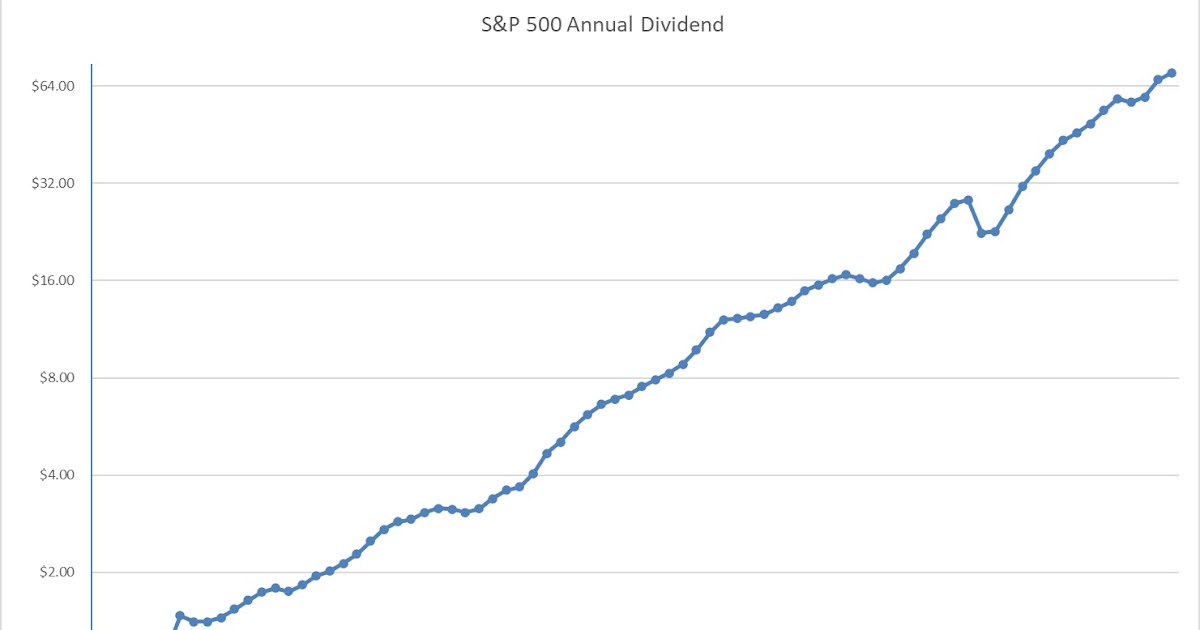

The US Stock Market is one giant dividend growth machine. What is truly remarkable is that the record of dividend payments by US corporations heavily favors rising dividends over declining dividends, almost irrespective of prevailing business conditions.

You can see how annual dividends on S&P 500, which is used as a barometer for the overall health of the US Stock Market, have gone up and up almost uninterruped over the long run. The only correction happened in 2008, when the whole US Economy was on its knees.

US Dividends grow over time, because companies grow earnings over time. You cannot fake the cash that’s needed to pay those dividends. Thus, only companies that can make actual profits tend to pay and grow those dividends. Speculative companies typically cannot afford to pay dividends.

I typically focus my attention on companies that have managed to grow dividends for at least a decade. Those are the best companies in the US, with strong competitive advantages, which drown their shareholders with rising torrents of cash each year. Such companies can be found on the lists of dividend champions, dividend aristocrats, dividend kings and dividend achievers.

As part of my reviews, I review the list of dividend increases each week. I use this review as part of my monitoring process. This exercise helps me monitor existing holdings and potentially identify companies for further research.

Last week, there were eight companies that both managed to raise dividends to shareholders, and also have a ten year track record of annual dividend increases under their belt. The companies include:

Avient Corporation (AVNT) operates as a formulator of material solutions in the United States, Canada, Mexico, Europe, South America, and Asia. It operates in two segments, Color, Additives and Inks; and Specialty Engineered Materials.

The company raised quarterly dividends by 4.90% to $0.27/share. This is the 13th consecutive annual dividend increase for this dividend achiever. In the past 5 years, annualized dividend growth has been at 7.20%.

Between 2014 and 2023, the company’s earnings went from $0.86/share in 2014 to $0.83/share in 2024.

