MARKET FORECAST: GOLD, US DOLLAR, EUR/USD, GBP/USD

- Gold prices fall on rising U.S. Treasury yields and a strengthening U.S. dollar

- EUR/USD and GBP/USD inch lower, but manage to hold above important tech levels

- The U.S. inflation report is likely to be a source of volatility in the week ahead

Most Read: US Dollar Eyes US CPI for Fresh Signals; Setups on EUR/USD, GBP/USD, Gold

Gold prices retreated last week in response to rising U.S. Treasury rates. Despite the increase in bond yields, which can negatively impact risk assets at times, U.S. stocks posted a strong performance, with the S&P 500 and Nasdaq 100 closing at fresh records.

S&P 500 AND NASDAQ 100 PERFORMANCE

Source: TradingView

Will the U.S. dollar continue to rebound or begin to retreat? Request our Q1 USD trading forecast to find out!

Recommended by Diego Colman

Get Your Free USD Forecast

In the FX market, the U.S. dollar climbed for the fourth consecutive week, although gains were limited. In this context, both EUR/USD and GBP/USD edged lower, but ultimately managed to hold above key support levels. USD/JPY, meanwhile, rallied strongly, coming close to regaining the 150.00 handle.

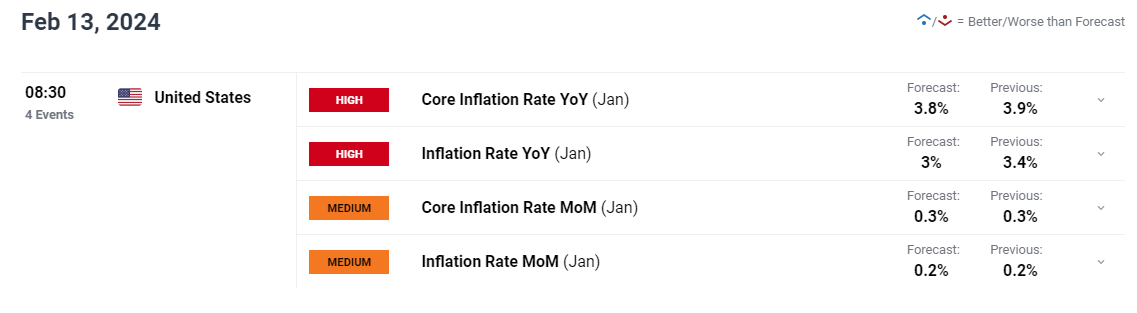

Looking ahead, volatility could accelerate in the new week, courtesy of a high-impact event on the U.S. economic calendar: the release of January inflation data on Tuesday. This could mean treacherous market conditions, so traders should be prepared for the possibility of wild price swings across assets.

UPCOMING US CPI REPORT

Source: DailyFX Economic Calendar

Gain access to an extensive analysis of gold’s fundamental and technical outlook in our complimentary Q1 trading forecast. Download the guide now for valuable insights!

Recommended by Diego Colman

Get Your Free Gold Forecast

In the grand scheme of things, a hotter-than-expected U.S. CPI report should be positive for U.S. yields and the U.S. dollar, but bearish for stocks and gold prices. The S&P 500 and Nasdaq 100, for instance, may face challenges in sustaining their upward trajectory if progress on disinflation disappoints.

On the flip side, if inflation numbers surprise to the downside, the opposite scenario is likely to unfold, resulting in lower yields and a weaker U.S. dollar. This, in turn, should provide support for both equities and precious metals, at least in the short term.

For a comprehensive analysis of the factors that may influence financial markets and become a potential source of volatility in the upcoming trading sessions, check out the following selection of key forecasts compiled and prepared by the DailyFX team.

Seeking actionable trading ideas? Download our comprehensive trading opportunities guide, filled with insightful strategies tailored for the first quarter!

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

FUNDAMENTAL AND TECHNICAL FORECASTS

British Pound Weekly Forecast: Busier Data Week Might Be Bruising

Sterling remains relatively elevated despite recent US Dollar strength. This week may make life a bit tougher for Sterling bulls.

Gold Price Forecast: US Inflation to Dictate Direction, Volatility Looms Ahead

This article discusses the fundamental and technical outlook for gold prices ahead of next week’s key U.S. inflation data, examining possible scenarios that could develop in the near term.

US Dollar Forecast: EUR/USD, GBP/USD and USD/JPY Price Action Setups

Next week US CPI headlines the schedule of high importance data. This forecast considers how major currency pairs shape up ahead of the US CPI release.

Eager to discover what the future holds for the euro? Delve into our Q1 trading forecast for expert insights. Get your free copy now!

Recommended by Diego Colman

Get Your Free EUR Forecast