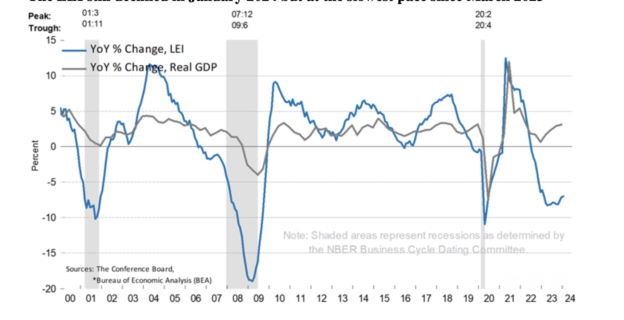

People put too much weight in then LEI, it gives us plenty of head fakes as the chart below shows.

“Davidson” submits:

In keeping with its being more heavily weighted on sentiment than economic inputs, the LEI is reported lower in Jan 24. Below the LEI link is a strongly pessimistic headline example of what one can locate in the news that most individuals witness.

The economic indicators remain in uptrends and this dramatic disparity between the LEI and economics makes the underpriced equities in the market, mostly energy and industrials, a good buying opportunity.

Excerpt from today’s release:

US Leading Economic Index® (LEI) Fell Further in January

Updated: Tuesday, February 20, 2024 https://www.conference-board.org/topics/us-leading-indicators

About the Leading Economic Index and the Coincident Economic Index:

The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

The LEI still declined in January 2024 but at the slowest pace since March 2023