First of all, what are investors whining about?

As you can see from the WEEKLY S&P 500 chart, you can barely see this week’s downturn as, once again, the Financial Media is Much Ado About Nothing (“Men were deceivers ever, One foot in sea, and one on shore, To one thing constant never” sums up the current news cycle quite nicely). While clearly there are lots of worries in the World – Earnings, so far, is not one of them.

Insight/2024/10.2024/10.21.2024_Earnings%20Insight/03-s%26p-500-earnings-growth-yoy.png?width=672&height=384&name=03-s%26p-500-earnings-growth-yoy.png)

While still dominated by Magnificent 7 earnings (54% of total earnings), the “Not-So Magnificent 493” are catching up as the entire S&P 500 is on track to show 4.1% year/year earnings growth. Unfortunately, the S&P 500 was at 4,200 last October (see above) and now we’re at 5,800 so up 38% more PRICE might seem like a lot to pay for 4.2% more ACTUAL EARNINGS but… well, there is no but – it’s ridiculous and traders are idiots!

So we are in a bubble – make no mistake about that and sometimes bubbles can get very very big before they burst but you wouldn’t be so foolish as to bet the bubble is never going to burst, right? After all, that is what bubbles do – ALL of the time!

What is an investor to do? Well, firstly, don’t panic. Market cycles are inevitable. What goes up must come down, and vice versa. This isn’t the first time we’ve seen irrational exuberance, and it won’t be the last.

What is an investor to do? Well, firstly, don’t panic. Market cycles are inevitable. What goes up must come down, and vice versa. This isn’t the first time we’ve seen irrational exuberance, and it won’t be the last.

This time does feel a bit different, though, doesn’t it? Perhaps it’s the sheer magnitude of the disconnect. 30x earnings? That’s not just exuberance; it’s a full-blown defiance of gravity.

Think of it this way: with 10-year Treasury notes offering a 4.2% yield, Investors have a viable, and dare I say, SENSIBLE alternative. Why chase risky stocks when you can lock in a guaranteed return with Uncle Sam? This Opportunity Cost, as it’s called, starts to weigh heavily on those lofty valuations. And let’s not forget Gold, shimmering at $2,750 an ounce. That’s a clear signal that Inflation fears are still simmering beneath the surface, ready to boil over at a moment’s notice. Suddenly, those future earnings, the ones supposedly justifying these astronomical prices, don’t seem so certain anymore…

Markets are driven by both logic and emotion and, at the moment, emotion seems to be in the driver’s seat. Logic will eventually reassert control and, when that happens – there will be shift in the balance of the force! Investors, driven by a renewed sense of risk awareness and a desire for value, will start to reallocate their assets out of equites – the trick is not to be the last fool at the punch bowl when the lights finally do come on.

Markets are driven by both logic and emotion and, at the moment, emotion seems to be in the driver’s seat. Logic will eventually reassert control and, when that happens – there will be shift in the balance of the force! Investors, driven by a renewed sense of risk awareness and a desire for value, will start to reallocate their assets out of equites – the trick is not to be the last fool at the punch bowl when the lights finally do come on.

This is certainly not to say that the market is going to crash tomorrow but we are very, VERY concerned as we approach the 30 times earnings mark – that may be a line the markets dare not cross. Bubbles can often persist longer than anyone expects but the underlying mechanics are clear. A 30x earnings multiple is simply not sustainable in the long run. Earnings growth, while decent, can’t keep pace with these inflated expectations forever.

