The EUR/USD pair is currently experiencing a lack of momentum, but there is a possibility of a breakout today. In this analysis, we show details of the economic data, technical and possible direction based on smart money concept

The EUR/USD currency pair has been facing downward pressure, The pair is near 1.0820. Investors are closely monitoring several economic indicators that could impact the pair’s direction. The following key factors influencing the EUR/USD exchange rate today:

1. German Retail Sales (MoM)

Anticipated Rise: German Retail Sales are expected to show a 0.3% increase month-on-month (MoM). This positive data could provide some support for the euro against the US dollar.

Context: In the previous period, retail sales declined by 0.4%, so any improvement would be closely watched by traders.

2. US GDP Annualized (Q4)

Consistent Growth: The US Gross Domestic Product (GDP) annualized rate for the fourth quarter is expected to remain consistent at 3.2%. Steady economic growth could bolster the US dollar.

Market Impact: A deviation from this forecast could lead to volatility in the currency markets.

3. Dovish Remarks from ECB Officials

EUR/USD Losing Streak: The euro has been extending its losing streak due to recent dovish remarks from European Central Bank (ECB) officials. Their cautious tone regarding the economic recovery has weighed on the euro.

Fed’s Influence: Meanwhile, the US dollar has found support from the Federal Reserve’s (Fed) optimistic outlook on the US economy.

Technical Overview

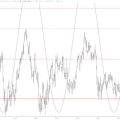

The Relative Strength Index (RSI) on the 4-hour chart remains below 40, suggesting that the recent recovery attempt is a technical correction rather than a reversal.

Resistance Levels: The first resistance area lies between 1.0830 and 1.0840 (200-period Simple Moving Average, Fibonacci 50% retracement level of the latest uptrend).

Further resistance levels are at 1.0860 (Fibonacci 38.2% retracement) and 1.0880 (50-period SMA, 100-period SMA).

Support Levels: On the downside, initial support is located at 1.0800 (Fibonacci 61.8% retracement), followed by 1.0760 (Fibonacci 78.6% retracement).

EURUSD Smart Money Overview

As per the smart money trading concept, we can see the price has broken the BOS on the left side of this chart. The price then moved further down but it was able to react on POI marked in gray color. Here we also mark another internal break out as (IB). We expect the price to sweep the nearest POI to the upside and then strongly move downward.