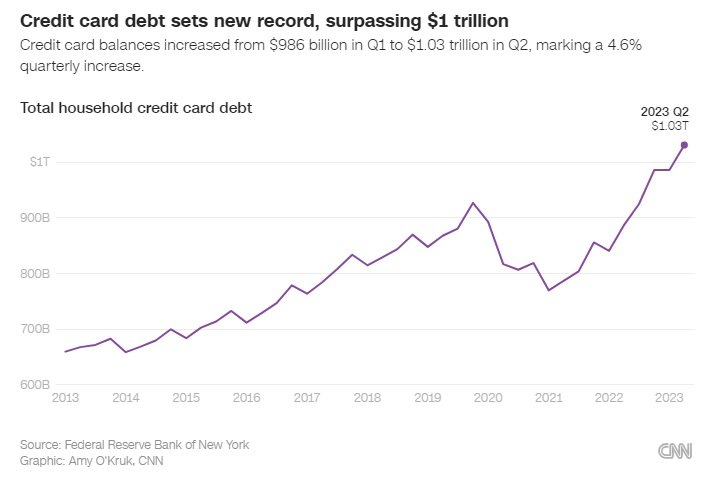

Before we get too concerned, consider the following:

1) Credit card “debt” is measured by simply combining all of the balances of every active card in the U.S. at any given time. So, if you use a credit card for everyday spending in order to get rewards and delay the cash outlay for the stuff you buy, that is considered “debt” even if you pay the balance in full every month and never owe a dime of interest. Considering how many people do this every month, and what percentage of overall credit card spend would come from such consumers, it is highly misleading to characterize every dollar of credit card balance each month as “debt.”

2) The financial media usually highlights the total amount of this so-called debt because it’s a big number. $1 trillion!!! Far more helpful would be per-capita data since the country’s population grows each year. If you don’t make that adjustment, most years will be a new record high.

3) As many financial professionals out there know, debt is one thing (sorry, for this one I am going to pretend the entire $1 trillion+ is debt) but what really tells the story of overall financial health is both assets and liabilities, income and expenses. Having debt is not a big deal (sometimes even quite beneficial) if your assets and income can easily support it.

With those ideas in mind, let me reframe the chart shown above to put credit card “debt” in better context:

a) Although total credit card balances have grown by 56% from 2013-2023, the U.S. population has grown by 24 million people during that time. Thus, on a per-capita basis, credit card balances average $3,029 per person in 2023, up only ~45% since 2013 ($2,089 per person).

b) As previously mentioned, the $3,029 figure does not represent true debt like a student loan or auto loan balance would. I don’t have data to indicate what fraction of card balances are carried over month-to-month, but it is safe to assume it is materially lower than $3,029.

c) How do we know if credit card spending has really been growing at problematic rates? Easy, let’s look at income data. According to the U.S. Department of Housing and Urban Development, median family income nationally has grown from $64,400 in 2013 to $96,200 in 2023 – an increase of 49%.

To summarize, $1 trillion in total U.S. credit card balances might appear to be concerning in the absence of any other information. If we adjust the data for population growth and compare it to income growth, we see that over the last decade incomes have risen 49% while credit card balances have risen 45%. Additionally, as credit card rewards programs have become more engaging over the last decade, it has become more common for consumers to use cards as a way to benefit financially by using them for most purchases and paying their balances off each month.

And so, there doesn’t appear to be a credit card debt problem at all.

That is not to say we will avoid a recession in 2024 (nobody knows that) – but rather simply that credit cards will not be a contributing factor if we don’t.