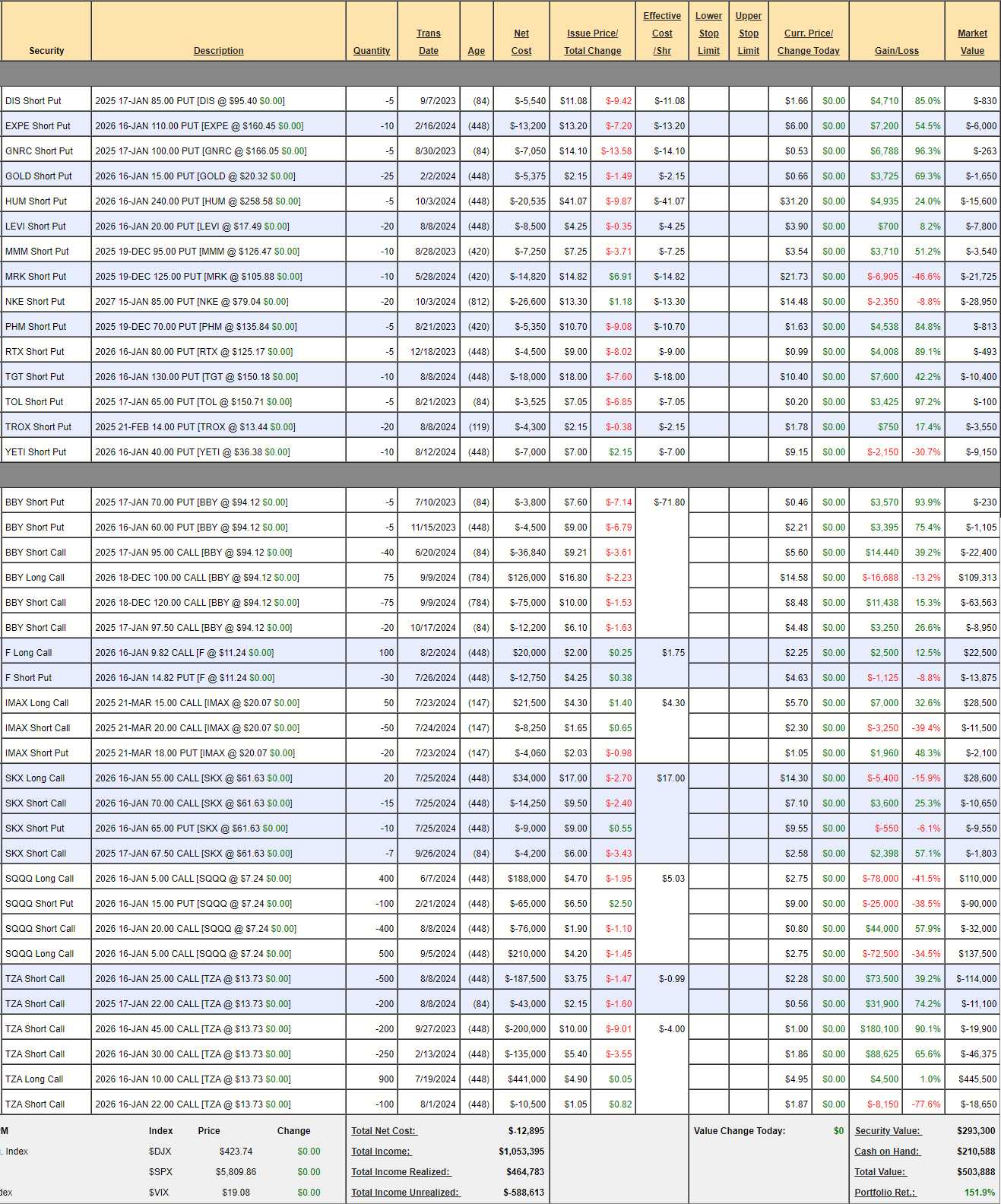

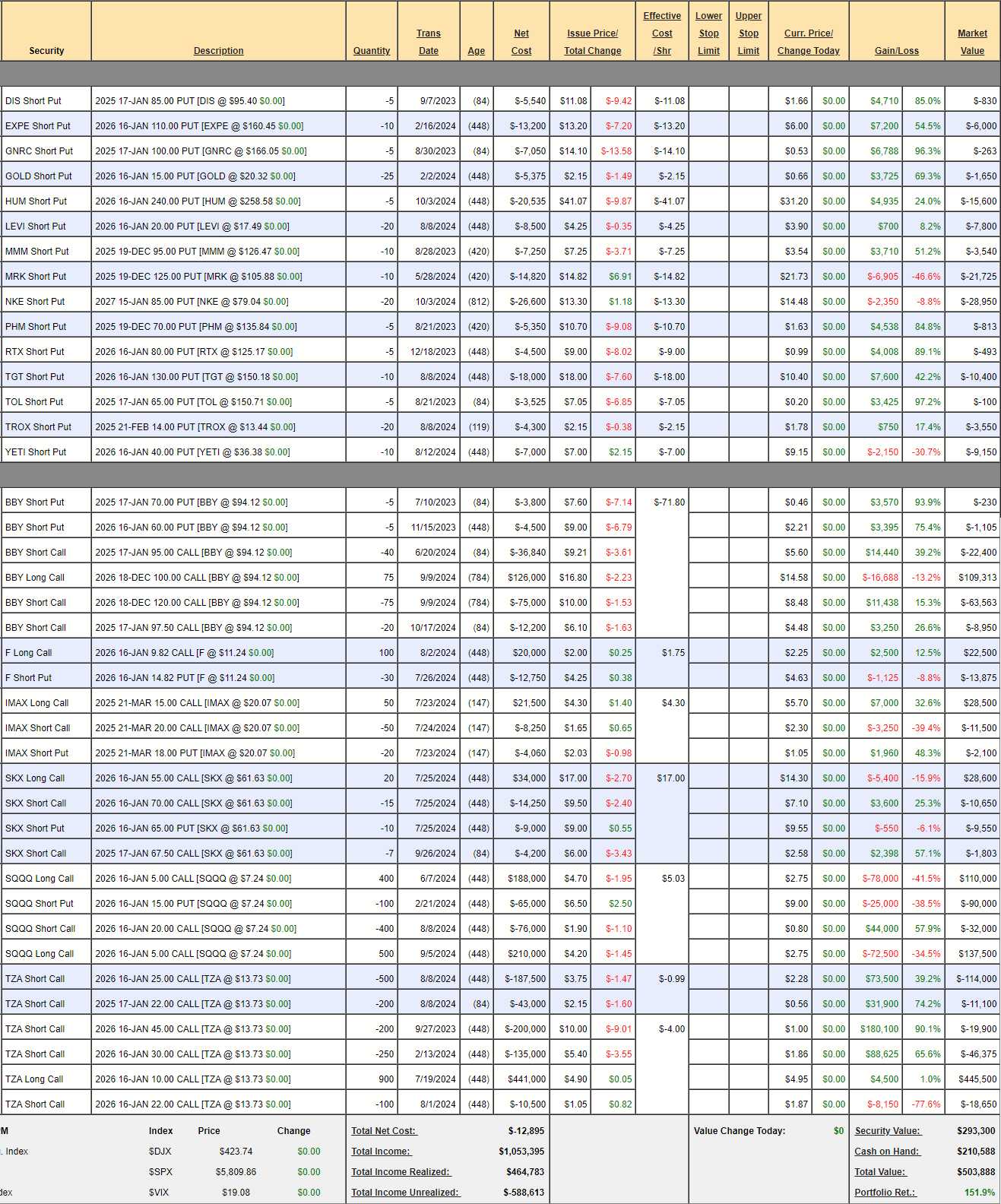

We’re very well-hedged going into the weekend so my concern is more about adding new companies to our Member Portfolios. The adjustments we made to our Short-Term Portfolio last Tuesday raised our net protection to $1,262,575 against a 20% drop in the market and our main hedge is against small caps (TZA), which have fallen 2.5% in the past week and our Short-Term Portfolio has gained $62,178 (14%) to offset the losses in our Long-Term Portfolio – EXACTLY how it’s supposed to work!

We also cashed in and protected many of our long positions – so the STP has less that they need to protect and that tilted us slightly bearish and slightly bearish seems “just right” into this weekend and into next week’s earnings and then the more earnings, the election AND the Fed AND Non-Farm Payrolls – all coming the week of Nov 4th-8th – so exciting, right?

Have a great weekend and let’s get ready for the mayhem ahead!