After more than three years of student-loan-payment-free bliss, borrowers are now preparing to add this expense back to their budgets. Interest on student loan balances will begin accumulating in September, and payments will come due beginning in October. And it’s going to be rough.

According to a survey by Credit Karma, 53% of federal student loan borrowers say they’re struggling as it is to pay other bills. And more than 2 in 5 (45%) say they expect to go delinquent on their student loan payments once the forbearance ends.

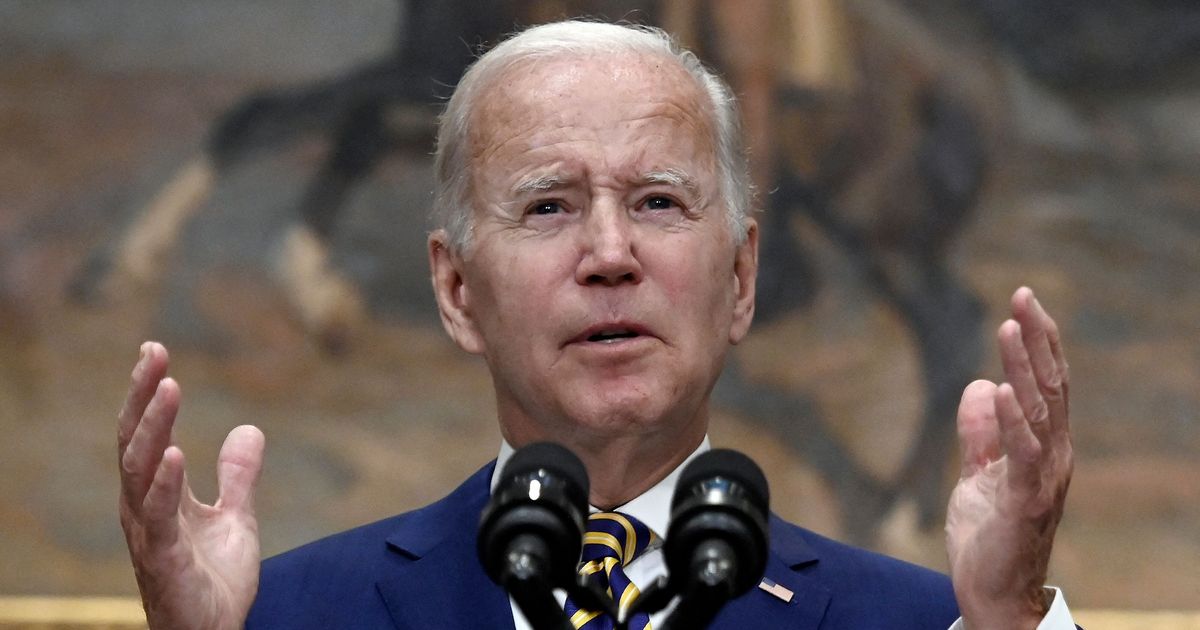

The restart of student loan payments was meant to follow the rollout of President Joe Biden’s widespread loan forgiveness plan, which more than 26 million borrowers had applied for once it was unveiled last year. However, that plan was ultimately overturned by the Supreme Court in June.

“The recent Supreme Court ruling striking down the Biden administration’s student loan relief plan, while not unexpected, was still a blow to the more than 45 million borrowers shouldering more than $1 trillion in collective federal student loan debt,” said Jonathan McCollum, chair of federal government relations for the law firm Davidoff Hutcher & Citron.

Following this defeat, the administration quickly announced a Plan B, this time attempting to exercise its power under the Higher Education Act of 1965. The HEA is considered to be the more legally sound option, but it also involves a lengthy rule-making process and public comment period, according to McCollum. “Americans will be waiting much longer for this much-needed relief — assuming it survives the inevitable new round of legal challenges that will follow,” he explained.

In the meantime, Biden has instituted a couple of measures to help provide some relief to overburdened borrowers, including a new plan known as “SAVE” that reduces payments to a small percentage of eligible borrowers’ income.

What Is SAVE — And Do You Qualify?

