Ag bulls awake this morning and find themselves happy to turn the calendar page after a brutal month of price action in every major Ag market traded. Corn, wheat (all classes but specifically KC and Minneapolis), cotton, hogs and cattle are all substantially lower from where they were 30 days ago. Below is the scorecard for August, a month that was marred by USDA surprises, trade failure, strong currency and ethanol/cattle/end user plant closings. As much as farmers hate getting welfare, they probably feel it deserved this month. Here is the score card:

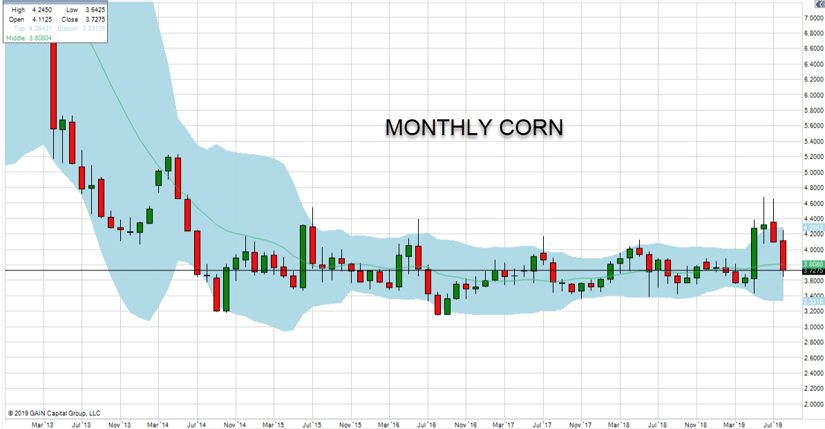

CORN- down 38 cents/9.5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}

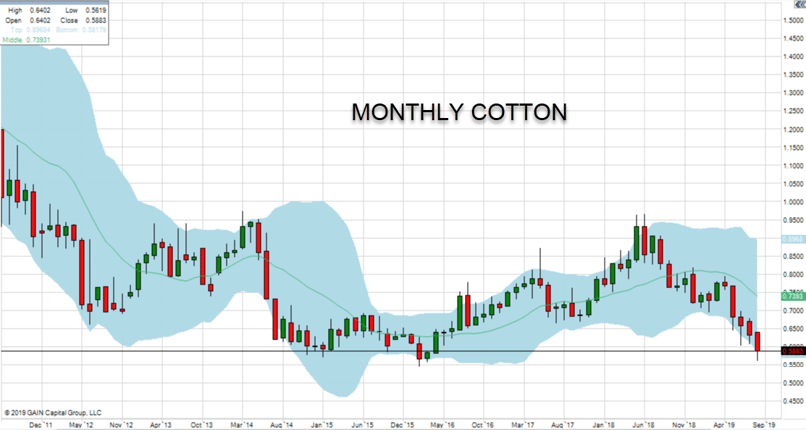

COTTON- down 4.8 cents/7.5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}

MIN. WHEAT- down 20 cents/7.6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}

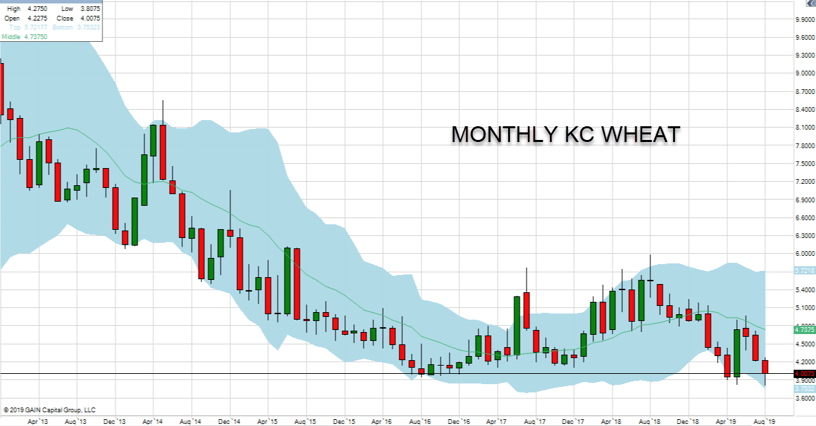

KC WHEAT- down 36 cents/8.6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}

