The Federal Reserve’s Open Market Committee changes every year and 2014 in particular iss a big year for the Federal Reserve because there are a number of new faces on the Federal Open Market Committee or FOMC. With her official confirmation on Monday, Janet Yellen will become the first woman to lead the world’s most influential central bank. Having served as the Vice Chair of the Federal Reserve since 2010, she is not new to the FOMC but her voice will be heard much louder this year in the highly anticipated quarterly post monetary policy meeting press conferences. Yellen is a vocal dove that puts growth ahead of inflation but actions speak louder than words and her vote to taper asset purchases in December suggests that as Fed Chair, she may not be as dovish.

Every year, the makeup of the Federal Open Market Committee also changes with previous voters rotating out and new voters rotating in. This year’s policymakers have the huge responsibility of determining the pace that asset purchases will be tapered and when Quantitative Easing will end.

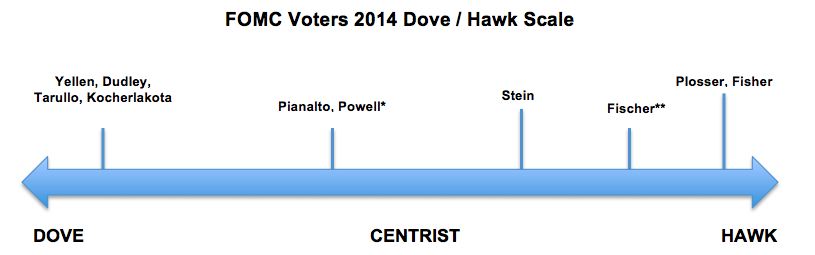

Two major doves favoring easier versus tighter monetary policy (Evans and Rosengren), one moderate hawk who favors tighter policy (George) and one centrist (Bullard) will be rotating out of voting positions. They will be replaced by Plosser and Fisher, two major hawks, Pianalto a moderate dove and Kocherlakota, who shares a similar bias as Yellen.

Former Bank of Israel Governor Stanley Fischer has also been nominated to replace Yellen as Vice Chair and if confirmed, another hawk would be added to the roster.

There will also be 2 vacancies this year – Elizabeth Duke’s seat (she retired in summer of 2013) and Sarah Raskin’s slot once she moves over to the Treasury. Jerome Powell’s term ends January 31st but President Obama is considering a reappointment. This would leave the central bank more hawkish and willing to follow Bernanke’s proposal for reducing asset purchases by $10 billion at every meeting this year.

Click on image to zoom

2014 FOMC Voters

Openly Dovish

New Fed Chair Janet Yellen

Fed Board Member Daniel Tarullo

NY Fed President William Dudley?

Minneapolis Fed President Kocherlakota

Moderately Dovish

Cleveland Fed President Pianalto

Fed Board Jerome Powell* (term ends Jan 31 but possible reappointment)

Moderately Hawkish?

Fed Board Member Jeremy Stein

Vice Chair Stanley Fischer** (waiting confirmation)

Hawkish?

Philadelphia Fed President Charles Plosser

Dallas Fed President Richard Fisher

2 Vacant Slots

Leaving 2014

Fed Chairman Ben Bernanke?(dove)

Kansas City Fed President Esther George (moderate hawk)

St. Louis Fed President Bullard (centrist)

Boston Fed President Eric Rosengren (dove)

Chicago Fed President Charles Evans (dove)

Potential Replacements for Vacant Slots

Lael Brainard, the former Treasury undersecretary is a possible candidate to replace Sarah Raskin’s seat on the Federal Reserve Board of Governors. She stepped down from the Treasury in November and has been known to play a major role in negotiations with China and Europe during the sovereign debt crisis. Brainard is a strong negotiator who pressured European leaders for a more aggressive response to the debt crisis. Thomas Hoenig’s name has been floated around as a possible replacement for Duke. Hoenig is a former Kansas Federal Reserve President who was a vocal hawk during his time at the central bank. Finally Jeremy Stein is expected to step down from the Fed and return to teaching at Harvard in May, which means that he could leave another seat vacant. The Obama Administration will be eager to fill these slots quickly and bring the FOMC back to full capacity.

SOURCE: Kathy Lien – Read entire story here.