The Saving on a Valuable Education plan is the latest additio to a suite of federal income-driven repayment plans that reduce a borrower’s payments to a small percentage of their income and extend the repayment term out to 20-25 years, depending on the specific plan. Once the borrower completes their income-driven repayment plan, any remaining balance is discharged (but may be considered taxable income for that year).

SAVE was created to replace the Revised Pay As You Earn (REPAYE) plan and address some of its shortcomings. The plan will be phased in, with some changes going into effect this summer and some on July 1, 2024, according to Robert Farrington, founder of the millennial-focused student loan debt site The College Investor.

“When the new SAVE plan goes into effect, the lowest-income borrowers will be able to pay smaller minimum payments each month,” Farrington said. In fact, the Department of Education estimates these borrowers will see their payments fall by about $0.83 per dollar owed. (The highest-income borrowers will see their payments fall by about $0.05 per dollar.)

The immediate changes SAVE participants will see include:

- More income protected from payments: With income-driven repayment plans, payments are based on a percentage of discretionary income. This is the difference between your adjusted gross income and 150% of the federal poverty guidelines. However, SAVE increases the amount of income shielded from payments by increasing that threshold to 225%. According to the Education Department, a single borrower who earns less than $15 per hour would qualify for $0 monthly payments. Those who earn more will save an estimated $1,000 per year on their loans.

- No more ballooning interest: Typically, if a borrower’s payment is not large enough to fully cover the accrued interest on their loan, the difference is rolled into the balance. This often results in loans that grow over time even as the borrower consistently makes their payments. SAVE aims to fix this problem; if a borrower’s payment doesn’t fully cover the interest charges, the government will subsidize the difference. It’s estimated that 70% of borrowers will benefit from this change.

- Spouse’s income doesn’t count: Married borrowers who file their taxes separately will no longer have to include their spouse’s income in their payment calculation. Spouses will also be excluded from their family size when calculating income-driven payments.

Additionally, the following changes will be implemented in July 2024:

- Payments cut in half for undergrads: Monthly payments will be reduced from 10% to 5% of discretionary income for undergraduate borrowers. Those who owe a mix of undergraduate and graduate loans will pay a weighted average of between 5% and 10% of their discretionary income, based on the original principal balances of their loans.

- Forgiveness down the road: For those who had an original principal balance of $12,000 or less, the balance will be forgiven after 120 payments. For every additional $1,000 above the $12,000, borrowers will need to make an additional 12 payments, up to a maximum of 20 or 25 years, in order to receive forgiveness.

Those who are currently enrolled in the REPAYE plan will automatically be switched over when SAVE becomes available. Everyone else who wants to enroll will need to apply on the Federal Student Aid website, and applications should be processed by the time payments resume in October. Borrowers who have federal loans, including direct subsidized loans, unsubsidized loans, consolidated loans and PLUS graduate loans, qualify for the SAVE plan. Parent PLUS loans, however, do not.

Struggling Borrowers Can Take Advantage of a Temporary Grace Period

The new SAVE plan isn’t the only change that’s been introduced to help those who are struggling the most with their loan repayments. The Biden administration is also introducing a temporary 12-month “on ramp” to shield borrowers from the harshest penalties if they fail to pay their bills on time and in full once payments resume.

Payments will still be due and interest will continue accruing. However, accrued interest won’t capitalize (be added to the loan balance) at the end of the 12-month period. Borrowers also won’t be reported to credit bureaus, be considered in default or have their accounts sent to collection agencies for late, missed or partial payments during this time.

For borrowers not on income-driven repayment plans, their future monthly bills will be automatically adjusted to include the accumulated interest from the on-ramp period.

“If you’re able to make payments, I always encourage borrowers to do so,” Farrington said. “But this on-ramp period provides those who can’t make immediate payments with the necessary time to adapt, making it possible for them to eventually catch up with their monthly payments and fulfill their financial obligations related to their loans.” He also noted that borrowers don’t have to take any specific actions to qualify for this on-ramp program.

CORRECTION: A previous version of this story used an incorrect title for Jonathan McCollum.