- The Japanese Yen gains positive traction against the USD for the second straight day on Tuesday.

- Tokyo inflation report lifts expectations for an eventual hawkish BoJ pivot and boosts the JPY.

- The uncertainty over the Fed’s rate cut trajectory weighs on the USD and drags USD/JPY lower.

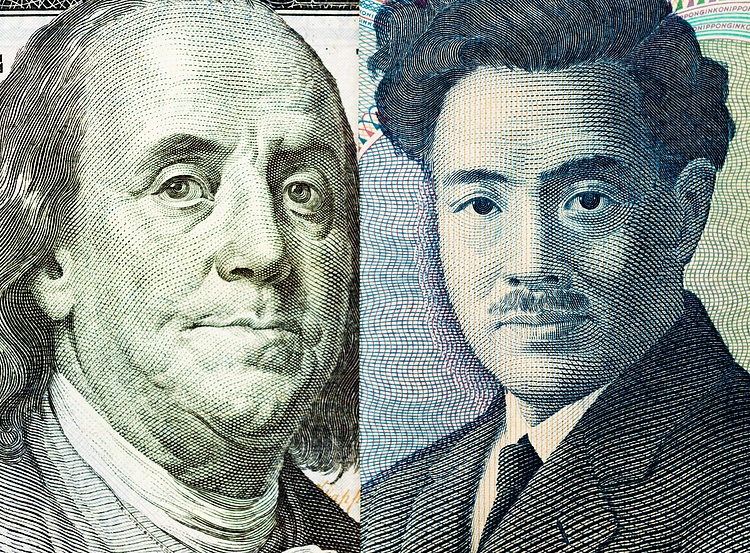

The Japanese Yen (JPY) attracts follow-through buying for the second straight day on Tuesday after data showed that inflation in Tokyo – Japan’s capital city – remained above the Bank of Japan’s (BoJ) 2% target. This fueled expectations that the central bank will start phasing out its massive stimulus sometime this year and boost the domestic currency. The US Dollar (USD), on the other hand, is undermined by bets that the Federal Reserve (Fed) will start cutting interest rates in March, bolstered by a fall in US Consumer Inflation Expectations. This, in turn, drags the USD/JPY pair below mid-143.00s during the Asian session, though the intraday downfall stalls ahead of the very important 200-day Simple Moving Average (SMA).

Government stimulus measures in the wake of a devastating New Year’s Day earthquake in Japan might have already delayed the Bank of Japan’s (BoJ) plan to pivot away from its ultra-dovish stance. This, along with a positive tone around the Asian equity markets, could keep a lid on any meaningful appreciating move for the safe-haven JPY. Furthermore, investors have been scaling back their expectations for a more aggressive policy easing by the Fed in the wake of the still-resilient US economy. Apart from this, the recent hawkish remarks by several Fed officials remain supportive of elevated US Treasury bond yields, which should act as a tailwind for the buck and help limit the downside for the USD/JPY pair.

Traders might also refrain from placing aggressive directional bets and prefer to wait for the release of the latest US consumer inflation figures on Thursday. The crucial US CPI report might provide some clarity over the timing of when the Fed will begin easing its monetary policy, which, in turn, will play a key role in influencing the USD price dynamics and determining the near-term trajectory for the USD/JPY pair.

Daily Digest Market Movers: Japanese Yen benefits after Tokyo CPI lifts bets for BoJ policy shift

- The Japanese Yen attracts follow-through buying during the Asian session on Tuesday, though the fundamental backdrop warrants some caution for aggressive bullish traders.

- Inflation in Japan’s capital fell as expected, with Tokyo core Consumer Price Index (CPI) inflation, which excludes volatile fresh food prices, rising 2.1% YoY in December.

- A core reading that excludes both fresh food, and fuel prices, and is closely watched by the Bank of Japan as a measure of underlying inflation, eased from 3.6% to 3.5%.

- Adding to this, the headline Tokyo CPI inflation fell from 2.6% in the prior month to an annualized 2.4% in December and is now within spitting distance of the BoJ’s annual target.

- This comes on top of a deadly earthquake in Japan and dampens hopes for an imminent shift in the BoJ’s dovish stance at the January 22-23 monetary policy meeting.

- Japan’s Finance Minister Suzuki Shunichi announces a 4.74 billion Yen spending and is considering expanding reserve funds of FY-24/25 budget plans for Noto Peninsula earthquake.

- The US Dollar remains on the defensive in the wake of last week’s mixed US economic data and bets that the Federal Reserve will start easing its monetary policy soon.

- The New York Fed said in a report on Monday that US consumers’ projection of inflation over the short run fell to the lowest level in nearly three years in December.

- The latest survey showed that inflation is expected to be at 3% one year from now, or the lowest reading since January 2021, as against a projection of 3.4% in November.

- Investors, however, have been paring bets for early interest rate cuts by the Fed, which remains supportive of elevated US bond yields and should act as a tailwind for the USD.

Technical Analysis: USD/JPY could find some support near 200-day SMA ahead of the 143.00 mark

From a technical perspective, the intraday downfall drags the USD/JPY pair below the 100-hour Simple Moving Average (SMA). A subsequent break through the 38.2% Fibonacci retracement level of the recent strong recovery from a multi-month low touched in December might have already set the stage for further losses. With oscillators on hourly/daily charts holding in the negative territory, spot prices seem vulnerable to slide further towards testing the very important 200-day SMA, currently around the 143.25 region, en route to the 143.00 mark, or the 50% Fibo. level.

On the flip side, the 144.00 round figure now seems to act as an immediate resistance ahead of the 144.25-144.30 region. A sustained strength beyond the latter could trigger a short-covering rally and lift the USD/JPY pair to the 145.00 psychological mark. Some follow-through buying might shift the bias back in favour of bullish traders and allow spot prices to make a fresh attempt to conquer the 146.00 mark with some intermediate barrier near mid-145.00s.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.08% | -0.11% | -0.01% | -0.13% | -0.47% | -0.11% | -0.15% | |

| EUR | 0.09% | -0.02% | 0.08% | -0.08% | -0.41% | -0.03% | -0.09% | |

| GBP | 0.11% | 0.03% | 0.10% | -0.04% | -0.36% | 0.00% | -0.04% | |

| CAD | 0.01% | -0.07% | -0.09% | -0.13% | -0.46% | -0.10% | -0.14% | |

| AUD | 0.14% | 0.08% | 0.06% | 0.17% | -0.34% | 0.05% | -0.02% | |

| JPY | 0.50% | 0.42% | 0.41% | 0.50% | 0.36% | 0.40% | 0.36% | |

| NZD | 0.11% | 0.03% | 0.02% | 0.11% | -0.05% | -0.39% | -0.04% | |

| CHF | 0.17% | 0.08% | 0.06% | 0.15% | 0.02% | -0.30% | 0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. Still, the Bank judges that the sustainable and stable achievement of the 2% target has not yet come in sight, so any sudden change in the current policy looks unlikely.