I review the list of dividend increases as part of my monitoring process. This process helps me review how the companies I own are doing. It also helps me identify companies for further research.

For this weekly review, I tend to focus my attention on companies with at least a ten year history of annual dividend increases, which also raised dividends last week. I provide a quick overview of each company that includes the amount of the most recent dividend increase, and compares it to its recent historical record. I also review the streak of annual dividend increases, and review earnings and valuation information.

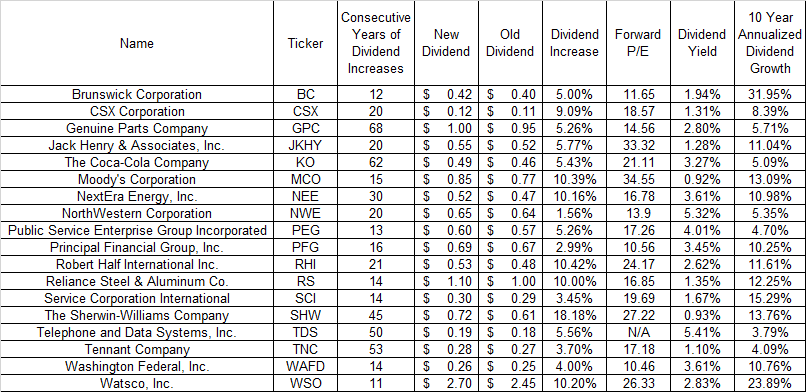

Over the past week there were eighteen companies that raised dividends, and have a ten year history of annual dividend increases. The companies include:

You can view the company, ticker, and ten year dividend growth. I have also included P/E ratio and dividend yield, as well as dividend payout ratio.

Each of these companies has managed to grow earnings over the past decade, which means that dividends have been well supported. If these companies can continue growing earnings per share over the next decade or two, I am confident that they would continue their streak of consecutive annual dividend increases.

However, our work here is not done. Just because we have identified a group of companies for further research, which I would love to own forever, that still doesn’t mean that these companies are automatic buys today. Some of these companies seem attractively valued to me today, based on a combination of their P/E ratios and dividend growth.

Others however seem a little pricey. Therefore, they would likely find a place in my portfolio if they become more attractively valued. This can be achieved either by earnings per share growth, by declines in the share price, or a combination of the two.

This my general framework on how I value companies. I take into consideration many inputs, such as P/E, interest rates, stability of earnings, dividend growth, in order to come up with a general idea of what to invest my money in. It is not a formula however.

It is helpful to be prepared to act when the right opportunities present themselves. This is why I have a watchlist and general ideas on valuation, so I can act when the time is right.

Relevant Articles:

– Dividend Growth Investor Newsletter

– Dividend Aristocrats List for 2024