The European Central Bank launched an unprecedented quantitative easing program in March that has started to pay dividends. The ECB is not expected to announce any changes to the benchmark interest rate or the QE program, but the words from ECB President Mario Draghi could further boost the USD versus the EUR as interest rate divergence continues to drive the forex market. A Reuters poll of economics showed that the consensus was for a positive impact from ECB QE measures. The announcement and launch of the trillion euro program has depreciated the currency and lowered bond yields in the European Union. The challenge remains in how to turn that liquidity into a productive force for growth.

ECB President Draghi will continue to be optimistic about European growth, and this time the data backs him up. Inflation has improved as per the latest CPI flash estimate (-0.1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} versus -0.3{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}). European manufacturing continues to expand as per the PMI readings released on March 24. Next week the advanced estimates for manufacturing in Europe will be released and should give further insight into the state of European factories.

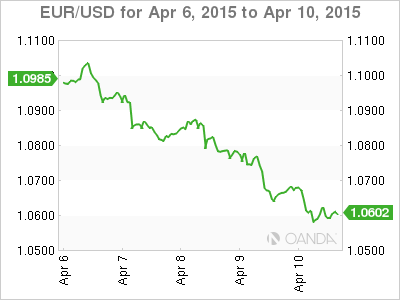

The EUR/USD has depreciated as rate divergence drives the EUR lower versus the USD. The effects of the disappointing NFP released on Good Friday started being discounted as the USD was boosted by Fed member comments about the possibility of a benchmark interest rate June hike still being on the table. Elections in the United Kingdom and the Greece debt repayment will continue to affect prices as they are ongoing events to consider.

SOURCE: MarketPulse – Read entire story here.