“Davidson” submits:

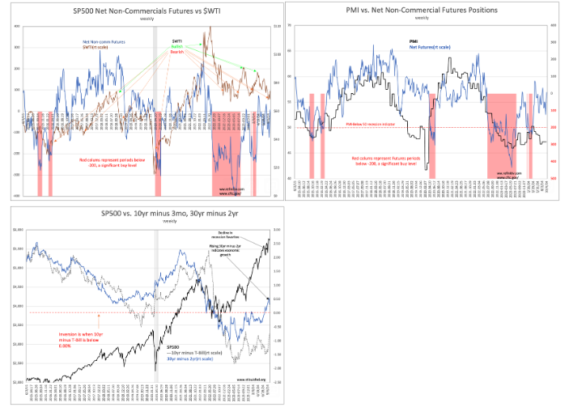

Market sentiment continues to improve. The SP500 Net Non-Commercial Futures has moved positive at 7.00, $WTI has come off lows near $68 to $74+, the 10yr minus 3mo Treasury rate is higher at -0.75 while the 30yr minus 2yr indicator remains positive even with the monthly PMI remaining unchanged at 47.2.

In the past, the SP500 has turned significantly higher well before any of these were decidedly positive. The same pattern exists today. There are calls for higher equity prices as recession fears subside. Some have called for the SP500 to be priced at $8,000 with Tom Lee well ahead of the rest at $15,000 but a longer timeframe. None of these price forecasts have valid fundamental support as they are founded on price-momentum. My own view of $8,000 in 2026-2027 is also a Momentum based pricing model but requires the next 2yrs-3yrs to produce better economic news than expected.

Our current trend appears headed in this direction as pundits raise their expectations to levels never dreamed of 2yrs ago.