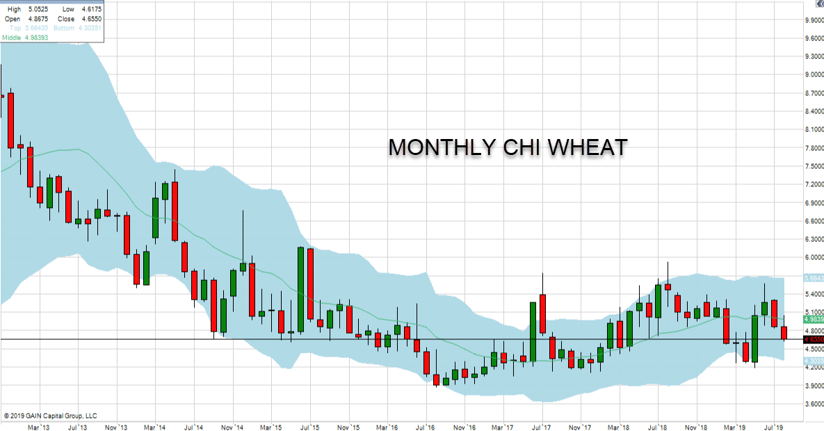

CHI WHEAT- down 30 cents (sep down 13 this morning)/ 9.3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}

SOYBEANS- down 6 cents/.75{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}

News

News is slow this morning. Equities are on the move and soybean futures are higher after China touted that it’s having ‘effective communication’ with the U.S. on the trade war. The world’s two biggest economies are keeping lines open, China’s Foreign Ministry said. President Donald Trump said more talks took place between U.S. and Chinese officials Thursday and more discussions are scheduled. Below are the latest temperature forecasts for the 8-14. Cold weather remains in place

Cotton

Cotton is trying to come along but just can’t muster much strength. Hurricane Dorian is strengthening, with the potential of reaching a Category 4 storm. The path is very sketchy at this point, all of Florida Is under a state of emergency. Im watching for rain totals into SW Georgia, it appears to be OK for now. The funds are so short right now, we have a 3 day weekend ahead with 40{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of cotton in GA opening bolls. I expect some short covering today, maybe even a test of 60 cents.

Corn & Beans

Corn and soybeans appear to have bottomed for now. The upside move we saw yesterday in corn was short lived. I think that will be the theme on rallies, so be ready. Use limit orders. If you have nothing sold, get started on an approach to 380. I think we could see a test of 400 if the crop concerns would grow enough, but right now I just don’t see where the yield losses will come from outside of some major event. Trading with that in mind is not a recommended plan. The next big event for corn and beans will be the USDA report on the 12th of Sep.

Below are monthly continuous charts. Woof….

It’s a holiday on Monday. The newsletter will be up on Monday night this week. Don’t bother me on Saturday, Ill be watching my Iowa Hawkeyes embark on a 15-0 season….

hbspt.cta.load(2022783, ‘8becfc02-c4a5-4bca-970b-f5f1d904fa74’, {});

hbspt.cta.load(2022783, ‘8becfc02-c4a5-4bca-970b-f5f1d904fa74’, {});

Subscribe to This Week In Grain

This Week In Grain – This Week in Grain (T.W.I.G.) is a weekly grain and oilseed commentary newsletter designed to keep grain market participants on the cutting edge, so they can hedge or speculate with more confidence and precision.

Contact Daniels Trading

To open an account or request more information, contact us at (800) 800-3840 or info@danielstrading.com and mention .

Risk Disclosure

This material is conveyed as a solicitation for entering into a derivatives transaction.

This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1.71. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. Due to various factors (such as risk tolerance, margin requirements, trading objectives, short term vs. long term strategies, technical vs. fundamental market analysis, and other factors) such trading may result in the initiation or liquidation of positions that are different from or contrary to the opinions and recommendations contained therein.

Past performance is not necessarily indicative of future performance. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results.

Trade recommendations and profit/loss calculations may not include commissions and fees. Please consult your broker for details based on your trading arrangement and commission setup.

You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. You should read the “risk disclosure” webpage accessed at www.DanielsTrading.com at the bottom of the homepage. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Daniels Trading does not guarantee or verify any performance claims made by such systems or service.

SOURCE: Daniels Trading – Read entire story here.