Gold (XAU/USD) Analysis and Chart

- US PPI comes in hotter-than-expected

- Retail sales missed market expectations and turned negative in January.

- Gold is correcting higher after being technically oversold.

Recommended by Nick Cawley

How to Trade Gold

Recently released US producer price inflation data has pushed the price of gold back below $2,000/oz. and raised expectations that next month’s US consumer price inflation may also move higher. Month-on-month PPI in January rose by 0.3%, compared to forecasts of 0.1% and December’s reading of -0.1%.

US retail sales data disappointed the market yesterday, turning negative and missing market forecasts by a margin. The January number 0f -0.8% was the lowest reading in nearly a year, while the previous two months’ data was also revised lower. Retail sales fell by 0.8% in January, while December’s data was revised to 0.4% from 0.6% and November sales were revised to 0% from an initial reading of 0.3%.

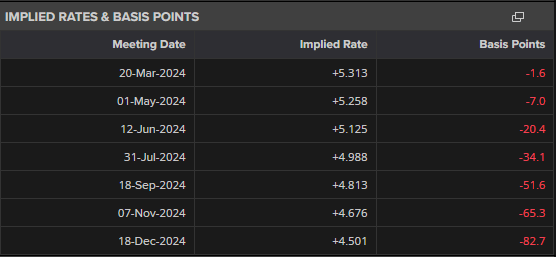

The drop off in consumer spending over the last three months sent US Treasury yields, and the greenback, lower on Thursday but did little to change market expectations that the Federal Reserve would not start cutting interest rates until the end of the first half of the year. The chances of an earlier rate cut fell on Tuesday this week after data showed that US inflation remained stickier than expected in January. Current market pricing suggests the first 25 basis point cut will take place at the June 12th FOMC meeting. The recent pairing back of US rate cut expectations has weighed on gold and sent the price tumbling lower over the past two weeks.

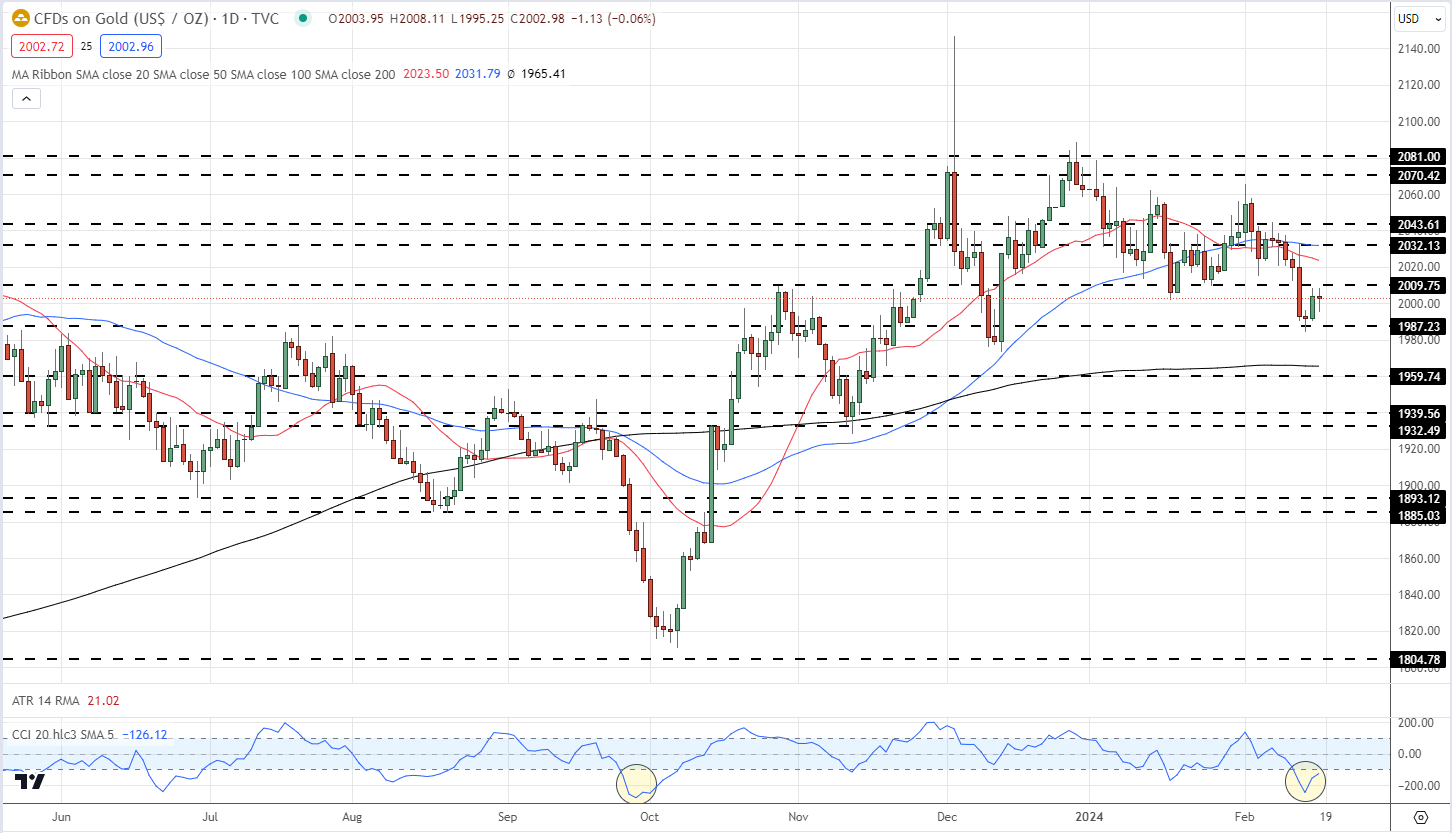

The precious metal turned higher yesterday, in part due to a technically oversold Commodity Channel Index (CCI) reading. The CCI indicator, comparable to RSI, compares the difference between the current and the historical price over a set time frame and shows if a market is overbought, neutral, or oversold. On Wednesday the CCI indicator showed gold deep in oversold territory and back at levels last seen in late September, just before the market rallied sharply. If the market continues to wash out this oversold reading, gold could retest $2,009/oz. ahead of the 20- and 50-day simple moving averages currently sitting at $2,023/oz. and $2,031/oz. respectively.

Gold Daily Price Chart

Retail trader data shows 68.74% of traders are net-long with the ratio of traders long to short at 2.20 to 1.The number of traders net long is 8.85% lower than yesterday and 21.69% higher than last week, while the number of traders net short is 6.65% higher than yesterday and 15.93% lower than last week.

| Change in | Longs | Shorts | OI |

| Daily | -11% | 2% | -7% |

| Weekly | -4% | 3% | -2% |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.