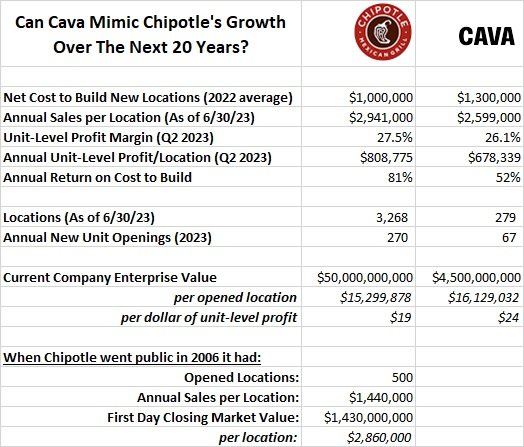

Much of Chipotle’s success has been due to extraordinarily low build out costs relative to the sales volumes and unit-level margins the locations deliver. I believe CMG has the highest four-wall profit margins of any publicly traded dining company. That said, CAVA’s 26% in Q2 of this year is pretty darn solid. I would be concerned about volatility on this metric though, as the company currently projects only 23% for the full year 2023 and last year was more like 20%. Chipotle has been much less varied.

I would point out two more things when it comes to the quantitative comparisons above. First, much of CMG’s outstanding stock market performance has come from multiple expansion (2x price to sales post-IPO to more than 5x price to sales today). Conversely, CAVA stock today already fetches more than 6x sales and has only traded publicly for 2 months. The potential for similar multiple expansion simply isn’t there – which means they will have to grow units quickly and maintain volumes and margins while doing so in order to impress investors.

Secondly, notice that the market is valuing each existing CAVA location more than each Chipotle unit, despite CMG outposts earning about 20% more in profit dollars. Has CAVA earned enough trust to warrant that relative valuation? As an investor, if I could only pick one would I want own a CMG for $15M or a CAVA for $16M? Easy answer for me, personally (the former).

Another interesting point to consider is that CMG is so big and profitable that it generates a ton of free cash flow (I estimate about $1.2 billion for 2023) for management to use for stock buybacks, whereas CAVA is still burning cash because they are choosing to open new locations faster than the existing ones book profits. So at least in the near term, CMG’s share count will likely fall, while CAVA’s will likely rise – impacting future stock performance.

To get excited about investing in CAVA today I think you need to be really bullish about the concept and its ability to be successful with hundreds, if not thousands, more units across the country. Additionally, you need to feel like you are getting a low enough price that the stock’s upside potential is worth the executional risk.

My personal view is that at current prices CMG could quite possibly outperform CAVA despite it already being more than 10x larger in terms of locations opened. But even if they merely track each other, or CMG trails a bit, given the higher risk profile of a chain with fewer than 300 locations (versus one with 3,000+), I believe a risk-reward assessment still favors Chipotle. Time will tell whether that view proves prescient.

Full Disclosure: No positions in the stocks mentioned at the time of writing, but that is subject to change at any time without further notice

As of the publication date, CAVA stock was quoted at $43 with CMG at $1,860

Data sources: CMG: Q2 2023 10-Q, 2022 10-K CAVA: Q2 2023 10-Q, 2023 IPO Prospectus