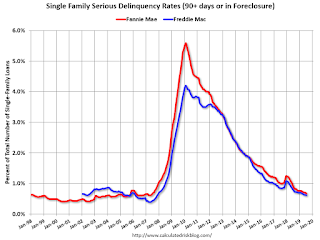

Fannie Mae reported that the Single-Family Serious Delinquency declined to 0.67{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} in July, from 0.70{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} in June. The serious delinquency rate is down from 0.88{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} in July 2018.

These are mortgage loans that are “three monthly payments or more past due or in foreclosure”.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}.

This is the lowest serious delinquency rate for Fannie Mae since June 2007.

Click on graph for larger image

By vintage, for loans made in 2004 or earlier (3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of portfolio), 2.51{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} are seriously delinquent. For loans made in 2005 through 2008 (4{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of portfolio), 4.22{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} are seriously delinquent, For recent loans, originated in 2009 through 2018 (93{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of portfolio), only 0.32{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes – there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

SOURCE: Calculated Risk – Read entire story here.