Avient is expected to earn $2.64/share in 2024.

The stock sells for 18.35 times forward earnings and yields 2.22%.

A. O. Smith Corporation (AOS) manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India.

The company raised quarterly dividends by 6.25% to $0.34/share. This is the 31st consecutive annual dividend increase for this dividend aristocrat. The company has managed to grow dividends at an annualized rate of 18.20%. The five year annualized rate of dividend growth is 9.90%, and decelerating.

The company has managed to grow dividends at an annualized rate of 16.20% over the past decade.

Between 2014 and 2023 the company grew earnings from $1.15/share to $3.71/share.

The company is expected to earn $3.96/share in 2024.

The stock sells for 20.40 times forward earnings and yields 1.70%.

Agree Realty Corporation (ADC) is a fully integrated real estate investment trust (“REIT”) primarily focused on the ownership, acquisition, development and management of retail properties net leased to industry leading tenants.

The REIT increased monthly dividends by 1.20% to $0.253/share. The monthly dividend reflects an annualized dividend amount of $3.036 per common share, representing a 2.4% increase over the annualized dividend amount of $2.964 per common share from the fourth quarter of 2023. This is the 12th consecutive annual dividend increase for this dividend achiever.

The company has managed to grow dividends at an annualized rate of 5.90% over the past decade.

Agree Realty Corporation grew FFO from $2.18/share in 2014 to $3.58/share in 2023.

The REIT is expected to generate FFO of $4.09/share in 2024.

The REIT sells for 18 times forward FFO and yields 4.13%.

Canadian Natural Resources Limited (CNQ) acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs).

The company raised quarterly dividends by 7.10% to $0.5625/share. This will make 2025 the 25th consecutive year of dividend increases by Canadian Natural, with a CAGR of 21% over that time.

The company has managed to grow dividends at an annualized rate of 16.84%.

Between 2014 and 2023, the company grew earnings from $1.80/share to $3.77/share.

Canadian Natural Resources is expected to earn $3.57/share in 2024.

The stock sells for 14.50 times forward earnings and yields 4.35%.

Calvin B. Taylor Bankshares, Inc. (TYCB) operates as the holding company for Calvin B. Taylor Banking Company that provides commercial banking products and services.

The company raised quarterly dividends by 2.90% to $0.36/share. This dividend champion has managed to grow distributions for 35 years in a row. Over the past decade, the company has managed to grow dividends at an annualized rate of 3.60%.

Earnings per share went from $1.39 in 2013 to $4.89 in 2023.

The stock sells for 12.60 times earnings and yields 2.91%.

Northwest Natural Holding Company (NWN) provides regulated natural gas distribution services to residential, commercial, and industrial customers in the United States.

The company raised quarterly dividends by 0.50% to $0.49/share. This is the 69th year of consecutive annual dividend increases for this dividend king. Over the past decade, the company managed to grow dividends at an annualized rate of 0.60%.

Between 2014 and 2023 the company managed to grow earnings from $2.16/share to $2.59/share.

The company is expected to earn $2.31/share in 2024.

The stock sells for 17.25 times forward earnings and yields 4.92%.

THOR Industries, Inc. (THO) designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, Canada, rest of Europe, and internationally.

The company raised quarterly dividends by 4.20% to $0.50/share. This is the 15th year of consecutive annual dividend increases for this dividend achiever. Over the past decade, the company has managed to grow dividends at an annualized rate of 7.63%.

Between 2015 and 2024, the company grew earnings from $3.75/share to $4.98/share.

The company is expected to earn $5/share in 2025.

The stock sells for 22 times forward earnings and yields 1.82%.

Terreno Realty Corporation (TRNO) acquires, owns and operates industrial real estate in six major coastal U.S. markets: Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami, and Washington, D.C.

The company raised its quarterly dividends by 8.90% to $0.49/share. This is the 13th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has managed to grow dividends at an annualized rate of 12.70%.

Between 2014 and 2023, the REIT managed to grow FFO/share from $0.86 to $2.23.

Terreno is expected to generate FFO of $2.42/share in 2024.

The stock sells for 26.20 times forward FFO and yields 3.10%.