- Injective price is on a recovery rally after a 21% climb from the $6.500 support floor.

- INJ could rise 6% to clear the August highs of $8.270 by clearing the 50% Fibonacci Retracement.

- A 3-day candlestick close below $6.853 level would invalidate the bullish outlook.

Injective (INJ) price is looking to clear the August highs as it nurtures a recovery rally from the dip that started mid-July. Riding on the back of the notion that “October has historically been a good month for trading,” the broader market is showing signs of a recovery led by Bitcoin (BTC), but investors should be cautious because this could just prove to be a bull trap in disguise.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, XRP bulls all fired up

Injective price has 6% gains in sight

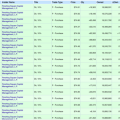

Injective (INJ) price is on a recovery rally after a 35% slump that began on July 15. The attempt comes after the $6.500 level broke the fall

In its way up, the cryptocurrency must clear several supplier congestion levels, starting with the 50% Fibonacci Retracement at $8.157. A break above this level would bring INJ to face the August highs at $8.270. Such a move would constitute a 6% move above current levels.

Further north, three critical levels are likely retests areas for Injective price, the 62%, 70% and 79% Fibonacci Retracement levels at $8.585, $8.888, and $9.191 in a highly bullish case. These levels coincide with previous roadblocks that capped the altcoin’s upside potential.

The position of the Relative Strength Index (RSI) above 50 coupled with the green histograms of the Awesome Oscillator supports the bullish thesis, showing bulls still reserve control in the INJ market.

INJ/USDT 3-day chart

Conversely, a rejection from the 50% Fibonacci level could see Injective price to the 50-day Exponential Moving Average (EMA) at $7.072. A flip of this support to a resistance ceiling could see INJ test the $6.853 support level. Such a move would constitute a 10% fall below current levels.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.